By Richard Morrison of CEI.

"Recently billionaire philanthropist Eli Broad called for a wealth tax

in The New York Times and fellow billionaire Ken Fisher responded in

USA Today with a challenge that wealthy Americans (and the rest of the

country) would be better off with the very wealthy investing their money

in further for-profit enterprises. That’s a pretty stark contrast, and

one that shows off two very different attitudes toward wealth and

prosperity in America.

Broad’s op-ed highlights issues including “the shrinking middle

class, skyrocketing housing and health care costs.” His assumption seems

to be that more money, taxed from the wealthy and spent by Congress, is

going to be the solution to these ostensible problems. That seems

unlikely.

Let’s take just his first concern. As it turns out, we do not have a

middle class economic crisis in America. But we may have an

inability-to-understand-economic-dynamism problem. As Brad Schiller, an

emeritus professor of economics at American University wrote in the Los Angeles Times earlier this year:

As proof, proponents of [the shrinking

middle class] view point to government data showing that the median

household income (adjusted for inflation) fell from $60,002 in 2000 to

only $58,476 in 2015.

But in fact, the whole notion of a shrinking middle class is a myth. Here’s why.

When you compare household incomes over

time, you have to look at identical households. The census defines a

household as one or more persons living in the same abode. Fifty years

ago, only 15% of all U.S. households had a single occupant. By 2017 that

percentage had nearly doubled, to 28% percent. In just the last 10

years, the percentage has increased by three points. So, the typical

household today is much smaller.

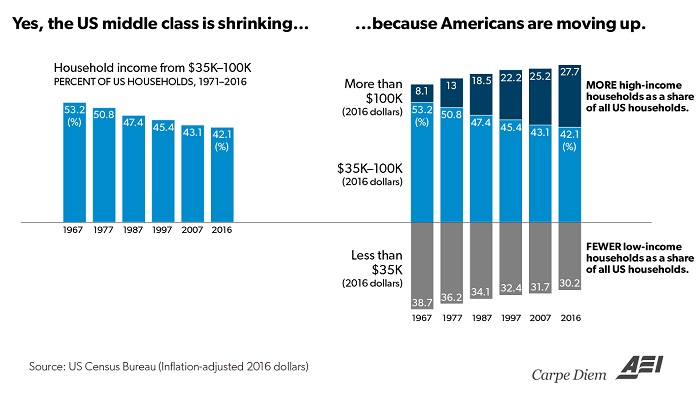

There’s more to the myth of the shrinking middle class than that, but

Schiller’s op-ed is a great start. It’s true that, as a statistical

construct, fewer people

are in the middle class that in previous decades, but that’s because

many of them have joined the upper class. The American Enterprise

Institute’s Mark Perry blogged about these trends earlier this year, specifically in regards to home ownership:

America’s middle class has been shrinking

over time, from 61% of US households in 1971 to only 50% in 2015, when

middle class is defined as households earning between two-thirds and

twice the median household income. And that middle-class shrinkage

apparently implies that there is a “widening gap between what people

earn and the housing that is affordable to them”…

However, there are at least two serious

issues and questions that need to be addressed: a) if the middle class

did shrink, where did they go? and b) is housing really becoming less

affordable for Americans?

It will no doubt surprise Broad and his fellow tax-us-rich-folks-more friends that most of the vanished middle-class actually ascended the economic ladder than slipped down it.

The analysis debunking the “disappearing middle class” didn’t all accumulate over the last year, either. A 2012 article

by the Brookings Institution’s Ron Haskins points to a misleadingly

narrow focus (looking at just the top 1%, rather than income by

quintile) as well as a dishonestly narrow definition of “income”

(ignoring the value of non-monetary work benefits and government

transfer payments). If we include the value of government benefits and

payments to low-income Americans, the problem of income inequality

begins to look very different:

What about those at the bottom, supposedly

floundering? Based only on their market income, the bottom 20 percent

lost about one-third of its income between 1979 and 2007. But when

[economist Richard] Burkhauser calculates the impact of government

transfers, the value of health insurance not paid for by households and

the decline in household size, the bottom 20 percent had about 25

percent more income in 2007 than 1979. Even the bottom is moving up.

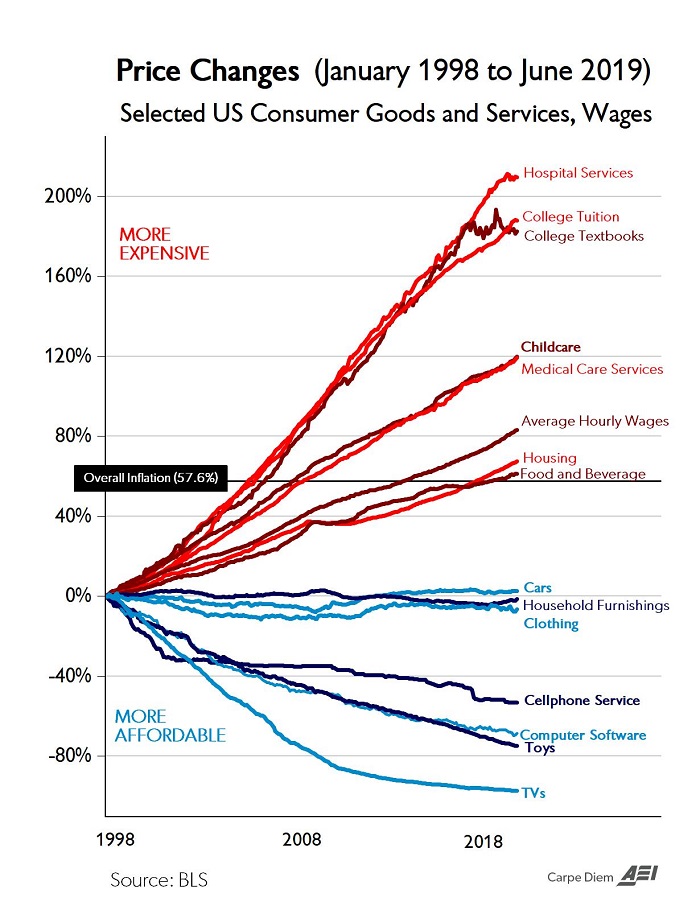

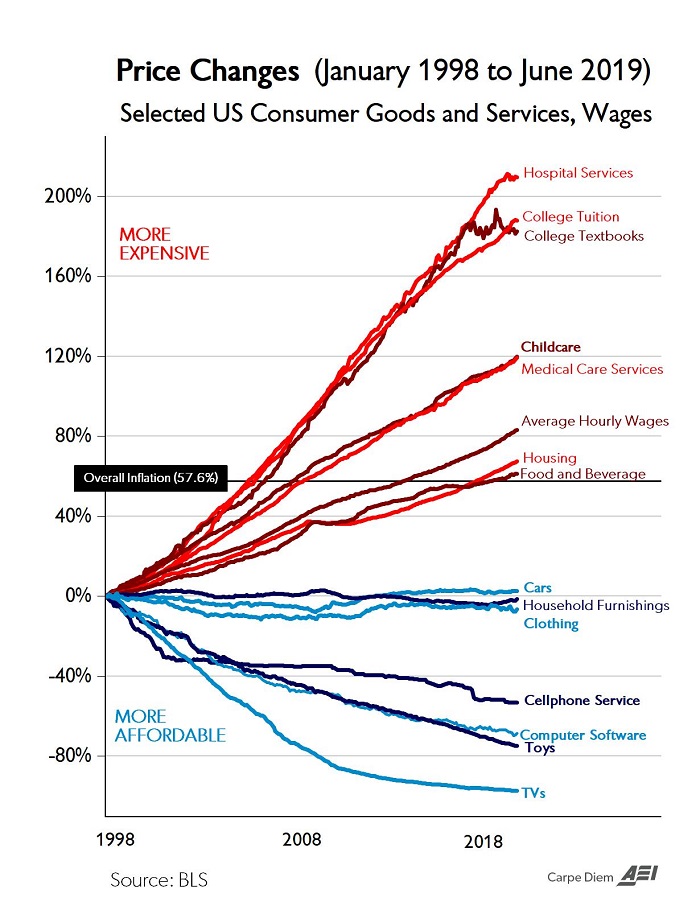

It’s true that we, as a nation, could and should be doing even

better. Economic growth and real wages should be growing even more

robustly. But trying to create an imaginary crisis in opposition to real

data is not the way to get there. Nor, the evidence suggests, is more

government spending and regulation. When it comes to middle-class

Americans being squeezed by rising costs of important household items,

the industries in which we’ve seen the greatest prices increases have

been precisely those that are the most highly regulated. Again, from

AEI’s Mark Perry:"

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.