"Lincicome and I, meanwhile, authored a recent op‐ed that called for reforming the Jones Act to allow the use of vessels from allied shipyards. Enabling US‐flag carriers to purchase ships at dramatically lower prices than those of US shipyards would promote fleet modernization and reduce the carriers’ need to repair and upgrade their aging vessels in Chinese state‐owned shipyards.

If Sen. Rubio wants Americans to do less business with China, he should advocate for measures that make it easier to trade with US friends and allies. Instead of taking away options from Americans, why not first strive to present them with better ones?

More fundamentally, discrete problems such as the reliance on China for particular sensitive products demand targeted, discrete solutions—not vastly expanded government meddling in the US economy."

"According to one of the most oft‐quoted papers on this topic, 2016’s “The China Shock” authored by economists David H. Autor, David Dorn, and Gordon H. Hanson, US job losses due to increased imports from China between 1999 (China was not admitted as a World Trade Organization [WTO] member until December 2001) and 2011 were a maximum of 2.4 million and most likely about half that number.

At least a couple of things should be kept in mind when evaluating these numbers. First, in the context of a US economy that sees tens of millions of jobs lost (and gained!) annually, they are quite modest. In February of this year alone, for example, over 5 million Americans were separated from their jobs.

Second, the loss of jobs due to Chinese imports was accompanied by job gains elsewhere in the economy. That’s almost certainly not a coincidence. Savings from the purchase of Chinese products provided Americans with more money with which to spend or invest in the US economy. In addition, the dollars used to purchase those Chinese imports later returned to the United States due to Chinese purchases of US goods (goods exports to China rose from $13.1 billion in 1999 to $104.1 billion in 2011) or investments ranging from the purchase of US stocks and treasury bonds to greenfield investments.

This helps explain some findings that Cato’s Scott Lincicome recently highlighted in his weekly newsletter:

First there’s the question of what Chinese imports did to other US jobs in other places (i.e., not the jobs and communities hurt by the shock). Nicholas Bloom and colleagues, for example, concur with ADH that the China Shock caused US manufacturing job losses, especially for those without college degrees, but they add that the losses were fully offset by gains in service jobs in other regions. Several other studies (see this Lorenzo Caliendo and Fernando Parro paper for a review of the academic literature) have similarly found that a decline in US manufacturing jobs during the China Shock period was accompanied by increases in American service‐sector jobs—and often well‐paying ones at the same manufacturing companies. The results from another group of economists were even more positive: After accounting for the effects of Chinese imports throughout the supply chain, specific jobs were indeed lost, but overall US employment and wages increased, even in regions that experienced large manufacturing employment declines (contra ADH).

Finally, one should not be left with the impression that the surge in Chinese imports during the early part of this century was solely—or even mostly—due to China’s WTO membership. Much of the increase reflects the increased competitiveness of Chinese firms as China liberalized its economy and became more market‐oriented. The story is as much, if not more, about China getting out of its own way as US reductions in barriers to Chinese imports."

"While output has indeed stagnated over the past 15 years, it has done so at near‐record levels. That performance is pretty good, particularly considering a) the increasingly services‐oriented nature of the US economy as consumers spend greater portions of their paychecks on things like vacations and dining out than more stuff (how many washing machines, ovens, irons, etc. does one need?); b) the propensity of manufacturers to produce for their domestic market; and c) dematerialization that has seen fewer materials used to produce goods and even the disappearance of numerous items as they are supplanted by smaller multipurpose products (e.g., alarm clocks replaced by smartphones) or slip into the digital ether (DVDs, compact discs, newspapers, books, etc.).

Talk of declining manufacturing employment, meanwhile, is at odds with data showing the number of such jobs as having risen by over 900,000 since April 2009. While the increase has correlated with the decline in productivity that Sen. Rubio highlights, this further supports the notion the decline in manufacturing jobs since 1979 is more a story about productivity (e.g., automation) than trade. Sen. Rubio can express concern over declines in manufacturing productivity, and he can bemoan declines in manufacturing employment, but he can’t credibly do both given the clear tension that exists between them."

"the US share of the world market as an indicator of manufacturing vitality is a deeply flawed metric. As other countries become more developed—as we should wish for them to—they will account for a greater share of global production. Consider, for example, that even if US manufacturing value‐added doubled over a certain period while international manufacturing value‐added tripled, the US share would decline. Rising global prosperity is to be celebrated, and we shouldn’t be led astray by statistics that paint this trend as a cause for worry."

"Neither the moon landing nor NASA (cited in Sen. Rubio’s Washington Post op‐ed), meanwhile, are the industrial policy trump cards that Sen. Rubio imagines them to be. In fact, they aren’t even examples of industrial policy, which is typically understood as government efforts to develop selected commercial industries in service of national economic goals in market‐beating ways. The primary purpose of winning the space race was besting the Soviet Union in a high‐stakes competition for global prestige, with any benefits to US industry a secondary concern."

"if “nationless corporations” are regarded by Sen. Rubio with such deep suspicion, why does he seek to empower them via industrial policy that their lobbyists will inevitably help shape? It’s worth noting, for example, that the primary beneficiaries of the Creating Helpful Incentives to Produce Semiconductors Act—Intel, Micron, TSMC, and Samsung—are all multinationals, the latter two of which are headquartered abroad. If these corporations are a malady, then providing them with government resources seems an odd cure indeed."

"The Founders’ use of tariffs did not reflect a belief in industrial policy but rather a need to raise revenue. As economist Douglas Irwin wrote in his detailed history of US trade policy Clashing over Commerce:

During this period, the term free trade did not mean zero tariffs and the absence of any government restrictions on trade. It was generally understood that governments would need to tax trade for revenue purposes. Instead, free trade meant the freedom of a country’s merchants to trade anywhere they wanted without encountering discriminatory prohibitions or colonial preferences as long as they paid the required duties. Free trade could be more accurately characterized as open trade in which countries could impose import duties and regulate shipping but did so in a nondiscriminatory manner.

Economic historian Phil Magness, meanwhile, notes that decisions over which items to place tariffs on produced testy exchanges among legislators. Rather than considering the country’s economic welfare as a whole, these politicians—as they are wont to do—instead took a more narrow perspective focused on their constituents:

The new nation’s first foray into tariff policy began innocently enough on April 9, 1789, when Madison introduced a bill to the House of Representatives proposing specific duties on alcohol and applying a tax “on all other articles ___ per cent. on their value at the time and place of import.” Most expected a short debate, as indicated by Rep. Elias Boudinot of New Jersey, who followed Madison in suggesting “that the blanks be filled up in the manner they were recommended to be charged by Congress in 1783.” Rep. Thomas Fitzsimmons of Pennsylvania derailed the plan with a hastily drawn amendment to “encourage the productions of our country, and protect our infant manufactures.”

The proposal caught Madison, and most of Congress, off guard. “If the duties should be raised too high,” Madison warned in a letter, “the error will proceed as much from the popular ardor to throw the burden of revenue on trade as from the premature policy of stimulating manufactures.” And yet the allure of specialized rates swept through Congress, prompting requests from a succession of amendments seeking differentiated rates for favored goods from their home district or state. In his first major congressional action, Madison had unwittingly awakened the very same brand of factional politics he so eloquently diagnosed in The Federalist Papers. Except for slavery, tariffs became the most contentious federal policy issue of the 19th century and remained a source of continuous discord until the Great Depression.

Such dynamics should surprise only the grossly naïve. Furthermore, what reason is there to think that the same parochial interests that helped set tariff policy would not also influence the direction of Sen. Rubio’s envisioned industrial policy? Perhaps more fundamentally, why does Sen. Rubio think that trade policies adopted in the late 1700s offer useful lessons for economic policy in the 21st century?

Policies adopted by President Ronald Reagan are at least within living memory, but here Sen. Rubio succumbs to factual and logical errors. Reagan did not increase tariffs but instead implemented a voluntary export restraint (VER) that limited imports of Japanese vehicles. And it’s certainly nothing to emulate. As Scott Lincicome detailed in a 2022 blog post, the VER cost US consumers billions of dollars, much of which was funneled money into the pockets of Japanese automakers (who could raise their prices due to the VER’s constraint on supply). Rather than using the import restraint as an opportunity to retool and raise its game, meanwhile, the US auto industry frittered away the increased profits generated by the VER on items such as aircraft and bonuses for company executives.

The larger context is also worth bearing in mind. While tactically ceding free trade ground through adoption of the VER (eventually scrapped in 1994), Reagan also used his time in office to sign a free trade agreement with Canada—the foundation of the North American Free Trade Agreement—and helped launch the Uruguay Round of trade talks that eventually culminated in the establishment of the WTO. Reagan’s trade legacy is far more rooted in expanded liberalization than the kind of industrial policy Sen. Rubio now champions."

"Talk of alleged “deindustrialization” in a country that accounts for the second‐largest share of global manufacturing output is odd if not outright false while claims of reduced resilience and cultural corruption are so nebulous and unspecific that they are difficult to respond to. Again, the inability to articulate the nature of the problem that Sen. Rubio demands the government be given fresh reserves of power and money to confront is a disturbingly recurrent theme.

That said, if Sen. Rubio is concerned about resilience it is unclear why he believes the answer lies in industrial policy. Far from undermining economic resilience, trade openness provides needed redundancies and alternative sourcing arrangements that help mitigate the impact of shocks such as the recent COVID-19 pandemic. Trade can also assist in the recovery process once these shocks subside. As a 2021 World Trade Organization report stated in its conclusion:

Trade can also better equip countries to deal with shocks. As a source of economic growth and productivity, it gives countries the technical, institutional and financial means to prepare for shocks. It also can help to ensure that critical services, such as weather forecasting, insurance, telecommunications, transportation, logistics and health services, as well as critical goods, are available in a timely manner before and after a shock hits. It can also enable countries to switch from domestic to external suppliers in case of domestic shortages, thereby making it possible to import essential goods quickly and more easily cope with shocks. In addition, trade contributes to economic recovery from shocks by improving allocative efficiency and unlocking scale effects, enabling the creation of export‐related jobs and the importation of affordable necessary inputs, ultimately leading to better incomes and increased productivity and innovation.

A perfect example of the value of global supply chains—and the risk of overreliance on domestic ones—was seen during the 2022 baby formula crisis. During this crisis, recalls of formula as well as the shutdown of a US plant that produced formula over contamination concerns led to widespread shortages. These, however, were only the shortage’s proximate cause. Their persistence was due to US import barriers, consisting of both tariffs as well as strict nutritional, labeling, and other standards imposed by the Food and Drug Administration, that enabled US producers to control over 98 percent of the baby formula market. Had these barriers been lower, or removed entirely, foreign‐produced supplies could have quickly eliminated the shortages.

The episode is a classic case of how severing Americans from global supply chains makes them more vulnerable and less resilient. The forced use of domestic production may seem like a wise exercise in self‐reliance, but the reality is more akin to placing all of one’s eggs in a single basket."

"what should be made of Sen. Rubio’s support for sugar protectionism that has encouraged US candy manufacturers to shift their production overseas? Is Sen. Rubio not complicit in fostering the very ills that he decries? If manufacturing is so vital, why does Sen. Rubio back policies that drive it away?"

Friday, April 26, 2024

Responding to Senator Rubio on Industrial Policy

Internet Regulation Is Back: FCC Refuses to Retire “Net Neutrality” Rules

"The Federal Communications Commission today voted to reinstate Title II regulations for the Internet, needlessly extending the so‐called net neutrality controversy into its third decade and opening the agency up to legal challenges. In 1996, before most Americans knew the sound of an AOL login dial tone (ask your parents), Congress passed a law announcing a national policy “to preserve the vibrant and competitive free market that presently exists for the Internet … unfettered by Federal or State regulation.” Lawmakers wanted to protect Internet services and companies from 70 years of accumulated telecommunications and media rules, including licenses to operate, content restrictions, and frequent, politicized rulemakings.

That deregulatory policy has been a resounding success. It was not obvious in the early 1990s that US tech companies would lead the world, but today, the largest Internet and artificial intelligence companies—Alphabet, Meta, Microsoft, Amazon, and the like—call the US home. Further, on the infrastructure side, there has been tremendous investment and improvement, including the millions of miles of new fiber optics, the roadside conduit, the radio spectrum, and cell towers.

The telecom industry spends over $100 billion spending in capex annually. Even before the pandemic and new federal spending, FCC data said around 130,000 rural households were getting high‐speed broadband for the first time every month.

Since the early 2000s, amid this rapid progress, the so‐called net neutrality movement has urged the FCC to apply 1930s telecom laws—Title II—to Internet access services. While appreciating the Internet’s democratic possibilities, regulation advocates have long regarded the prevailing Internet and tech culture as too libertarian, too disruptive, and too troll‑y to leave to market forces and general law. Thus, these advocates argued regulation by experts was needed.

Many in the FCC didn’t need much encouragement; the agency’s areas of regulation—telegraph, telephone, broadcast‐TV, and cable‐TV providers—are obsolete, dying, or being reinvented with Internet technology. The Internet undermined the FCC’s authority over media distributors and regulation advocates inside and outside the agency realized that the FCC needed new problems to “solve.”

For many of us who have followed the net neutrality controversy, the FCC’s attempt to re‐impose Title II is a tremendous waste of the FCC’s expertise and time. Since 2003, when “net neutrality” was coined, millions of households have seen their Internet speeds increase from 200 kilobits per second to a gigabit per second, due in part to the deregulatory policy of Congress and a lot of infrastructure investment. It’s difficult to identify another service Americans use regularly that has seen a 5,000-times quality improvement in 20 years.

Title II regulations, created to police the Ma Bell phone monopoly, would transform Internet access from one of the least‐regulated services in the United States into a national common carrier service. Access providers would be subject to second‐guessing by regulatory lawyers, interminable waiver proceedings, and the FCC’s vague, new “general conduct standard.”

The FCC faces immense legal challenges. For one, it’s hard to square Title II common carrier regulation of the Internet with Congress’ deregulatory policy for the Internet. Courts struck down two previous attempts at net neutrality regulations, though the FCC extended Title II to Internet access companies for a couple years before it was rescinded by the Trump administration. Further, net neutrality enforcement creates complex First Amendment problems that the FCC seems indifferent to. Finally, the FCC claims it has the power to be the judge, prosecutor, and jury in net neutrality enforcement, an argument that seems to violate the separation of powers, and will likely receive a chilly reception from courts.

If history is any guide, these Title II rules will compel the thousands of small Internet service providers to “lawyer up” and keep abreast of the unpredictable interpretations and pronouncements of Washington, DC, regulatory lawyers. Larger companies will grow more sclerotic and risk‐averse, as the pernicious revolving door between regulators and corporation spins faster. Hopefully, the net neutrality controversy will be retired—by courts or by Congress—before it does much damage to the Internet services and infrastructure sectors and before it enters a fourth decade."

Thursday, April 25, 2024

How regulation hurts the California insurance market

See Great Moments in Denying Reality by David Henderson.

"California has some of the strictest insurance regulations in the country. It is the only state where insurers are not allowed to base their rate hikes on catastrophe models — forward-looking calculations of risk — or the rising cost of reinsurance premiums, according to both Zimmerman and the Department of Insurance.

Under current regulations, insurers are only allowed to use catastrophe models to calculate rates for earthquake insurance. One proposed change under the Sustainable Insurance Strategy would expand that to wildfire risk, as well as the risk of post-earthquake fires and terrorism. Another proposed regulation yet to be released would also allow insurers to incorporate reinsurance costs into rate hikes, the department previously announced.

The above quote is from Megan Fan Munce, “Major California home insurer could resume writing new policies. Here’s what it would take,” San Francisco Chronicle, April 24, 2024.

In case you haven’t heard, price controls on home insurance are causing a number of insurers not to write new homeowners’ insurance policies and, in some cases, to quit the business in California. The two paragraphs above lay out one important way in which prices are controlled. Insurers are not allowed to base rates on expected risks.

While my wife and I are lucky because State Farm has said it will renew our policy, I’m not so lucky in another role. I’m a limited partner who owns approximately 1% of a large apartment complex in Bakersfield. Our insurer has told the general partner that it will not renew our insurance and he has been unable to find any insurer that will."

Pain at the Pump

Blame Politicians, Not Producers, for High California Gasoline Prices

By Robert J. Michaels & Lawrence J. McQuillan. Robert J. Michaels is Professor Emeritus of Economics at California State University, Fullerton. Lawrence J. McQuillan is Senior Fellow at the Independent Institute.

"California’s gasoline market—throughout the entire supply chain—is competitive but also features isolated choke points, bottlenecks, and government interventions that result in a gasoline production and supply network that is slower, more rigid, and less adaptive and efficient than it otherwise could be. The overall effect is persistently higher prices at the pump and greater price volatility during periods of disruption. Those consequences stem from federal, state, and local policies by the U.S. Congress, the U.S. Environmental Protection Agency, the California State Legislature, the California Air Resources Board, the California Environmental Protection Agency, California governors, local boards of supervisors, and local city councils and mayors, among others."

"Prices at different locations for crude oil will tend to move toward parity as arbitrage occurs (the “law of one price”). Transaction costs represent obstacles that keep prices from equalizing in the long run along with local events that disrupt markets temporarily. It is fair to say that the sources of crude oil used to refine California gasoline can be, and have been, located almost anywhere in the world, including California."

"California’s oil and gasoline industry is in some ways an isolated “fuel island” cut off from adjustment mechanisms that are available in other regions of the country. Market fundamentals and institutions explain California gasoline prices without resorting to conspiracy theories inconsistent with economic logic and the available data."

"The policy choices of officials drive retail gasoline prices higher by 30 percent to 70 percent or more in the Golden State, acting effectively as a regressive tax hitting hardest the state’s poorest residents"

"different refinery designs and operating procedures are best suited to process certain types of crude, most importantly “sweet” or “sour” crude, defined by low or high sulfur concentration, respectively."

"Gasoline spending per capita in 2021 was highest in sparsely populated Wyoming ($1,756) and lowest in urbanized New York ($754).[3] In 2009, California ranked 13th in per capita spending on gasoline, and by 2021 it had fallen to 21st ($1,338). The average increase in gasoline prices nationally from 2009 through 2021 was 30.7 percent, but California’s increased by 57.9 percent. The price of crude oil delivered to California also increased, but by a less extreme percentage."

"a recent report by investor website MarketWatch correctly claimed that Californians paid nearly 70 percent more per gallon than the rest of the country"

"only recently, around 2010, did California persistently become the highest-priced western state for gasoline."

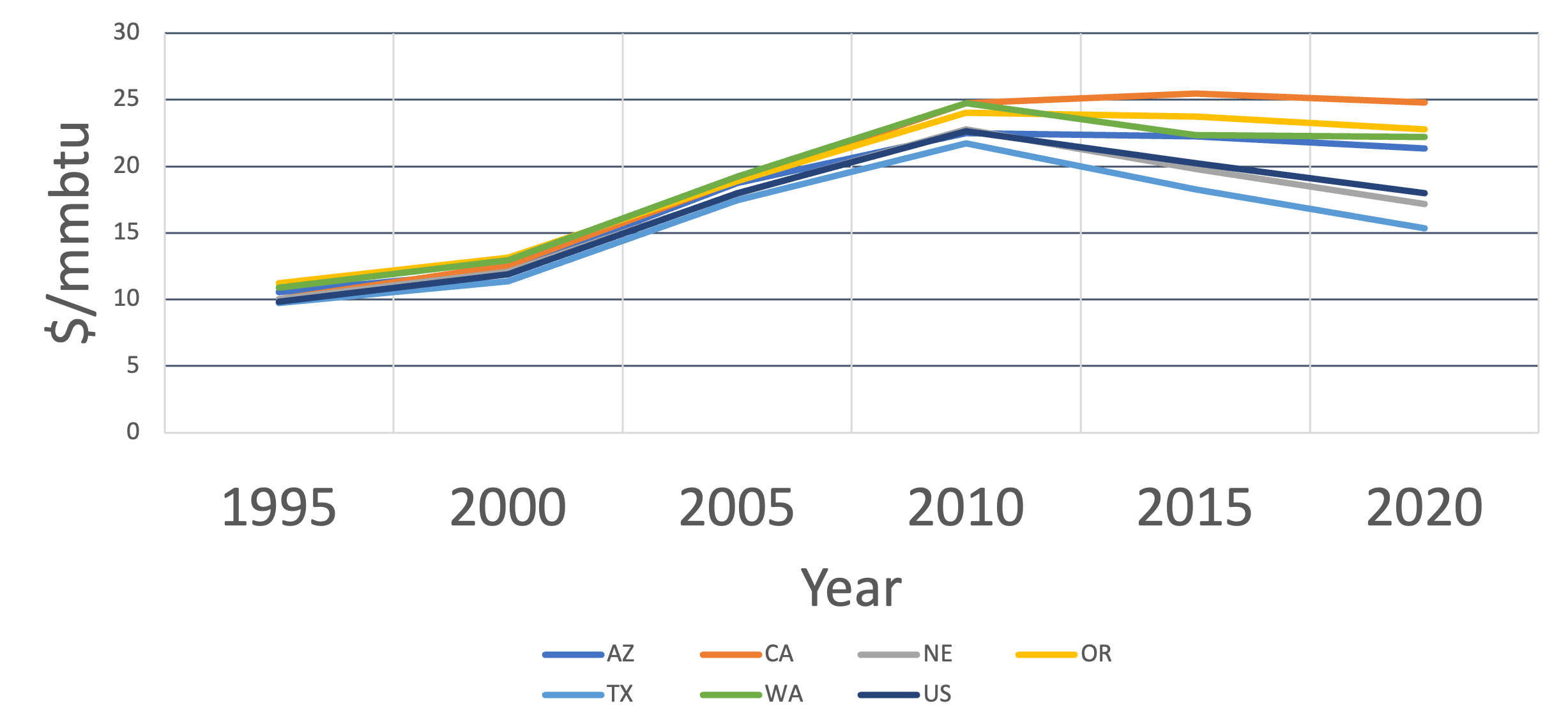

Figure 1: The retail price of gasoline per MMBtu for selected U.S. states, 1995–2020.Sources: U.S. Department of Energy, Energy Information Administration, State Energy Data System, State Profiles and Energy Estimates, Motor Gasoline Price and Expenditure Estimates, Ranked by State, 2021, table E20; U.S. Department of Energy, Energy Information Administration, Motor Gasoline Price and Expenditure Estimates 1970–2020, table F20; and U.S. Department of Energy, Energy Information Administration, Primary Energy, Electricity, and Total Energy Price and Expenditure Estimates 1970–2021, table ET-1."California became a high-price state for retail gasoline quite recently"

"To explain gasoline prices, we begin by examining the market process of price convergence. Figure 2 shows prices for crude oil deliveries at three important locations during a 10-year period."

Source: IndexMundi: Dated Brent, WTI, Dubai p

When transactions that exploit localized differences are reallocated, prices become better indicators of relative scarcity and abundance over wider areas. Changing prices facilitate adjustments to unexpected events.

"The successful performance of crude oil markets that experience surprise “shocks” is perhaps best illustrated by attempts to cartelize oil markets by the Organization of Petroleum Exporting Countries (OPEC). Reaction to OPEC’s 1973 oil embargo was a textbook exercise in market economics: The price for a barrel of oil quadrupled, and prices at the pump roughly doubled. Non-member countries responded by producing larger amounts of new oil, exploration activities burgeoned around the world, and by the end of the decade OPEC’s influence on prices, if any, was difficult to spot. OPEC infighting destroyed a united front going forward. Over the longer term, producers innovated such new technologies as directional drilling and hydraulic fracturing, also called fracking. As time passed and technologies changed, new reactions to scarcity became possible. Natural gas went from a local by-product of oil extraction to an internationally traded commodity that moved globally on ultra-cold liquefied natural gas tanker ships and increasingly competed with oil.

The lesson: The data demonstrate that in mature global markets such as crude oil, prices will tend to converge over time and move together when events impact market participants. Transaction costs represent “obstacles” that keep prices from equalizing in the long run. Local events, such as refineries suddenly shutting down due to unexpected maintenance, a fire, or a hurricane, can disrupt markets temporarily—more so in California"

"Perhaps surprisingly to many people, California’s most important source of crude oil in 2019 was California, 28.9 percent of the total processed in the state. Alaska accounted for another 14.9 percent of the total. Ongoing production declines and regulatory limits on exploration and drilling have reduced domestic oil’s importance in California such that by 2022 foreign sources dominated, especially Saudi Arabia, Ecuador, and Iraq."

"Mexico’s history of oil field nationalization since the 1930s and its problematic political relationship with the United States have combined to reduce its actual and potential exports to the United States and California. Canada sends substantial amounts of crude oil to the Midwest and Northeast, but limited pipeline capacity leaves it with only a small fraction of California’s market."

"California’s relatively small pipeline networks and storage capacities limit the state’s use of regional throughput for gasoline and blending components to less than 7 percent of total capacity. Since general agreement apparently exists that politics and economics are combining to shrink California’s oil consumption, there is little prospect on the horizon that pipeline capacity will be expanded in California. California refiners can send gasoline out of the state but have virtually no import capability. The state refines most of Nevada’s, and nearly half of Arizona’s, transport fuels.

Those constraints create scenarios wherein supply and demand can become tight. Little spare capacity further limits California’s ability to adjust to unforeseen events, and dependence on maritime shipping makes adjustments even slower and more expensive. Sudden changes, such as a refinery accident, can impose costs in California that would be mitigated by slack capacity and pipeline arbitrage in less constrained areas.

California’s ability to adjust is constrained by the law. In many regions of the United States, a refinery accident leads to temporary shortages and short-term price spikes. The shortfalls are relieved by local action, such as more outside deliveries through pipelines. But in California, where deliveries come by ship, the federal Jones Act (enacted in 1920) requires that transportation between U.S. ports be made on U.S.-flagged ships built in the United States and crewed largely by American sailors. Spare tanker ship capacity is limited, and the entry of additional shippers often is uneconomical.[13] The Jones Act hampers seaborne tanker shipments to California, increasing delays and reliance on trains and capacity-constrained pipelines.

Long-term supply issues might be minor given the world market. But local factors might cause significant short-run price spikes and supply shortages, which are less likely in less constrained parts of the country. California environmental regulations that require a special fuel blend mean that its refiners and retailers cannot simply purchase gasoline from other states, even if pipeline capacity was sufficiently in place.

The supply-demand balance in California determines the choices of producers and consumers, which are made under pervasive uncertainty. The details of those choices are critical because they determine the benefits that originate in markets and the distribution of those benefits. Transactions may be short- or long-term, may be seasonally variable, and can cover flows that are secure or not (“firm” or “interruptible”). They apply to different possible mixes of crude inputs and finished product outputs whose values depend on market prices, to name only a few dimensions.

Many factors also impact the market structures of refining and retailing, and their relationships. Gasoline sales involve a complex volumetric interdependence between oil production, refining, and retail gasoline distribution. Crude oil and refined products are costly and dangerous to store, and the underlying chemistry of boiling and evaporation limits the rates at which various products can be produced. Most important, the high costs of interruptions require that the entire process operate continuously. Minimizing long-term cost may entail storing crude rather than refining it immediately, or not releasing from storage a currently salable product because future operating costs might be higher if it were sold today. Inventories and “buffer” supplies are costly to maintain, but cost may be even higher if the operator must make rapid adjustments.

Continuous operation requires a dependable incoming stream of crude oil, in terms of both deliveries and the pricing of those deliveries. The refiner’s limited and costly storage capacity requires that the refiner have dependable outlets and prices for gasoline, which is most efficiently produced in a continuous stream. Recognizing the realities of the fuel production process helps to explain seeming anomalies that many observers have viewed as evidence of monopoly.

Volumetric interdependence motivates large refiners, also known as “majors,” to mitigate the risk of unsold output by vertically integrating “backward” into exploration and production of crude oil that they will use as scheduled. To solve their own inventory and continuity problems, refiners also contract with “independent” specialist producers like Apache and Devon for additional crude oil supplies or to reduce the costs of maintaining inventories.

One common solution balances the costs and benefits for oil producers and gasoline retailers by binding them into long-term relationships with franchise contracts that can be terminated only by mutual agreement. The refiner sets its price in the face of market conditions (including competition from other refiners) but cannot specify the price that a retailer legally can charge. Under a voluntarily entered contract with the refiner, the retailer is said to be “captive,” and, absent special arrangements, it can deal only with that refiner. The franchise contract, however, typically rewards efforts by gas stations to sell goods such as tires and minor repairs as allowed by the station’s parent brand, which itself has a reputation to protect by maintaining customer loyalty."

As "Vehicles became more technologically complex and heavily regulated for pollution and safety in ways that benefited auto dealerships over corner gasoline stations, leaving retail stations with low-margin residual business (fixing flat tires, for example) and reducing their incentives to make gasoline-related sales efforts to win motorist loyalty."

"customers had become less loyal to established brands and increasingly sought low prices while retail margins on gasoline fell. The “service station” that once sold both gasoline and repairs is giving way to enterprises (“pumpers”) working to maximize income from low-price gasoline sales and downplaying services. Yet another consequence has been the rise of the “convenience store,” which is typically not operated by the fuel supplier and offers low-price gasoline to draw people into the store, where higher-margin merchandise is sold."

"California is in many ways a “fuel island,” cut off from adjustment mechanisms that are available in other regions of the country. Supply shocks cause greater and longer-lasting price spikes in California because of the state’s unfortunate reliance on capacity-constrained pipelines and ships to move crude oil and gasoline. California’s strict environmental fuel standards make it impossible for gasoline refined elsewhere to be simply transported to California when prices rise. Contractual arrangements, such as franchise agreements and vertically integrated production and distribution structures, are not evidence of monopolistic behavior. Rather, they provide efficiency benefits to producers and consumers, especially as technology and regulations have changed."

Source: California Energy Commission, “Estimated Gasoline Price Breakdown and Margins,” July 17, 2023.

The average retail price per gallon of branded gasoline in California on July 17, 2023, was $4.721, about $1.20 (or 34 percent) more than the national average of $3.53 on the same date.[15] In recent months, California’s average gasoline prices have been about $1.20 to $1.50 above the national average per gallon. The difference was much larger during the summer and fall of 2022, during the peak of then record-breaking prices."

"During normal times, the average retail price for a gallon of gasoline in California is 30 percent to 40 percent higher than the national average. But the difference can spike temporarily to 70 percent or more during periods of significant disruption in the supply chain (for example, on September 27, 2023, the price difference was 54 percent or $2.06 per gallon due to several supply shocks).

Comparing California’s percentage breakdown in Figure 6 with the national average breakdown[20] shows that California’s price differential of $1.20 is driven by three components: about 32 cents more per gallon explained by a higher state excise tax (26 percent of the difference), 42 cents more per gallon attributable to higher refinery costs (35 percent of the difference), and 51 cents more per gallon resulting from greater environmental regulatory costs plus other state and local taxes and fees, such as sales taxes (42 percent of the difference). As economic theory predicts, the crude oil price differential was just 2 cents per gallon, supporting the law of one price. In other words, higher taxes, stricter environmental regulations, and unique fuel island effects explain the higher gasoline prices in California compared with prices experienced elsewhere. The share attributable to fuel island effects surges typically during periods of sizable disruption, such as a significant break in the supply chain."

"Greed, however, cannot be the explanation because both buyers and sellers invariably are self-interested. No plausible reasons can be found for believing that producers, refiners, and retailers somehow became greedier overnight in the summer of 2022, and then became less greedy overnight, allowing prices to fall later in the year. Instead, the fundamentals of supply and demand changed during that summer and fall within California’s unique institutional regime, which explains the behavior of gasoline prices.

Selective data frequently are cited to substantiate allegations of greed and “windfall profits” by producers. Gasoline, however, can be relatively abundant or relatively scarce. The relevant question is whether oil and gasoline sellers persistently are more profitable than those in comparably risky businesses. It is not enough to present data on high prices or profits without showing that they resulted from activities beyond ordinary competition. If price fixing exists, it is subject to state and federal antitrust laws, and hefty profits await those who spot it and succeed in court. As we have seen, global markets tend to converge around a single price, and the recent U.S. experience is part of it. Prices around the world were comparably high in the summer and fall of 2022, and they moved in parallel, but the record fails to show evidence of monopoly."

"On September 30, 2022, Governor Gavin Newsom directed the California Air Resources Board to make an early transition to mandatory use of lower-cost winter blend gasoline.[23] On the same day, Newsom noted that crude oil had fallen from roughly $100 per barrel at the end of August to about $85 per barrel during the following 30 days, while gasoline prices had risen from $5.06 per gallon to $6.29. He said, “We’re not going to stand by while greedy oil companies fleece Californians. Instead, I’m calling for a windfall tax to ensure excess oil profits go back to help millions of Californians who are getting ripped off.”

Few if any reasons exist for believing that a windfall profits tax would do anything more than effect minor transfers of wealth among Californians. In 1980, the U.S. Congress and President Jimmy Carter enacted the Crude Oil Windfall Profit Tax Act. According to Ajay K. Mehrotra, a professor of law and history at Northwestern University, for a variety of reasons, “[m]ost economists declared it a colossal failure.” He went on to conclude that such excess and windfall profits taxes “rarely deliver on their promise of greater enduring tax equity.”"

"The CEC [California Energy Commission ] and other state agencies have failed to unearth data that would support a valid conclusion of monopoly or price fixing. Responding to an earlier inquiry in 2019 on the causes of price increases, a CEC report noted,

[it] does not have any evidence that gasoline retailers fixed prices or engaged in false advertising."

"As an example of the factors that must be accounted for to substantiate a charge of profiteering, consider the summer of 2022. Retail gasoline prices were high, but sales volumes were lower than expected. Nevertheless, station profitability during the summer driving season was roughly 70 to 90 percent higher than in the past three summer driving seasons. It was among the most profitable periods on record, as the growth in margins outweighed the decline in volumes.

"Consistent use of competitive bidding among private companies, without union-labor and prevailing-wage mandates, to fix and build roads and bridges could lower overall costs, allowing excise taxes or mileage-based user fees to be reduced over time. It costs California $44,831 to maintain each lane-mile of state roadway—the fourth-highest rate in the nation, which may explain why California’s gasoline excise taxes are so high, compared with those of other states."

"California leads the nation in the prohibition of new gas stations and new fuel pumps at existing gas stations"

"A consequence of fewer gas stations is that many consumers must drive farther to fuel their vehicles, which not only consumes more gasoline, but it can also force consumers to use gas stations in more dangerous areas."

"Oil drilling in California has also been curtailed, and new prohibitions have been enacted recently, ostensibly to combat climate change and advance “environmental justice.” As early as 1969, California stopped issuing new permits for offshore oil drilling in state waters.[40] In 2021, Los Angeles County supervisors voted unanimously to prohibit new drilling and phase out existing oil and natural gas wells in unincorporated areas of the county."

"California’s summer seasonal fuel blend, intended to reduce unhealthy ozone and smog levels, especially in the Los Angeles area, is more expensive for refiners to produce than the winter fuel blend.[37] The seasonal fuel blends plus California’s “reformulated gasoline” requirement (which is designed to burn cleaner) create a “fuel island” effect in California, since refiners and retailers cannot simply buy gasoline from other states in a pinch to meet demand."