"The Biden administration is nearing its deadline to announce what it will do about federal student debt. In part this is because the latest freeze on student debt repayment ends on August 31. Also, at least in part, this is because progressives are demanding cancellation. But pushy progressives and a freeze that should have ended long‐ago do not make a policy wise. Indeed, there are at least five major reasons mass cancellation is a terrible idea.

1. Helping the Winners

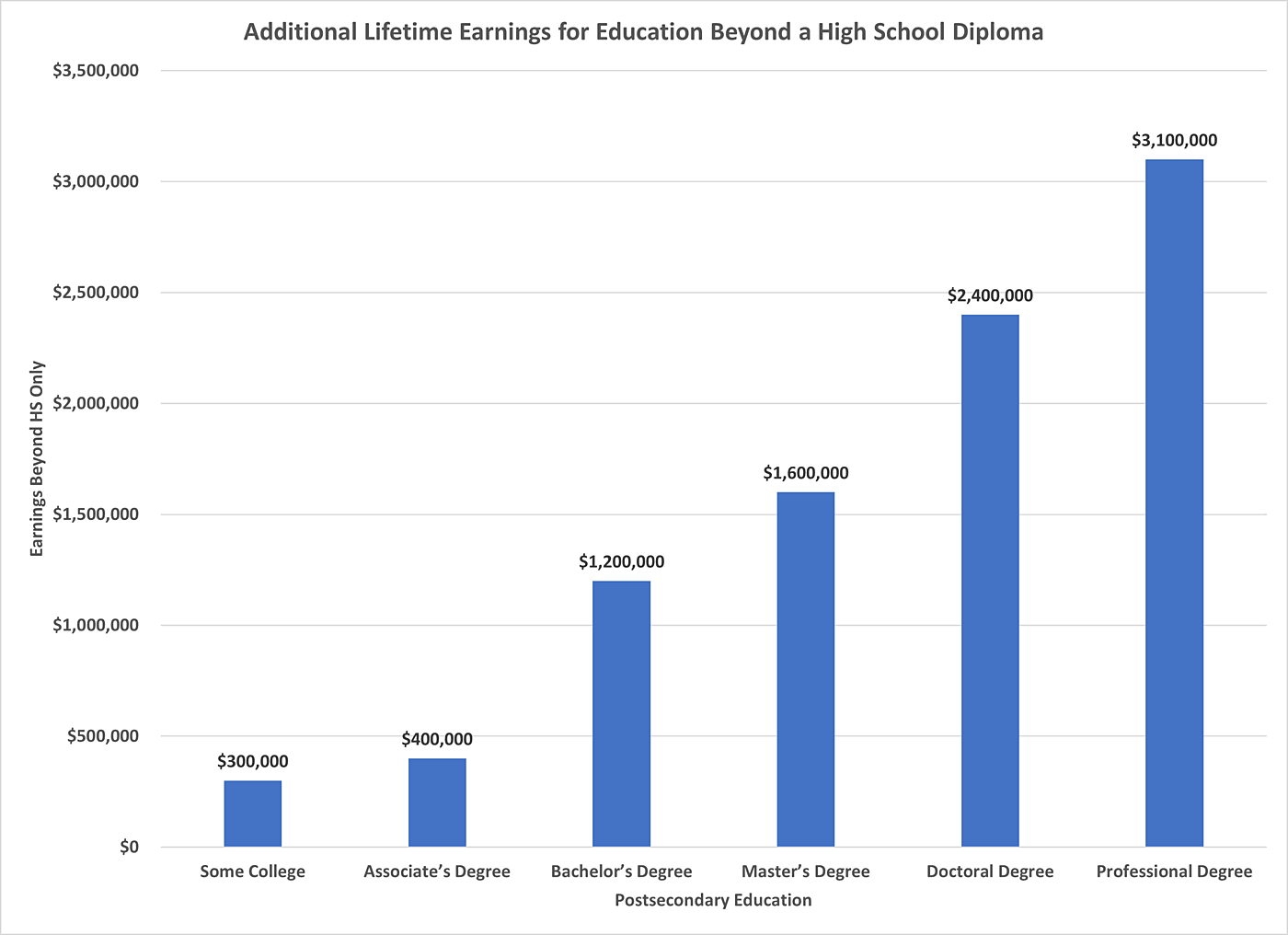

People who have attended, and especially graduated from, college are typically set for a huge increase in their lifetime earnings. As seen below, the average person with a bachelor’s degree will earn an estimated $1.2 million more over their lifetime than someone topping out at a high school diploma. For someone with a graduate degree – and student debt is disproportionately taken on for graduate study – that earnings premium rises to between $1.6 and $3.1 million.

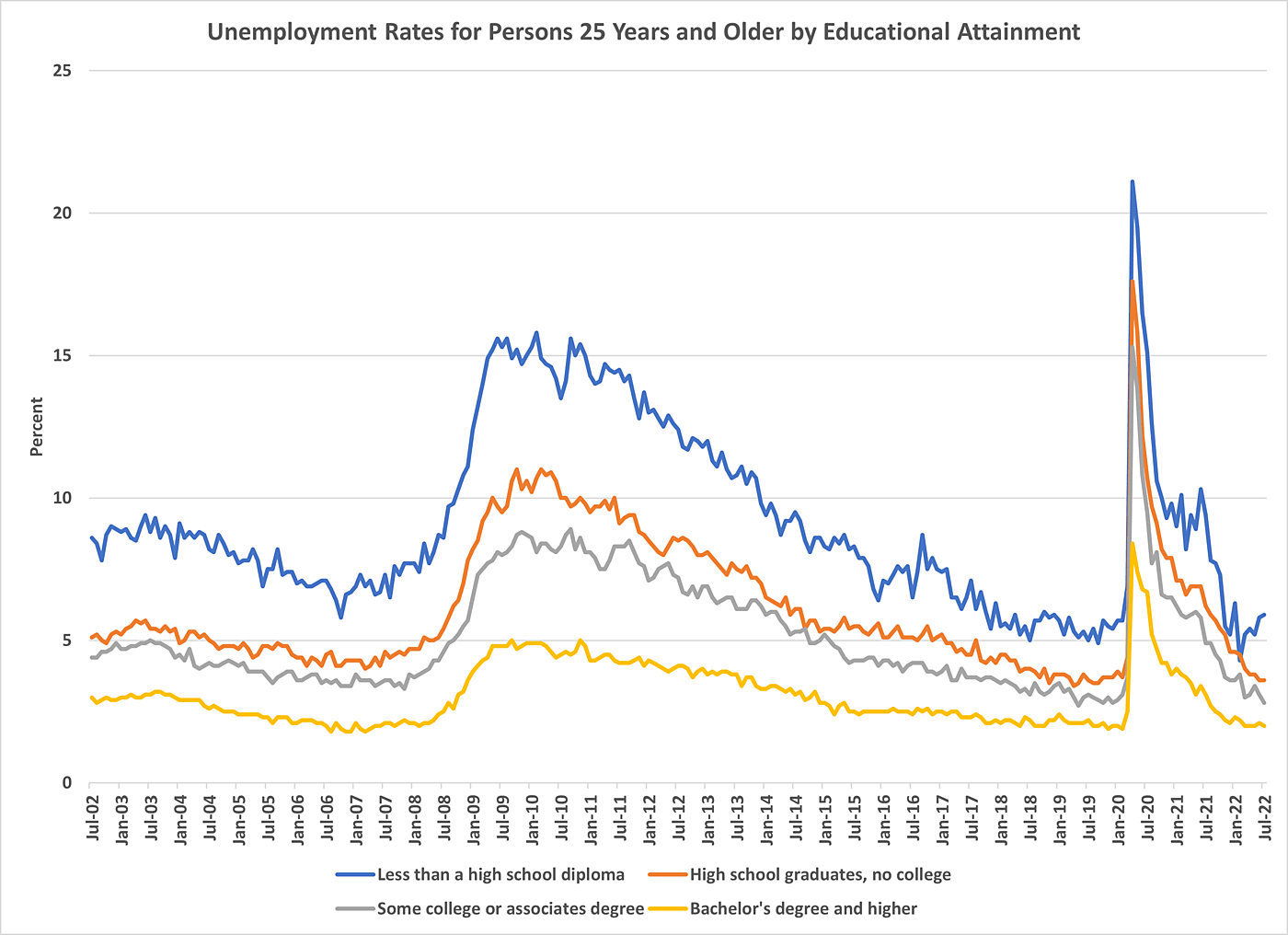

In addition to huge earnings increases, people who attended college have much greater job security than those who did not, and this benefit was especially stark during COVID-19 lockdowns. In April 2020, the unemployment rate only hit 8.4 percent for college graduates, versus 17.6 percent for Americans topping out at a high school diploma and 21.1 percent for workers with less than that.

There is no reason that people in such a good financial position should not repay taxpayers, roughly two‐thirds of whom do not have bachelor’s degrees.

2. Regressive

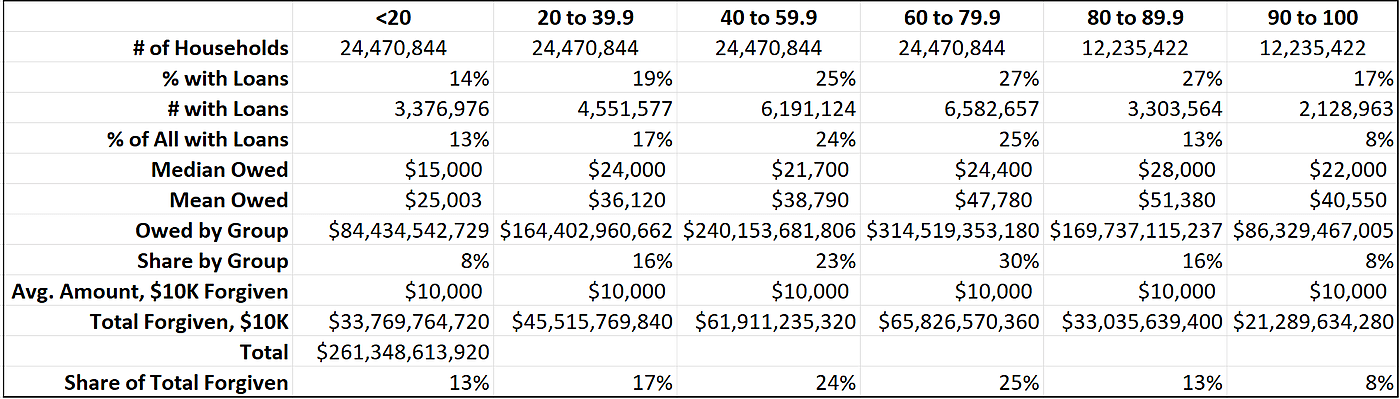

We have seen various cancellation proposals floated by different people, but one of the most recent was reported from the Biden White House: $10,000 cancellation with an income cap of $150,000 individually and $300,000 for joint filers. The table below is an estimate for the cancellation amounts and distribution of that plan by income quintile (and decile for top earners).

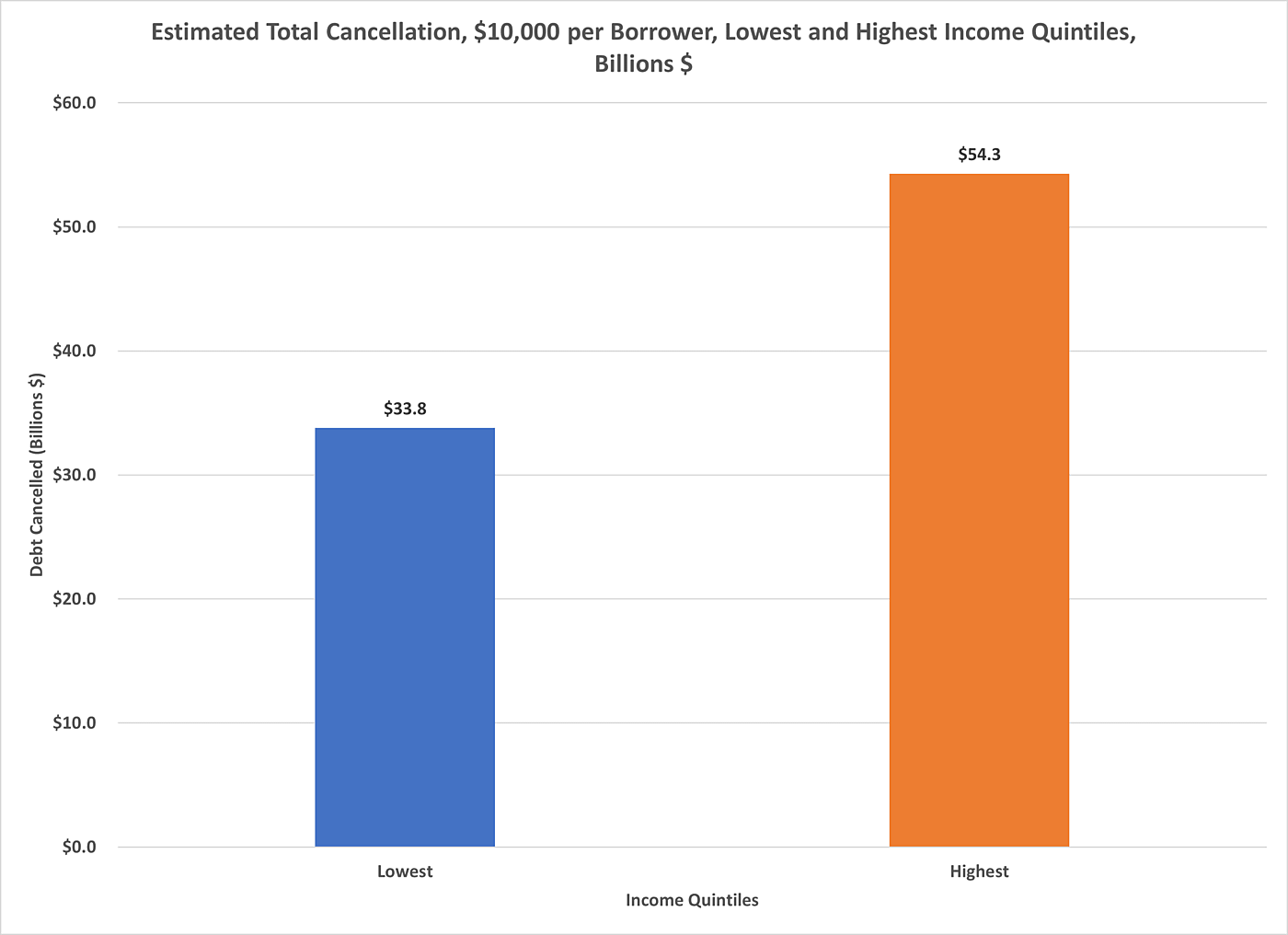

As highlighted in the graph below, much more of that aid would go to the highest quintile of earners than the lowest — $54.3 billion versus $33.8 billion. That’s because higher‐income people are more likely to borrow, and borrow more, for college than lower‐income.

3. Huge Cost to Taxpayers

The $10,000 plan discussed in reason number two would cost taxpayers – the people who funded all these student loans whether they liked it or not – an estimated $260 billion. $50,000 per borrower with no cap would cost taxpayers around $1 trillion. And forgiving the whole amount would cost taxpayers more than $1.6 trillion.

4. Even Worse Price Inflation

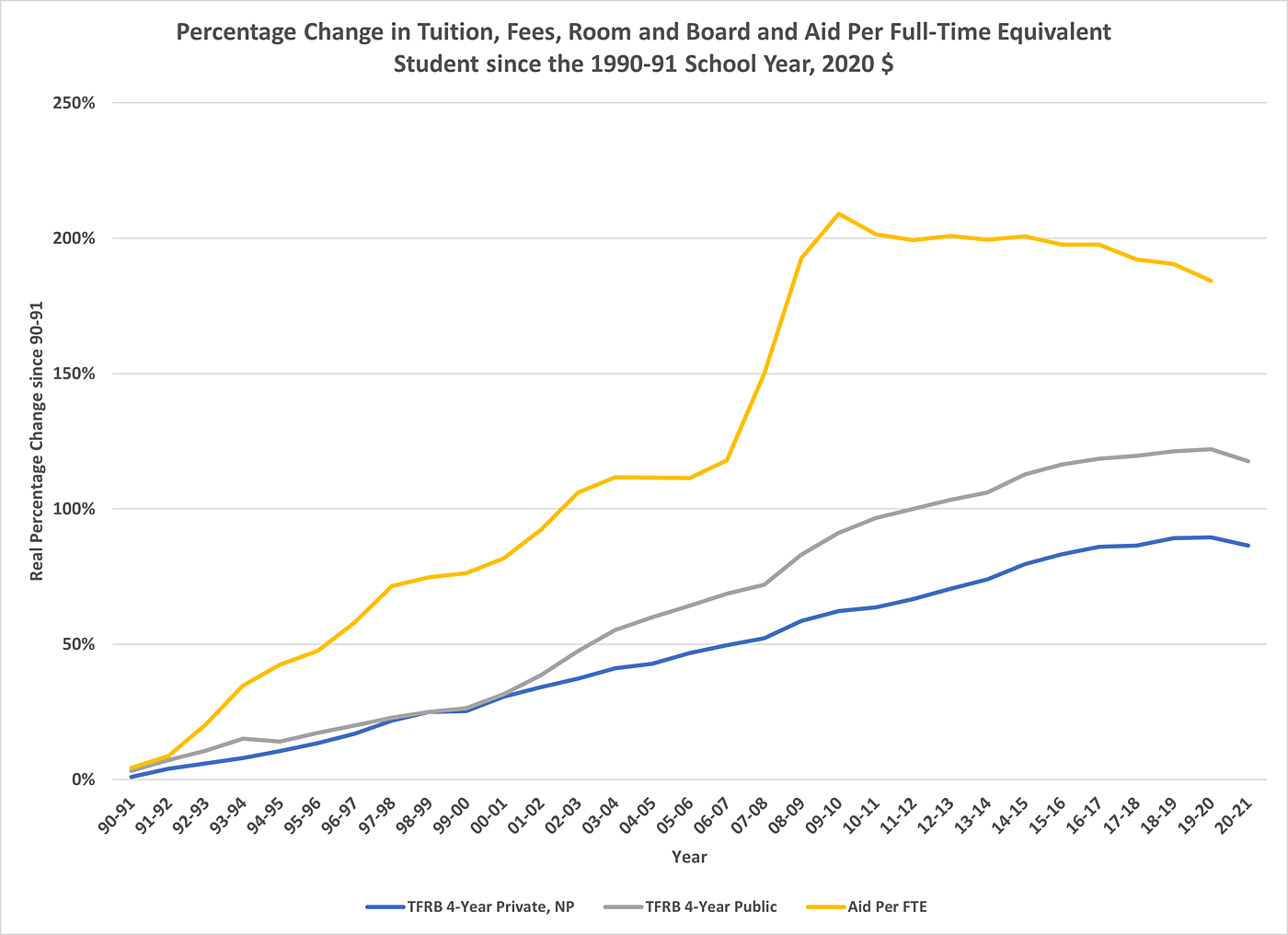

The biggest problem in higher education is its incredibly expanding price. As seen below, inflation‐adjusted tuition, fees, room and board at four‐year, nonprofit private colleges ballooned from $27,720 in the 1990–91 school year to $$51,690 in the 2021–22 school year, an 86 percent increase. At public four‐year institutions it rose from $10,430 to $22,690, a 118 percent ballooning. It was accompanied by a huge increase in aid per student.

Much research has shown that aid fuels college price inflation, including a Federal Reserve Bank of New York finding that for every 1 dollar increase in “subsidized” student loans, colleges raise their prices 60 cents. Mass cancellation would incentivize much greater inflation as neither colleges nor prospective students would believe future loans would have to be repaid, blowing the lid off of prices.

5. Unconstitutional

The Constitution gives Congress, not the president, the power of the purse. A president unilaterally cancelling up to $1.6 trillion would be a rank violation of that power. Of course, the federal student loan programs are themselves unconstitutional. The federal government only has the specific, enumerated powers given to it by the Constitution, and the authority to fund education, either directly or through loans, is nowhere among them. Cancellation would thus be a double violation of the Constitution.

Some cancellation advocates argue that Congress gave the president the power to cancel all loans in the Higher Education Act. But not only is the constitutional ability for Congress to give away its power highly dubious, the Higher Education Act does not authorize blanket cancellation, only forgiveness under specific loan repayment programs.

Conclusion

Mass cancellation would be a blatantly unconstitutional giveaway of taxpayer money to the people who arguably need it the least, and it would exacerbate the biggest problem in higher education."

Wednesday, August 24, 2022

Top Five Reasons Federal Student Debt Cancellation Is a Bad Idea

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.