"Two months ago, I wrote about a remarkable example of the Laffer Curve, involving Ireland’s low 12.5 percent corporate tax rate.

According to the New York Times, Ireland was collecting so much corporate tax revenue that the government was having a hard time figuring out what to do with all the money (as you might expect, I suggested that politicians lower other taxes).

Today, let’s look at a different story about Ireland’s corporate tax policy.

Only we’ll be talking about jealousy and bitterness rather than how to dispose of extra tax revenue.

Sarah Collins reports that some of the world’s best-known left-wing economists are upset that Ireland is so successful.

Three leading economists – including France’s Thomas Picketty and former IMF official Ashoka Mody – have accused Ireland of “siphoning” other countries’ tax revenues and operating a “parasitic” corporation tax policy. …Princeton professor Ashoka Mody, the former International Monetary Fund economist…, said Ireland’s policy was “parasitic”.

…French economist Thomas Picketty, professor at France’s school for advanced studies in social studies (EHESS)…, said Ireland is “siphoning” taxes off other countries. …Their comments follow a tweet on Wednesday by French economist Gabriel Zucman, head of the EU Tax Observatory and author of a recent EU-funded report that called Ireland a tax haven. …It comes the same week corporation tax receipts were revealed to be up more than a quarter in November compared with the same month last year, boosting overall revenues and putting the State on track to beat last year’s record tax take.

What makes this story amusing (above and beyond the whining) is that left-wing economists should be happy with Ireland.

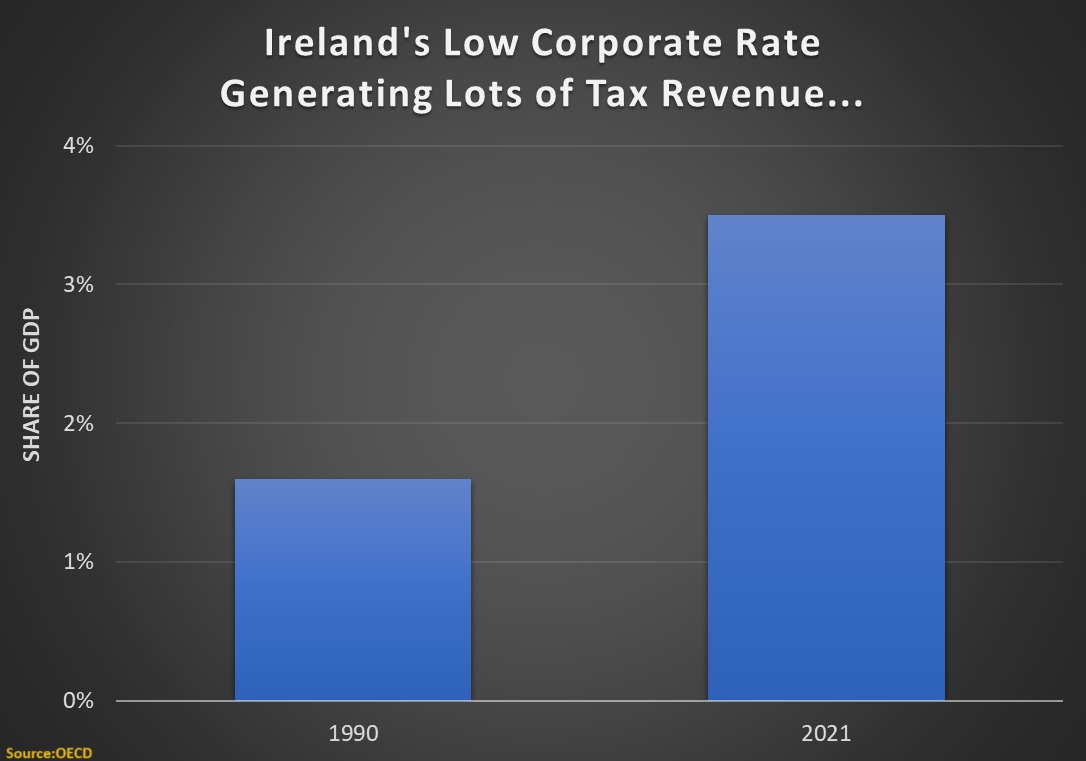

The OECD’s annual Revenue Statistics was just released and the data show that Ireland is collecting much more tax revenue from corporations.

What makes these numbers so remarkable is that there is more than five times as much GDP in Ireland today as there was in 1990.

So the government is collecting more than twice as much revenue from a pie that is more than five times larger.

You would think lefty economists would applaud.

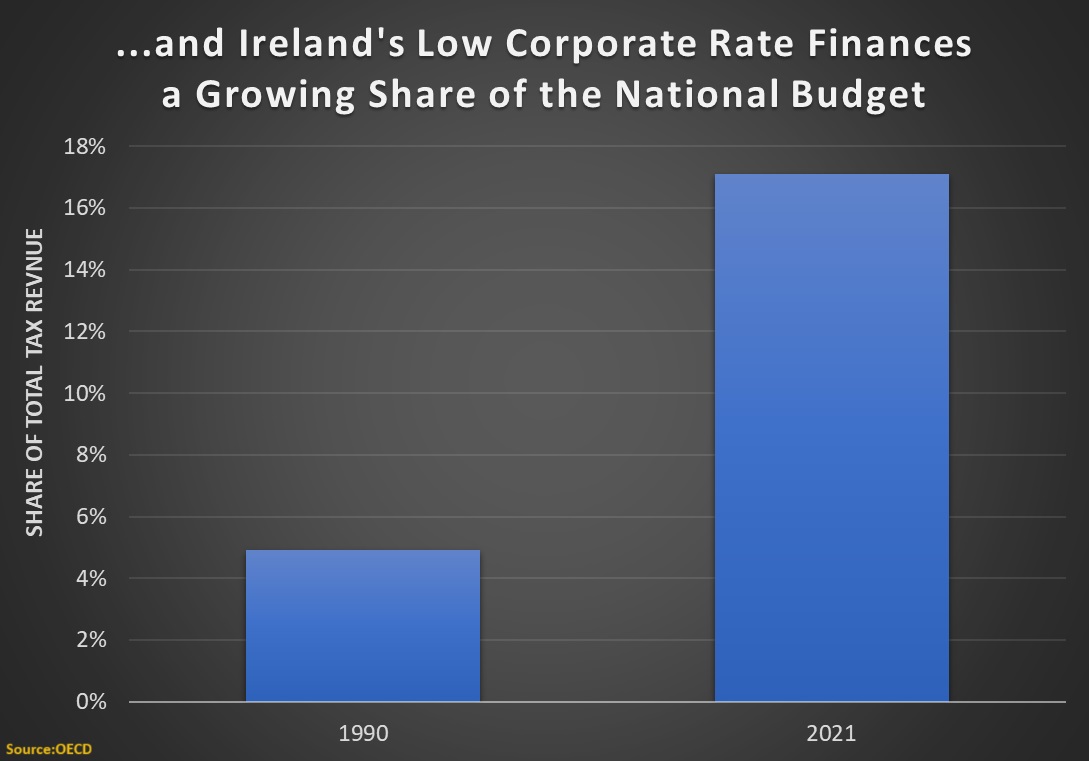

Here’s some more data from the OECD report. It shows corporate tax revenue as a share of overall tax revenue.

This is another chart that the left should applaud. They complain that big companies don’t pay their “fair share.”

Yet when there’s an example of a country where corporate tax revenues have soared, they are not happy.

There are three reasons for their unhappiness.

- They don’t like Ireland’s low corporate tax rate because it shows that supply-side tax policy generates prosperity and it shows that the Laffer Curve is real.

- They don’t like Ireland’s low corporate tax rate because they are mostly motivated by envy and they like punitive tax rates even more than they like tax revenue.

- They don’t like Ireland’s low corporate tax rate because it puts pressure on other countries to lower their corporate rates to become more competitive.

Let’s look at a favorable article about Ireland.

Lawrence Reed wrote earlier this year that the Emerald Isle is a case study for economic freedom Here are some excerpts.

Though fewer people today live in Ireland than did almost two centuries ago, they’re busy teaching the world that economic freedom works. The Heritage Foundation’s Index of Economic Freedom ranks the Irish economy as the third freest in the world, behind Singapore and Switzerland.

…In 2022, the Irish economy grew at the astonishing rate of 12.2 percent, the fastest on the European continent. (By comparison, the US economy grew by 2.1 percent in 2022.) If you think there’s no connection between Irish freedom and Irish prosperity, contact your economics teachers and demand a refund. …Ireland ranks high because property rights and contracts are well protected. The business climate is friendly because regulations aren’t nutty and intrusive, while tax rates are competitive. …It’s freedom, not the “luck of the Irish,” that explains Ireland’s remarkable economic success.

I agree that Ireland is a success story, but I also warn that it is not quite as successful as some people think.

Way back in 2011, I explained that the presence of so many companies created a distorted picture of Irish prosperity and that it’s better to use gross national income rather than gross domestic product.

Ireland is still a success story with GNI numbers, to be sure, but you won’t find 12.2 percent annual growth.

For wonky readers, I recommend this thread on Irish economic data.

And if you want to understand how Ireland wound up enacting a good corporate tax system, here’s another very illuminating thread.

I’ll close with a couple of negative observations about Ireland. First, Ireland does not get a good score on the Tax Foundation’s International Tax Competitiveness Index, so it definitely should be using any extra tax revenue to finance lower personal income tax rates.

Second, it appears that Ireland has a relatively low burden of government spending (see the chart in Thursday’s column), but those numbers would look much worse if we used GNI rather than GDP. And Ireland has gotten in trouble before because of excessive spending.

The bottom line is that Ireland has an admirably low corporate tax rate, but other fiscal policies often leave much to be desired."

Saturday, December 9, 2023

Corporate Taxation, Ireland, and Jealousy

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.