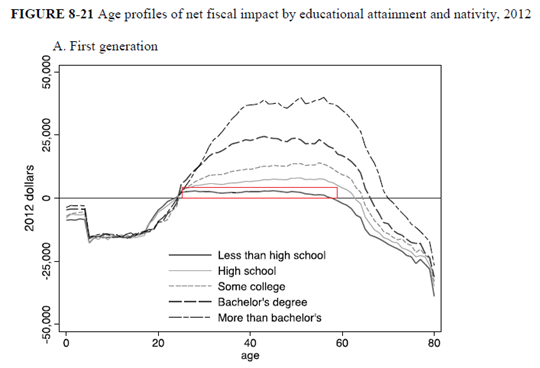

1) Dramatically expanded high skilled immigration would improve federal and state budgets, while spurring economic growth.

The fiscal and economic benefits of high skilled immigration are

tremendous. The net value to the federal budget is between $210,000 and

$503,000 for each immigrant with a bachelor’s degree over their lifetime

(the full chart below highlights the overall impact). The sections on

immigrant entrepreneurship and innovation are also universally positive.

“High-skilled immigrants raise patenting per capita, which is likely to

boost productivity and per capita economic growth,” they conclude (p.

205).

Exempting spouses and children of legal immigrants, as Congress

intended, would

double the flow of high skilled immigrants, allowing the United States to capture these benefits.

2) Legalization could hasten assimilation.

One conclusion of the report is that wage and language assimilation is

lower among the 1995-1999 cohort of immigrants than among the 1975-1979

cohort. The rise of illegal immigration likely explains much of this

difference. More than one in four immigrants today is illegally present

in the United States. As Douglas Massey

has shown,

documented and undocumented immigrants had roughly the same wages until

the 1986 law banning employment of undocumented immigrants, which

depressed the wages of undocumented immigrants. Legalization would

reverse this.

Moreover, other studies have shown that immigrants who are legalized

rapidly increase

their earnings and invest in skills, including language acquisition. A

legalization program that specifically required language classes,

education, and workforce participation while restricting welfare, as the

2013 Senate-passed bill did, would further enhance the gains from

legalization.

3) A large guest worker program can mitigate the negative fiscal impacts of low-skilled immigration.

The most negative finding in the report is that the lowest skilled

immigrants have negative fiscal impacts, but those impacts are entirely

driven by costs in childhood and retirement, as the figure below from

the report shows (p. 331). A large guest worker program that allowed

low-skilled immigrants with less than a high school degree to enter

during their prime years and retire in their home country would be a

strong fiscal gain for the United States.

4) Governments should strengthen the wall around the welfare state. The positive fiscal gains from immigration could be improved by limiting immigrants’ access to benefits. As I

have shown before, immigrants overall did very well after benefits were partially restricted in 1996, and my colleagues

have detailed

a number of ways that these barriers could be reinforced. One

particular insight of the report is that most of the welfare usage comes

after retirement, so that should be a focus of reform.

There are many other implications of this report, but these four are enough for Congress to get started on."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.