"I wrote yesterday to criticize Andrew Biggs of the American Enterprise Institute and Alicia Munnell of Boston College for suggesting a $3 trillion 10-year tax increase on IRAs and 401(k)s.

My column explained that more double taxation was a bad idea, and I also pointed out that shifting to a savings-based system was the right way of addressing Social Security’s long-run fiscal problems.

But I committed a sin of omission, which needs to be rectified.

I did not challenge the Biggs-Munnell assumption that a big tax increase would deal with Social Security’s huge funding shortfall.

That was a mistake on my part. We have lots of evidence, as Milton Friedman wisely observed, that tax increases “feed the beast.”

In other words, politicians will increase the burden of spending when they get more revenue.

And this point is especially relevant because today’s column is going to analyze another giant tax increase being advocated by someone at the American Enterprise Institute.

Just last month, Alan Viard testified to a subommittee in Congress in favor of an add-on value-added tax. Here are some excerpts from his testimony.

A value-added tax (VAT) is an essential component… The United States should follow the lead of 170 other countries and territories by adding a VAT… We should act sooner rather than later to limit the debt buildup and ease the fiscal burden on future generations.

…there is no viable way to fully address the fiscal imbalance without middle-class tax increases. …The European Union, the International Monetary Fund, and the World Bank have promoted the VAT. …To be sure, the VAT is not as economically efficient as entitlement benefit cuts. Notably, a VAT (or a retail sales tax) creates work disincentives similar to those created by income taxes. …When addressing the fiscal imbalance, time is not on our side. To promote long-term economic growth and ease the fiscal burden on future generations, we should adopt a VAT sooner rather than later.

I’m not sure why Viard thinks copying bad policies of other countries is a good idea. Especially since the United States is much richer than about 98 percent of those nations. Seems like they should be copying us.

But the main point I want to get across is that it is utterly naive to think that giving politicians a huge source of additional revenue will lead to less debt.

Why do I say that?

For the simple reason that the nations most similar to the United States tried Viard’s approach and the results were horrible.

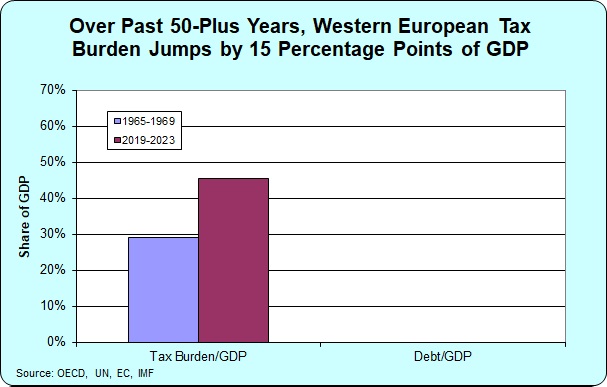

I’m going to recycle three charts from last year. The first one shows that the tax burden increased dramatically in Western Europe over the past 50-plus years – in large part because all those nations adopted big value-added taxes.

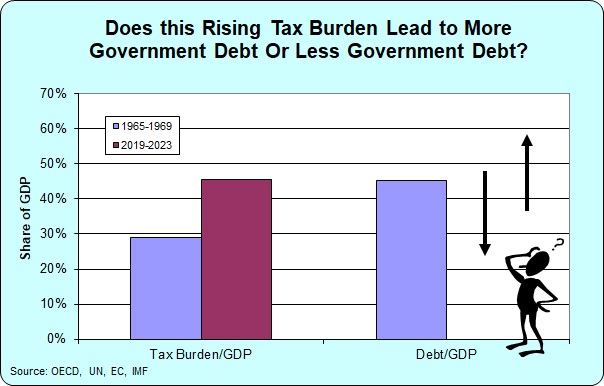

My second chart than asked whether those massive tax increases in Europe reduced the debt, which averaged about 45 percent of GDP in the late 1960s.

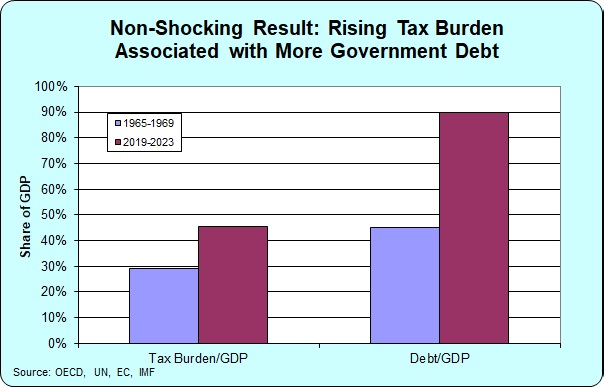

The answer, unsurprisingly, is that debt increased. Dramatically.

Politicians spent every single penny of the additional revenue. And then spent even more.

So much more spending that debt in Western Europe now averages 90 percent of GDP, two times higher than it was before value-added taxes were imposed.

Needless to say, Viard did not address that point in his testimony."

"P.S. In the above charts, I used averages for five-year periods so that nobody could accuse me of cherry-picking a single year that might not be representative of actual trends.

P.P.S. Some readers may be wondering if debt skyrocketed in Europe because of emergency pandemic spending instead of the value-added tax. Nope. I also did similar sets of charts in 2012 and 2016 and you see the same pattern. All that has changed is that taxes, spending, and debt get higher every time I update the numbers."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.