By Peter C. Earle & Thomas Savidge. They are both Research Fellows at the American Institute for Economic Research. Excerpts:

"While the BEA publishes a measurement titled “Value Added by Private Industries (VAPI),” it does not get nearly as much attention as it deserves. The most recent data show that VAPI contributes to just under 89 percent of all economic growth. Despite this, GDP is still the more prominent metric, in part because the BEA treats government spending as a value added to the economy."

"VAPI includes private outputs that are purchased by government (i.e. a defense contractor) while GDPP (Gross Domestic Private Product) treats those purchases as part of “Government Consumption and Gross Investment.”"

"A cursory glance at the BEA’s description of government assumes that all levels of government “contribute to the nation’s economy when they provide services to the public and when they invest in capital. They also provide social benefits, such as Social Security and Medicare, to households.”

The description also notes that the government gets its revenue taxes, transfers, and fines, as well as rent and royalties. It fails to mention, however, that government receipts come at a cost. That cost, what economists call opportunity cost, is the next-highest valued use of that money.

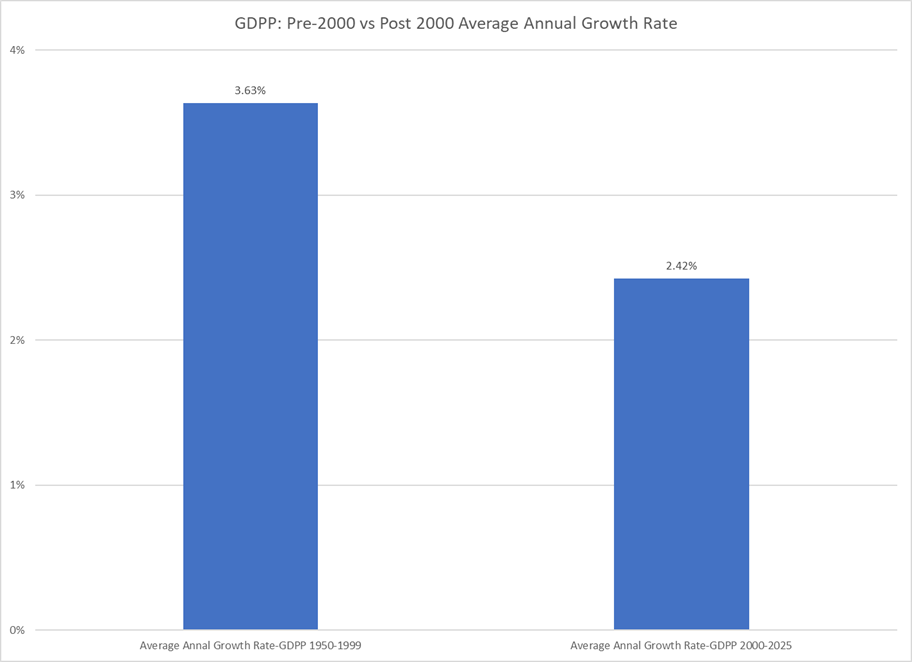

We can see this effect reflected in the BEA’s own data. When examining the growth of government and the private sector both before and after 2000 in our analysis published last year, government growth (both federal as well as state and local) outpaced that of the private sector. Below is an updated analysis of last year’s findings. Note that the same still holds true: Government outpaces the growth of the private sector, especially state and local governments.

Source: United States Bureau of Economic Analysis, Department of Commerce. Table 1.1.6 Real Gross Domestic Product, Chained Dollars, Authors’ Calculations.

Source: United States Bureau of Economic Analysis, Department of Commerce. Table 1.1.6 Real Gross Domestic Product, Chained Dollars, Authors’ Calculations.

Furthermore, we find that the private sector has grown 33 percent slower per year since the start of the new millennium. It is also important to remember that transfer payments, such as Social Security or unemployment insurance, are excluded from GDP estimates of government spending because those transfers are counted toward private spending.

Furthermore, we find that the private sector has grown 33 percent slower per year since the start of the new millennium. It is also important to remember that transfer payments, such as Social Security or unemployment insurance, are excluded from GDP estimates of government spending because those transfers are counted toward private spending.

Source: United States Bureau of Economic Analysis, Department of Commerce. Table 1.1.6 Real Gross Domestic Product, Chained Dollars, Authors’ Calculations.

A recent review of the academic literature on government stimulus in the economy finds that government stimulus makes, at best, modest, short-term contributions to economic activity. In the long-term, however, the review finds that government stimulus effects “often diminish or turn negative due to reduced private investment and consumption, emphasizing the role of anticipatory effects and private-sector responses.”

Economists, both past and present, have argued that calculating government contributions to the economy is more complicated than official GDP calculations claim. Economist Patrick Newman notes Nobel Prize-Winning Economist Simon Kuznets’s own objections that government was treated as “an ultimate consumer” on par with private consumers regardless of whether private citizens valued government consumption and investment. Newman takes Kuznets’s concerns further and argues that such positive treatment of government in economic growth calculations opened the door to the flawed views of Modern Monetary Theory.

Alternatively, economists Vincent Geloso and Chandler S. Reilly examine government consumption and investment minus defense spending, called “Defense-Adjusted National Accounts”. The result is a much lower level of GDP, but the clear lesson “that wars do not improve living standards.” These challenges to the status quo of economic growth calculations help, in the words of Geloso and Reilly, “bridge the gap between official economic data and the perceptions of the American public.”"

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.