"A study released today by Texans for Natural Gas (TNG) demolishes the long-running scare campaign waged by corporate rent seekers, eco-activists, and “progressive” politicians to restrict exports of domestically fracked natural gas.

Anti-export advocates claim that rising exports of liquefied natural gas (LNG) would allow other nations to bid up U.S. gas prices, which in turn would dramatically inflate consumer utility bills and, worse, destroy the competitive advantage of U.S. manufacturers who obtain key industrial feedstocks from natural gas.

During the heyday of this controversy, Massachusetts Representative Ed Markey in 2012 introduced legislation to ban the export of natural gas produced on public lands and place a 13-year moratorium on U.S. government approval of new LNG export facilities. In support of those proposals, Markey’s staff produced a report, Drill Here, Sell There, Pay More: The Painful Price of Exporting Natural Gas. Dow Chemical CEO Andrew Liveris organized a corporate coalition dubbed America’s Energy Advantage (AEA) to lobby policymakers for new restrictions on gas exports.

Well, the results, now in, are exactly the reverse of what export opponents prophesied.

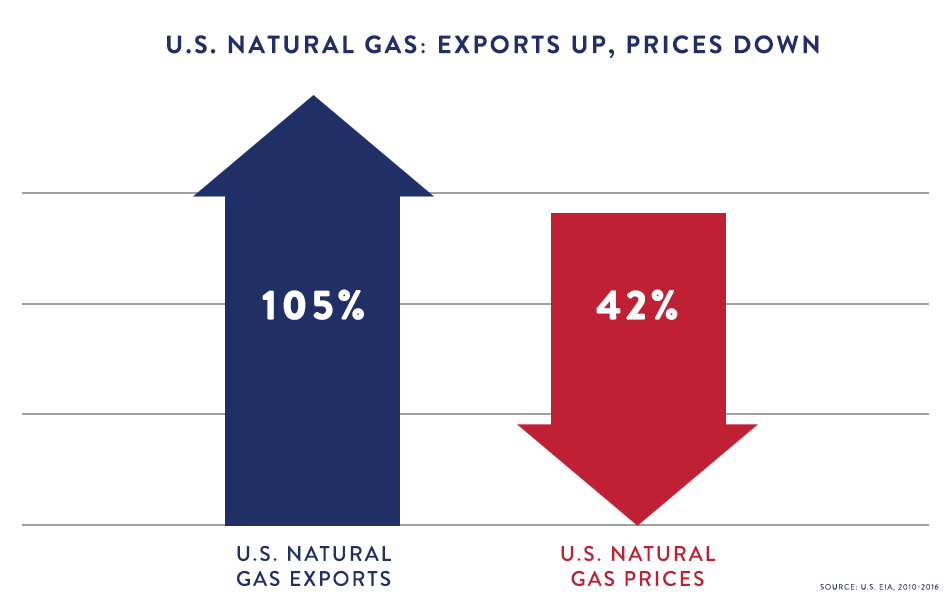

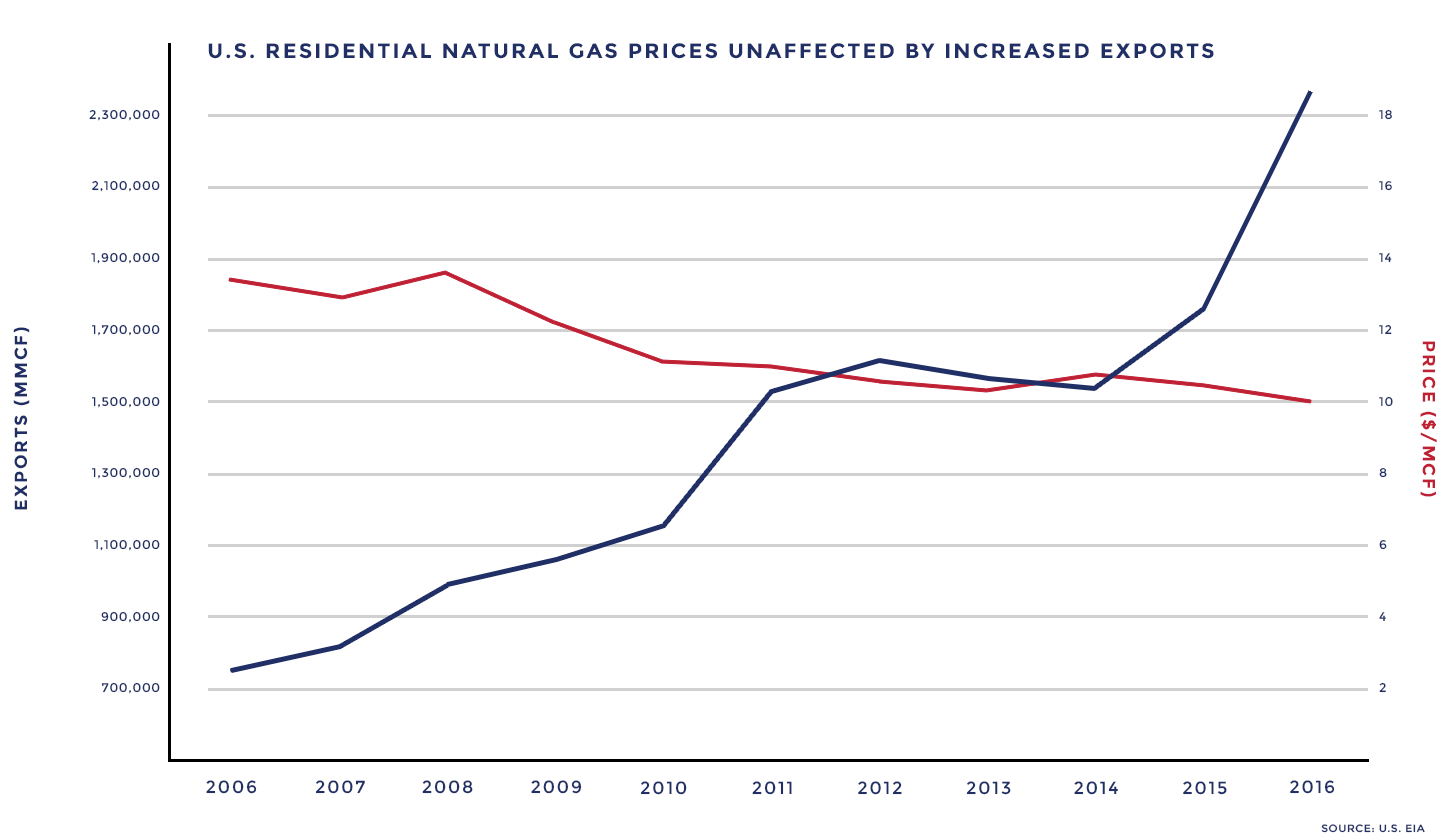

During 2010-2016, U.S. natural gas exports more than doubled, increasing by 105 percent. Instead of skyrocketing, as export foes warned, natural gas prices declined by 42 percent.

Even the U.S. Energy Information Administration (EIA) got it wrong. In EIA’s 2012 report, cited repeatedly by the anti-export crowd, increased LNG exports “lead to increased natural gas prices” in all scenarios examined, with prices in 2017 exceeding the reference (no-additional export) case by five to 25 percent.

Note also that even EIA’s reference case projected prices would remain above $4 per thousand cubic feet (Mcf).

Instead, the TNG study reports, “Between 2010 and 2016, Henry Hub natural gas spot prices declined by 42 percent, from $4.53 per thousand cubic feet (Mcf) to $2.61/Mcf. The average price in October 2017 was $2.98/Mcf. Residential natural gas prices—what households pay for their monthly bills, which include transmission and infrastructure costs—have fallen by about 12 percent since 2010.”

Why did increasing gas exports coincide with declining gas prices? The TNG study does not venture to say, but those outcomes are what Econ 101 tells us should occur.

Allowing U.S. gas producers to compete in the global marketplace spurs new investment, which boosts production, which increases supply, which lowers prices. Export bans or restrictions do exactly the reverse—scare away investment, decrease production and supply, and increase prices.

As noted in an earlier post, freedom to export is an essential component of free enterprise. Economic liberty primarily means the right to offer one’s goods and services for sale. Exporting is just competing for customers on the other side of lines drawn on maps.

In reality, every sale to anyone living outside the walls of your domicile is an export. What we today call capitalism Adam Smith more accurately called the “system of natural liberty”—the spontaneous order that flourishes when government protects rather than suppresses people’s natural propensity to “truck, barter, and trade.”

To put this another way, freedom to export—to sell goods or services to customers outside the household, clan, or tribe—is a fundamental property right. As economist Richard Stroup explains, genuine property rights are 3D—defined, defendable, and divestible (transferable). A total ban on the sale of a product would reduce its market value to zero (assuming no black market and no prospect of the ban’s repeal). To the owner, the injury is the same as outright confiscation.

A ban on sales to foreign customers is similarly injurious, just to a lesser degree. Being confiscatory, export bans and restrictions depress supply and increase prices, whereas free trade generally increases supply and lowers price.

Why are anti-export advocates unable to wrap their heads around that simple logic? Actually, I suspect some do understand it, but seek to drive fossil-fuel producers into bankruptcy, calculating that what oil, gas, and coal companies cannot sell, they will have to leave in the ground.

It is possible that restricting LNG sales to foreign buyers would have temporarily lowered gas prices by creating a glut in U.S. domestic markets, and perhaps that was the economic calculus behind AEA’s opposition to natural gas exports. Lucky for them, their lobbying efforts came to naught, because any short-term gain would soon have been succeeded by long-term price increases as production and supply dwindled along with investment in an industry targeted for hostile regulatory treatment designed to limit its customer base.

Liveris and his AEA partners never responded to criticism that their anti-export argument applied with equal force to their own product lines. Dow, Alcoa, Eastman, Huntsman, and Nucor primarily manufacture intermediate goods, not final goods. As natural gas is an input to them, so their products are inputs to still other companies.

AEA-produced chemicals, plastics, electronic components, aluminum, and steel reach the consumer only after other manufacturers add value by turning those “feedstocks” into paints, cosmetics, fertilizers, pharmaceuticals, computers, cell phones, automobiles, and so on. So by AEA’s logic, the government should restrict exports of chemicals, aluminum, and steel to hold down domestic prices in order to make U.S. manufacturers of final goods more competitive.

In any event, my colleague, Energy In Depth analyst Steve Everley, concisely summarizes the big picture confirmed by the TNG study:

Natural gas exports have increased, investment in U.S. chemical manufacturing has increased, and natural gas prices have decreased. Approving LNG exports has been a clear winner for the United States, creating jobs, reducing our trade deficit, and giving our trading partners access to cleaner and cheaper energy. Meanwhile, the United States continues to reap the benefits of domestic, clean-burning natural gas, which include leading the world in reducing carbon emissions."

Sunday, December 17, 2017

Allowing Natural Gas Exports Did Not Lead To Higher Prices

See Results Are In: Freedom to Export Lowers Energy Prices by Marlo Lewis, Jr. of CEI.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.