"Here is Ayn Rand on the antitrust laws:

Under the Antitrust laws, a man becomes a criminal from the moment he goes into business, no matter what he does. For instance, if he charges prices which some bureaucrats judge as too high, he can be prosecuted for monopoly or for a successful “intent to monopolize”; if he charges prices lower than those of his competitors, he can be prosecuted for “unfair competition” or “restraint of trade”; and if he charges the same prices as his competitors, he can be prosecuted for “collusion” or “conspiracy.” There is only one difference in the legal treatment accorded to a criminal or to a businessman: the criminal’s rights are protected much more securely and objectively than the businessman’s.

Exaggeration? Here is the FTC case against Amazon which has switched almost overnight from one theory to the diametrically opposite theory:

“It’s really hard to square the circle of the earlier theory of harm that Lina Khan enunciated with the current complaint,” said John Mayo, an economist who leads Georgetown University’s Center for Business and Public Policy. “The earlier complaint was that prices were going to be too low and therefore anticompetitive. And now the theory is they are too high and they are anticompetitive.”

More generally, the FTC under Khan seems to be a lost opportunity. There are abusive practices such as hidden pricing by hospitals that could be improved but the FTC is throwing it away on pursuing the greatest store the world has ever known. Why? I have liberal friends who quit the FTC because they wanted to work on real cases not political grandstanding."

Saturday, September 30, 2023

Ayn Rand on the Antitrust Laws

The Economic Case for School Choice

"Although it is only 2023, the 2020s already can be categorized as the decade of school choice thanks to legislation in West Virginia, Arizona, Iowa, Utah, Arkansas, Florida, Indiana, Oklahoma, and North Carolina.

The main argument for choice is that government schools squander record amounts of money and deliver very poor results. Especially for disadvantaged students.

But there are other arguments for choice.

- Saving money for taxpayers.

- Improving performance of government schools.

- Boosting civil rights.

- Increasing success in college.

Today we’re going to consider potential economic benefits of school choice.

Back in August, Lindsay Killen and Ella Bevis of the James Madison Institute wrote a column for Real Clear Policy to explain why school choice also is a pro-growth policy.

Here are some excerpts.

…the impact of education choice stretches across communities and economies, helping to unleash prosperity and growth that benefits everyone. …With school choice comes increased competition, encouraging businesses – especially small business entrepreneurs and real estate investors – to transform their development and growth strategies

to cater to emerging markets, as families relocate to take advantage of expanded educational options. …Why does the economy benefit from school choice? Dr. Bartley Danielson, associate professor of finance and real estate at N.C. State University, emphasizes that school choice fosters community-wide economic prosperity. This allows families to remain in their dwellings, rather than feeling led to switch neighborhoods based on school districts. In turn, real estate becomes equally coveted across regions where school choice is implemented.

The big takeaway is that the economy is less efficient when families feel they have to live in a certain neighborhood to get decent education for their kids.

That problem disappears with school choice.

Their article also includes this paragraph about taxpayers savings, which surely is an economic benefit as well.

Beyond benefiting states’ economic livelihood, taxpayers across the states are also seeing savings as a result of these expanding programs. Out of 52 analyses on the fiscal impact of private school choice programs, 47 were found to generate overall savings for taxpayers. An additional study in 2018 found that school choice programs generated $12.4 to $28.3 billion in tax savings.

Better student performance and lower costs. What’s not to like?

P.S. I cited some research back in 2009 about potential economic benefits of school choice.

P.S. For further information (especially for my left-leaning friends), there are very successful school choice systems in Canada, Sweden, Chile, and the Netherlands."

Friday, September 29, 2023

The impact of professional sports franchises and venues on local economies: A comprehensive survey

By John Charles Bradbury, Dennis Coates & Brad R. Humphreys.

"Abstract

Local governments routinely subsidize sports stadiums and arenas using the justification that hosting professional franchises produces economic development and social benefits in the community. The prevalence of venue subsidies generated an extensive and vibrant research literature, which spans over 30 years and includes more than 130 studies. We chronicle this body of research from early studies of tangible economic impacts in metropolitan areas, using basic empirical methods, through recent analyses that focus on sublocal and nonpecuniary effects and employ more sophisticated empirical methods. Though findings have become more nuanced, recent analyses continue to confirm the decades-old consensus of very limited economic impacts of professional sports teams and stadiums. Even with added nonpecuniary social benefits from quality-of-life externalities and civic pride, welfare improvements from hosting teams tend to fall well short of covering public outlays. Thus, the large subsidies commonly devoted to constructing professional sports venues are not justified as worthwhile public investments. We also investigate the paradox of local governments continuing to subsidize sports facilities despite overwhelming evidence of their economic impotence. Our analysis informs academic researchers and policymakers to motivate future studies and promote sound policy decisions guided by relevant research findings."

How Garrity v. New Jersey Transformed Public Employee Discipline

"In Garrity v. New Jersey (1967), one of the most remarkable decisions of the Warren Court, a 5–4 majority of justices said public employees cannot be found guilty of crimes based on their admissions in disciplinary interviews conducted as a condition of employment.

Justice Harlan, writing in dissent, said the majority had fundamentally misunderstood the nature of the constitutional right against compelled self‐incrimination. The relevant scope of “involuntary as a matter of law,” in his view, should be seen to reach only situations of actual legal compulsion, not those in which the price you pay for declining to speak frankly about how you behaved on the job is that your employer might not want to keep you on its payroll.

Garrity has become a key element of legal weaponry for public employees and their unions seeking to minimize consequences for on‐duty misbehavior. (Although the original setting was one involving police officers, the decision applies broadly to public employment generally.)

Aside from its momentous reading of employment relations as themselves a species of coercion, Garrity has been cited as a key breakthrough for the “New Property” ideas associated with the late Yale law professor Charles Reich. He had argued that the holding of a government job or the receipt of welfare benefits should be analogized to property and protected in similar fashion by vigorous judicial action.

The Garrity doctrine plays a key role in this stomach‐churning new Reason cover story by C.J. Ciaramella about impunity for prison rape.

Internal Affairs [at the federal Bureau of Prisons] then forced the correctional officers to sit for sworn interviews. Once those officers confessed to sexual assault, the possibility of criminal prosecution evaporated [under Garrity]…

By compelling prison guards to admit to criminal conduct, BOP internal affairs investigators got enough dirt to kick them out of the agency but also shielded them from future criminal prosecution.

Although it would technically be possible for federal prosecutors to bring charges now, they would have to rely on other evidence and prove that nothing in their case was tainted by those interviews. Perversely, the more detailed and thorough the confession, the harder it is to prosecute—a feature that any BOP employee who screws up badly enough to get called in for a sworn interview understands.

Interviews held on a condition of non‐prosecution are known as “Garrity interviews,” but they had a nickname:

A former correctional officer at [the problem institution] says they were called “queen for a day.” As in, “Did you hear that Smith got queen for a day?” The term is more commonly used in criminal law to refer to a proffer agreement between federal prosecutors and a potential defendant—basically, spill the beans in exchange for possible immunity—but it worked much the same way between BOP internal affairs investigators and correctional officers.

Garrity interviews also allowed the BOP to quietly remove problem officers without the media attention that criminal charges would bring.

It’s hard to escape the conclusion that the 1967 decision has had some gravely damaging consequences. As an error in constitutional interpretation, it cannot practically be revised or revisited by agencies themselves, by lawmakers, or by lower court judges. That leaves the high court itself. Is it wise or prudent for the U.S. Supreme Court to afford Garrity the eternal benefit of stare decisis?"

Biden and McCain both wrong on bundling

See Whatever We Are Doing is Wrong by David Henderson.

"Eric Boehm, in “Taylor Swift, Junk Fees, and the ‘Happy Meal’ Fallacy,” Reason, October 2023, does a nice job of explaining the case for, in some instances, charging separately for some components of a purchase rather than for bundling.

In his State of the Union address, President Biden discussed the pressing issue of whether airlines should charge an air fare plus extra charges for various special features, or should charge a price for a bundle that doesn’t allow people to choose the individual components. Biden, in his wisdom, proposed the latter and, strangely, claimed that it would save people money. Boehm writes:

Consider the budget airlines that currently offer low fares but charge additional fees for picking seats, bringing bags (sometimes even carry-on luggage), and getting in-flight snacks. If those airlines have to bundle all those costs together for every flyer, passengers who want to travel light, are willing to sit anywhere, and can go 90 minutes without a snack will have to pay more so that other travelers can avoid paying for those things à la carte.

The second group won’t pay less; they’ll just pay it all upfront. Meanwhile, a low-cost option will disappear for the first group. Instead of being able to evaluate tradeoffs—should I save money even if that means I don’t get to sit with my traveling companions?—consumers would face a market with fewer choices.

Well said.

Reading it made me recall an earlier issue on which a life arranger from a different political party, John McCain, proposed forced unbundling. In 2013, he proposed legislation to force cable companies to let people choose specific components separately rather than charging for a bundle.

What do Biden and McCain have in common? They think they know better than the individuals and companies buying and selling and they’re so confident about it that they want (or, in McCain’s case, wanted) to use force to get their way. Whatever we’re doing, according to them, is wrong."

Thursday, September 28, 2023

Did Pandemic Unemployment Benefits Increase Unemployment? Evidence from Early State-level Expirations

By Michael R. Strain, R. Glenn Hubbard & Harry Holzer.

"Abstract

During the 2021 pandemic year, the generosity of Unemployment Insurance benefits was expanded (Federal Pandemic Unemployment Compensation [FPUC]) and eligibility for benefits was broadened (Pandemic Unemployment Assistance [PUA]). These two programs were set to expire in September 2021. In June 2021, 18 states exited both FPUC and PUA and three states exited FPUC (but not PUA). Using Current Population Survey data and a wide range of estimation methods, we find that the flow of unemployed workers into employment increased by around two-thirds following early exit among prime-age workers. We also find evidence of reductions in state-level unemployment rates, increases in employment-populations ratios, and reductions in the share of households that had no difficulty meeting expenses.

Click here to access the published version of the paper.

Click here to read the full paper."

FTC’s Amazon Complaint: Perhaps the Greatest Affront to Consumer and Producer Welfare in Antitrust History

"The FTC—joined (unfortunately) by 17 state attorneys general—on Sept. 26 filed its much-anticipated antitrust complaint against Amazon in the U.S. District Court for the Western District of Washington. Lacking all sense of irony, Deputy Director Newman, quoted above, bragged about the case’s potential to do greater good than almost all previous antitrust lawsuits.

A quick perusal of the FTC’s press release announcing the suit reveals the basic claims the FTC will be making in court. While full details are set forth in the commission’s formal complaint, the press release provides one sufficient reason to believe that this high-profile antitrust complaint is baseless. A few initial comments on this travesty of a lawsuit follow.

In a recent Truth on the Market commentary, Lazar Radic and Geoffrey Manne provided an outstanding succinct critique of key elements of the FTC’s (then) expected Amazon case. I draw upon that commentary in the discussion that follows.

Discussion

The press release begins by setting forth the crux of the complaint:

The FTC and its state partners say Amazon’s actions allow it to stop rivals and sellers from lowering prices, degrade quality for shoppers, overcharge sellers, stifle innovation, and prevent rivals from fairly competing against Amazon. . . . By stifling competition on price, product selection, quality, and by preventing its current or future rivals from attracting a critical mass of shoppers and sellers, Amazon ensures that no current or future rival can threaten its dominance. Amazon’s far-reaching schemes impact hundreds of billions of dollars in retail sales every year, touch hundreds of thousands of products sold by businesses big and small and affect over a hundred million shoppers.

Various specific assertions then follow this bold pronouncement.

Anti-discounting measures that punish sellers and deter other online retailers from offering prices lower than Amazon, keeping prices higher for products across the internet.

This apparently refers to “price parity clauses,” or PPCs, by which Amazon requires that retailers not charge a higher price on Amazon than they do on other platforms. But as Radic and Manne have explained, PPCs often promote competition by benefiting consumers (who can avoid wasting time searching among sites), and by incentivizing e-commerce sites to invest in good search functions and friendly consumer interfaces, rather than sacrificing both in competing on price. These agreements are not price-fixing deals, since retailers are perfectly free to undercut prices charged by Amazon for similar brands. In short, banning PPCs would undercut Amazon’s incentive to invest in its own platform, to the detriment of sellers and consumers.

Conditioning sellers’ ability to obtain “Prime” eligibility for their products—a virtual necessity for doing business on Amazon—on sellers using Amazon’s costly fulfillment service, which has made it substantially more expensive for sellers on Amazon to also offer their products on other platforms.

Amazon’s fulfillment service—under which Amazon picks, packs, and ships third-party orders—is very popular and beneficial to consumers. If Amazon decided to no longer offer this service to third parties, it would harm many businesses and consumers, who no longer would patronize product lines not offered through fulfillment by Amazon. As Radic and Manne point out, because Amazon’s own products account for 40% of total revenue, this denial of fulfillment by Amazon (and U.S. antitrust law does not require that one deal with one’s competitors) is a real possibility. Other scenarios are possible, as well, but interfering with Amazon’s ability to jointly promote fulfillment by Amazon and Prime services—both highly popular with consumers—is likely to entail a loss in consumer and producer welfare.

Degrading the customer experience by replacing relevant, organic search results with paid advertisements—and deliberately increasing junk ads that worsen search quality and frustrate both shoppers seeking products and sellers who are promised a return on their advertising purchase.

This is, in effect, an assertion that the FTC is authorized to micromanage nondeceptive advertising decisions by a platform that it finds inappropriate, simply because the advertisements somehow selected lower “search quality.” There is no basis in antitrust law for such a claim. Truthful advertising (whether “junk” or not) is a form of commercial speech that enjoys First Amendment protection (see the U.S. Supreme Court’s 1980 Central Hudson decision, here and here), and any attempt by an antitrust enforcer to characterize such speech as raising antitrust issues is highly problematic, if not absurd on its face.

Biasing Amazon’s search results to preference Amazon’s own products over ones that Amazon knows are of better quality.

Self-preferencing by platforms is not unusual. Supermarkets, for example, may grant preferred placements to their store brands (or to third-party brands that pay for the privilege), but this is part of accepted competition in the marketplace.

More generally, as Geoff Manne has explained:

Self-preferencing is a common business practice throughout the economy. Supermarkets and other retailers, for example, regularly sell — and preference — their own products alongside those of third-party businesses. Like offline retailers, platforms often prioritize their own products through, e.g., preferential product placement, by improving their products based on information gleaned from third-party sales, or by conditioning third-party use of their platform on the consumption of their services.

Platforms’ incentives are to maximize the value of their whole ecosystem, which includes both the core platform and the services they attach to it.

Platforms that grant preference to their own products frequently end up increasing the value of the market overall by growing the total share of users of a particular product, and those that give preference to inferior products end up hurting the attractiveness to users of the platform, weakening themselves to competition from rivals.

In short, an antitrust court should give short shrift to FTC claims that self-preferencing by Amazon is anticompetitive (pun intended). (See also here for more on Amazon’s self-preferencing.)

Charging costly fees on the hundreds of thousands of sellers that currently have no choice but to rely on Amazon to stay in business. These fees range from a monthly fee sellers must pay for each item sold, to advertising fees that have become virtually necessary for sellers to do business. Combined, all of these fees force many sellers to pay close to 50% of their total revenues to Amazon. These fees harm not only sellers but also shoppers, who pay increased prices for thousands of products sold on or off Amazon.

This FTC assertion likewise is totally lacking as a theory of antitrust harm. Like any other business, Amazon has every right to charge what it deems appropriate to third parties that desire access to its platform. Amazon is not subject to statutory price regulation and, like all other unregulated firms, has every right to set the prices it deems appropriate for access to its platform. As Justice Antonin Scalia stressed in Verizon v. Trinko (2004), “[t]he mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful; it is an important element of the free-market system.”

But what if Amazon were an “essential facility”? As Manne and Radic point out, the “essential-facility doctrine” has fallen out of favor and likely would not be accepted by a court. And Tad Lipsky explains that this doctrine “is no more useful as a response to concerns about access to digital platforms than to the other situations that have led to the [Supreme] Court’s profound doubts regarding” the doctrine.

But in any event, Amazon is not an “essential facility,” in that access to it is not absolutely essential for third parties to be able to compete. As Manne and Kristian Stout have argued:

Granting retailers access to Amazon’s platform on artificially favorable terms is no more justifiable than granting them access to a supermarket end cap, or a particular unit at a shopping mall. There is, in other words, no business or economic justification for granting retailers in the time-tested and massive retail market an entitlement to use a particular mode of marketing and distribution just because they find it more convenient.

Furthermore, even if Amazon were deemed to be an essential facility, Radic and Manne emphasize that it could just grant all parties equivalent but inferior access to amazon.com. For example, delivery requirements and other aspects of Prime could be degraded, to the detriment of consumers. As Radic and Manne note, “[o]ver time, this would make amazon.com worse—less trusted, less popular with consumers, and less beneficial to the very sellers that [FTC Chair Lina] Khan wants to empower.”

As such, the FTC’s concern about fees charged to third parties lacks antitrust substance.

Big Picture Observations: Looking Beyond the FTC-States’ Complaint

The joint FTC-states complaint against Amazon does, of course, merit close reading. The FTC may well characterize it as including sufficient specific acts by Amazon to justify characterizing the firm as an “evil monopolist,” out to maintain its dominant position (or, more accurately put, to maintain its position as the most effective competitor in the marketplace).

But actual effects in the marketplace are the key to evaluating Amazon’s conduct. Amazon does not require any firm to join or remain part of its network. Moreover, smaller producers and retailers have a broad choice of alternative online platforms to engage in commerce.

The fact that so many firms seek to affiliate with Amazon’s platform tells you that they perceive economic benefits in doing so. And that is not surprising, because consumers love Amazon, both here and abroad (see, for example, here, here, here, here, and here).

A recent survey of Amazon users by Adlucent found that: (1) “consumers pick Amazon because they have a better product selection”; (2) “people pay for Prime memberships to get free shipping”; and (3) “consumers buy electronics, home goods, and books on Amazon.”

Adlucent focused on the consumer benefits generated by Amazon’s model as something retailers should emulate in order to compete effectively: “retailers who want to compete with Amazon need to focus on offering a wide product selection, affordable and fast shipping, and excellent customer service.”

In sum, Amazon’s success derives from an innovative system that consumers enjoy patronizing. This is a manifestation of procompetitive consumer-welfare-enhancing innovation, not exclusionary anticompetitive harm. The FTC’s plans to dramatically change Amazon’s business practices are therefore nothing less than an attack on a vibrant competitive process.

The FTC is once again demonstrating a bureaucratic pretense of knowledge in believing that government can tinker with and thereby improve a highly innovative business system that has showered enormous benefits on both consumers and producers (as have other platforms, see here). This is a particularly odious manifestation of the nirvana fallacy (see Harold Demsetz’s seminal article on this topic), for the FTC is not merely purporting to “perfect” a clearly good institution (the Amazon business system, which benefits consumers), but is rather mischaracterizing it as competitively harmful.

The American law of monopolization does not condemn innovative conduct that plainly has benefited consumers. As the D.C. Circuit stated in its landmark en banc 2001 Microsoft decision:

[In order] to be considered as exclusionary, a monopolist’s act must have an “anticompetitive effect.” That is, it must harm the competitive process and thereby harm consumers. In contrast, harm to one or more competitors will not suffice. [Emphasis in the original.]

Moreover, the FTC should recall that, as the Supreme Court emphasized in Reiter v. Sonotone (1979), antitrust is “a consumer welfare prescription.” When substantial consumer-welfare enhancement can be demonstrated, as in the case of the Amazon business model, it is folly for government to intervene in the belief that government intervention will somehow “make things better.” Just as a doctor should not prescribe medicines having major side effects for a healthy individual, the FTC should not sue to upend a company business structure that has generated enormous social benefits, accruing to consumers and to other businesses.

Finally, the FTC’s Amazon complaint sends a terrible signal to other businesses, who over time seek to continuously improve their business model for the benefits of consumers, following Amazon’s example (see here). It is no coincidence that Amazon and the other great digital platforms of the 21st century, which have so benefited consumers around the world, are “American made.” The FTC’s complaint implicitly suggests that a huge platform should not try to be “too successful,” a suggestion that may lead to reduced innovation and diminished future social welfare. The complaint also reassures foreign competition agencies that attacking successful American platforms is just fine. In a time of robust international competition, this is sheer stupidity (doubtless the Chinese government is taking note).

Conclusion

When Pandora opened her box, evils flew out, but hope remained. Let us hope that the federal court assigned this case will quickly and authoritatively dismiss the FTC’s complaint, consigning it to the dustbin of bad antitrust ideas where it richly belongs."

Wednesday, September 27, 2023

Academic Lies about Free-Market Economists

"The academic history profession has a problem with intellectual integrity. Over the past decade, a cottage industry has emerged in elite university departments that explicitly aims to tear down free-market economists (often misnamed as “neoliberals”) by accusing them of racism, fascism, and similarly discredited beliefs.

Although these are serious charges, the historians who make them seldom have evidence to back their accusations. Instead, they misrepresent historical records, make up falsehoods out of thin air, and even rearrange quotations by their targets to make them appear racist. One of the worst offenders in this regard is Duke University historian Nancy MacLean, whose 2017 book Democracy in Chains tried to portray pioneering Public Choice economist James M. Buchanan as a complicit partner of Senator Harry Flood Byrd’s “Massive Resistance” efforts against Brown v. Board of Education.

MacLean’s thesis collapsed under scholarly scrutiny. To build her case, she mixed up the contents of historical records, misread and conflated footnotes in the secondary literature, and simply fabricated salacious stories wherein Buchanan became a secret admirer of John C. Calhoun and Agrarian Poetry, despite providing no evidence of either. When she wasn’t making them up out of thin air, MacLean also altered quotations to change their meaning, usually in ways that depicted their authors as monsters. In a more honest academic climate, it’s the type of behavior that would earn a professor a stern reprimand from the dean and perhaps a few article retractions.

Six years have passed since this episode, but MacLean is still up to her old tricks. Her newest target is the South African economist William Harold Hutt, who wrote a blistering critique of racial apartheid in 1964. MacLean’s interest in Hutt stems from the fallout over Democracy in Chains, because Buchanan recruited Hutt to the University of Virginia as a visiting faculty member in 1965. Having a prominent opponent of apartheid in Buchanan’s department did not mesh well with MacLean’s attempts to depict Buchanan as an agent of the arch-segregationist Byrd machine.

To get around this obstacle, MacLean has now seeks to besmirch Hutt. She has a new article out in the History of Economics Review, co-authored with Duke professor William S. Darity and graduate student M’Balou Camara. Its “thesis,” if it could even be called that, is to accuse Hutt himself of being a “white supremacist.”

Most of the new article is a recycled and slightly updated version of an error-riddled working paper that advanced similar claims. Art Carden and I dissected that paper last year, finding multiple instances where MacLean and her co-authors misrepresented their source materials to make their flimsy charges stick. But MacLean’s latest piece adds a new line of attack on Hutt, containing one of the most egregious examples of quote-editing that I have ever encountered in an academic work.

To support their contention that Hutt was a “white supremacist,” MacLean et al. excerpt a passage from his 1963 anti-apartheid book, The Economics of the Colour Bar. I reproduce their treatment of that passage here in full:

[Hutt] went further, admonishing that ‘races which grumble about the ‘injustices’ or ‘oppressions’ to which they are subjected can often be observed to be inflicting not dissimilar injustices upon other races (Hutt 1964, 39). The choice of verb (grumble) along with the scare quotes around injustices and oppressions illustrate how Hutt aimed to undercut the legitimacy of apartheid’s black South African critics, who were gaining international support as he wrote. His aim can be readily inferred: to deny the victims of apartheid the moral high ground claimed by the anti-apartheid movement.

In fact, this quoted excerpt is one of the main pieces of “evidence” that MacLean and her co-authors deploy to support their claims. As they describe it, “These passages attest that Hutt clearly saw the world through the lens of white racial superiority.” By allegedly denigrating the victims of apartheid in their cause, Hutt “demonstrated his belief that the fundamental source of racial disparity in South Africa and elsewhere was dysfunctional black behaviour.”

This is a serious charge to make against another scholar. It is also a falsehood.

Compare MacLean et al.’s portrayals to the full passage from page 39 of the Economics of the Colour Bar. The excerpted part of the quotation is in bold:

“Races which grumble about the ‘injustices’ or ‘oppressions’ to which they are subjected can often be observed to be inflicting not dissimilar injustices upon other races. We find a very clear case of this in any study of the grievances of the Afrikaners against ‘British imperialism’ and their fight against the threat of ‘Anglicisation’. In their policies towards the non-Whites, they are inflicting injustices which are remarkably similar to those of which they themselves have complained.”

If you’re wondering how these transgressions on the text passed basic peer review with the journal’s editors, you are not alone. Contrary to the claims of MacLean and her co-authors, Hutt was not attempting “to undercut the legitimacy of apartheid’s black South African critics.” He was writing about the racist hypocrisy of South Africa’s white Afrikaner community. The Dutch-descended Afrikaners often complained of historical injustices against their community at the hands of British colonial authorities, yet as Hutt pointed out, they turned around and perpetrated injustices against black Africans in the form of apartheid.

MacLean et al. took Hutt’s attack on white racists and, through selective excerpting of the original quotation, altered it into an attack on the victims of apartheid.

If this quote-editing exercise was a single incident, it might be possible to chalk it up to sloppiness or incompetence. But Hutt’s explicit reference to Afrikaner hypocrisy appears in the very next sentence, making a careless oversight unlikely. More importantly, MacLean and her colleagues have a long track record of similar behavior, misrepresenting sources and abusing historical evidence.

To academics like MacLean and Darity, both of whom write from positions of power, holding endowed chairs at an elite institution, historical inquiry is no longer an exercise in pursuing truth and understanding about the past. It is a tool for their own far-left political activism. To borrow a phrase from ethicist Nigel Biggar, they treat history as “an armoury from which to ransack politically expedient weapons.” In the process of that ransacking, they cross the line into willful misrepresentations of their source material, all in the service of a modern-day political cause. It’s a pattern of scholarly dishonesty that the academy has tolerated (and even elevated) for far too long."

Estimating the Fiscal Impact of Stadium Developments: Evaluating a Pro Forma Model

By Robert W. Baumann and John Charles Bradbury.

"Abstract

Although researchers have demonstrated conclusively that sports stadiums are not economic development catalysts, stadium projects that include preplanned ancillary developments have been proposed as a salutary strategy to overcome the widely observed dismal economic performance of standalone stadiums. Using an objective rubric for evaluating economic impact studies, we review a commissioned pro forma model that claims to demonstrate net positive fiscal impacts of two prominent publicly-financed stadium-anchored developments. Using assumptions informed by existing research and established discipline standards, the model estimates substantial negative returns for both projects (−$40 to −$60 million in Worcester, Massachusetts and −$100 to −$200 million in Cobb County, Georgia). We find that the reported fiscal surpluses derive from chosen assumptions and not the stadiums’ complementary developments. We conclude that pro forma estimates do not provide credible forecasts of fiscal impacts, and ancillary developments do not improve the fiscal returns of stadium projects."

Tuesday, September 26, 2023

The Great Northeast Wind Bailout

The politicians are already demanding more green corporate welfare

"If only the hot air blowing at the United Nations’ Climate Ambition Summit this week could be used to generate electric power. That would be especially convenient since Governors in the Northeast are lobbying the White House to bail out their states’ offshore wind projects, which have hit a gale of ballooning costs.

“Inflationary pressures, Russia’s invasion of Ukraine, and the lingering supply chain disruptions resulting from the COVID-19 pandemic have created extraordinary economic challenges,” wrote Govs. Kathy Hochul (N.Y.), Ned Lamont (Conn.), Phil Murphy (N.J.), Maura Healey (Mass.), Wes Moore (Md.) and Dan McKee (R.I.) to President Biden last week.

“Offshore wind faces cost increases in orders of magnitude that threaten States’ ability to make purchasing decisions,” they say. “Without federal action, offshore wind deployment in the U.S. is at serious risk of stalling because States’ ratepayers may be unable to absorb these significant new costs alone.”

The pandemic and Ukraine are excuses. The real problem is government policies that have increased demand for wind equipment and ships, which has inflated prices at the same time interest rates have climbed. Wind turbine makers are having to replace defective equipment, which is leading to order backlogs.

The U.S. lacks specialized ships for assembling turbines at sea that comply with the 1920 Jones Act, which requires cargo vessels that run between U.S. ports to be built and crewed by Americans. Offshore wind developers are having to resort to expensive work-arounds like ferrying parts from Canada.

Large offshore developers are asking New York for an average 48% price adjustment on contracts to cover rising costs. Two have moved to scrap contracts for projects off Martha’s Vineyard. Danish developer

is warning it may have to write down its projects off New Jersey, Rhode Island, Connecticut and New York.Orsted CEO Mads Nipper recently told Bloomberg News that it’s “inevitable” that consumers will have to pay more for renewable energy. “And if they don’t, neither we nor any of our colleagues are going to build more offshore,” he warned. “It’s very simple.”

But the Governors fear making their constituents pay for their climate follies. Ergo, they are lobbying the Administration to boost the value of the Inflation Reduction Act’s (IRA) renewable energy tax credits for offshore wind. Orsted has also been putting “maximum pressure,” to quote Mr. Nipper, on the Administration to sweeten the credits.

They want the White House to let offshore projects qualify for “bonus tax credits,” which the IRA conditions on using U.S. manufactured content and building in “energy communities.” These subsidy sweeteners would boost credits to 50% from 30% of a project’s cost. Yet the projects don’t meet either condition.

The IRA defines an energy community as abandoned land that is polluted from an industrial activity; a census tract with a recently closed coal mine or plant; or an area disproportionately reliant on fossil fuels for employment or tax revenue. If oil drilling were allowed off New England, maybe the wind projects could qualify for bonus credits. But they don’t.

The Governors also want offshore wind transmission lines to be eligible for tax credits, which would socialize the costs of building out the green grid.

All of this exposes the folly of government industrial policy that force-feeds an energy transition that makes no economic sense, and won’t matter to the climate in any case. The corporate welfare demands will keep coming, and consumers will pay one way or another."

A Union Railroad Job in Congress

The Railway Safety Act does more to boost union jobs than to promote safety

"It pays to be wary of politicians rushing out legislation after an accident or disaster, and the Railway Safety Act is a classic of the genre. It uses February’s train derailment in East Palestine, Ohio, to enact a Big Labor priority.

The bill is courtesy of Ohio’s Senate duo, Democrat Sherrod Brown and Republican J.D. Vance.

railroad is covering the more than $800 million cost to clean up the hazardous chemicals, but the Senators say their bill is meant to head off future accidents.Yet the bill’s main provisions are irrelevant to the Ohio rail accident and most others. Instead it maximizes work hours for union laborers and slaps mostly redundant rules on rail carriers.

The biggest union giveaway is a mandate requiring rail carriers with more than $1.032 billion in annual revenue to maintain two-person train crews. That would mean more jobs and longer hours for rail workers, and more dues for the union, but any safety benefit is speculative. The Federal Railroad Administration declined a crew-size mandate in 2019 after finding it would have no effect on safety, and the failed Ohio train had three men aboard. Yet the 12 rail labor unions have sought it for years.

The same goes for the bill’s handling of inspections. It mandates that railcars be inspected by a railroad-certified mechanic instead of a conductor, and it directs the Transportation Department to ban railroads from setting a maximum time limit for inspections. The result will be backed-up trains awaiting inspectors, but no visual check would have caught the heat failure that caused the Ohio derailment.

Sensors beat human eyeballs in detecting malfunctions, as shown in a pair of studies by consulting firm Oliver Wyman in 2015 and 2021. Rail carriers in recent years have focused on developing on-board technology for heat sensing and other common malfunctions, and the mandates will divert money that could finance future breakthroughs.

The biggest carriers already have two-man crews under their collective-bargaining agreements with the rail unions. Midsize carriers often don’t, however, and they would be hit hardest by new costs. Sens. Brown and Vance rushed their bill into draft after the Ohio crash, and they seem not have considered how its rules will burden rail shipping.

Mr. Vance has said he “privately” has enough Republican support to clear the 60-vote Senate filibuster rule. But let’s hope the months since the accident have given other Senators time to consider the merits rather than the easy politics. Majority Leader Chuck Schumer planned to schedule a full vote after the bill cleared the Commerce Committee in May, but only seven Republicans have said they would support it. It would also face a tough hurdle in the GOP-controlled House.

Lawmakers will always be tempted to follow a crisis with new laws they can take credit for, especially when the event is close to home. Yet there’s no excuse for passing an ill-considered law loaded with unnecessary priorities that cater to a political special interest."

Monday, September 25, 2023

Cheap federal flood insurance encouraged people to buy pricey homes in flood-prone areas

See Flood-Insurance Program Faces a Backlash—and a Deadline by Jean Eaglesham and Katy Stech Ferek of The WSJ. Excerpts:

"Previously, premiums were based on an outdated model that FEMA said no longer accurately reflected a home’s risk of flooding. Critics said the cheap insurance encouraged people to buy pricey homes in flood-prone areas, in part by repeatedly bailing them out.

More than 3,000 properties had 10 or more claims from 1978 through 2022, according to FEMA. Nearly two-thirds of those were in five states: Louisiana, Texas, New Jersey, Missouri and New York.

To help shore up its funding, FEMA last year asked Congress to consider letting it drop coverage on properties that received four or more claim payments of at least $10,000. Congress has yet to take any action."

"Already, the program’s failure to charge adequate rates for years has dug it deep into debt. It is paying $1.7 million in interest a day to the Treasury on $20.5 billion in loans, even after Congress forgave it $16 billion of debt in 2017."

DayQuil, Covid Vaccine Boosters and FDA Science

The industry studies that showed a decongestant was effective turned out to be flawed. Sound familiar?

By Allysia Finley. Excerpts:

"But unlike a sugar pill, phenylephrine can cause lightheadedness, queasiness, headaches and a rapid heartbeat. What took the FDA so long to act?

Perhaps typical bureaucratic inertia and reluctance to backtrack on “settled science.” This episode mirrors the debate over Covid boosters, which the FDA approved last week, the day before its advisory committee concluded phenylephrine is ineffective. As was the case for phenylephrine, booster recommendations are based on flawed studies and extrapolations."

"studies as early as the 1930s showed that significantly higher doses of phenylephrine than are safe would be needed to have a decongesting effect"

"When the agency revisited the issue in 2007, an industry meta-analysis of prior flawed studies showed phenylephrine was effective. But as an agency scientific adviser quipped at a regulatory briefing that March, “all meta-analysis is post facto. You only do it if you know you’re going to win.” The FDA then sought more studies to measure the efficacy of higher doses—yet the three placebo-controlled trials between 2015 and 2018 were negative."

"early studies demonstrating the drug’s efficacy were flawed and possibly biased. Ten, all from the same industry sponsor, had “multiple methodological and statistical issues” and apparent “data integrity” problems."

"The FDA last week approved updated boosters based on data showing they generated antibodies and past studies purportedly demonstrating that the original vaccine and earlier booster versions worked. But these are large extrapolations based on flimsy evidence. No placebo-controlled trials have shown the boosters are effective, and studies on prior boosters systemically suffer from what scientists call “healthy user bias”—the process by which healthier people, who are more likely to receive a treatment, skew retrospective analyses.

One widely cited study from Israel found people who got the first boosters were 90% less likely to die of Covid within a 54-day period. Yet scientists from Stanford and the University of California, San Francisco, who analyzed the data estimated that those who didn’t get boosters were also 94.8% more likely to die of non-Covid causes during the same period."

The $20 minimum wage in California would lead to a loss of 5,100 fast-food jobs and more than 300 establishments

See How California Does (In) Business: Sacramento subverts democracy to extort fast-food restaurants. WSJ editorial. Excerpts:

"An analysis by Oxford Economics estimates the $20 minimum wage would lead to a loss of 5,100 fast-food jobs and more than 300 establishments.

The economic impact will extend beyond the fast-food industry as unions well know. Fast food’s $20 minimum wage will force employers in such industries as retail and transportation to raise pay to compete for workers. That means $20 an hour will become the state’s de facto minimum wage, which will threaten many small businesses. Nearly eight million workers in the state earn less than $20 an hour.

Unemployment in California has crept up to 4.6%—the second highest in the country after Nevada—from 3.8% last July. One reason is businesses are leaving for states where they don’t have to worry about getting extorted by the Democratic union machine for daring to ask voters to override the Legislature. Democracy withers in this one-party state."

Sunday, September 24, 2023

How government highways hurt blacks

See Black Community Cut Off by Akron’s ‘Road to Nowhere’ Seeks to Undo Damage by By Kris Maher of The WSJ. Excerpts:

"A freeway built in the 1970s through a Black community in Akron was supposed to reinvigorate the city’s downtown, but instead it became known as the “road to nowhere” that devastated several neighborhoods.

Akron is now trying to reimagine a mile-long section of the city’s Innerbelt freeway. The sun-bleached stretch of road was closed to traffic in 2017 and is bare except for weeds filling its cracks. But it still separates a mostly Black neighborhood from the commercial and cultural life of downtown.

“To me, it’s an urban scar,” said Akron Mayor Daniel Horrigan, who added that people suffered an emotional toll as homes and businesses were torn down. “We, as a city, did that to our citizens,” he said.

The reassessment of the Innerbelt in Akron mirrors a process taking place in other cities where Black communities were split apart and cut off by projects spurred by federal highway bills in the 1950s aimed at improving commerce and national defense.

The Akron freeway was designed to be a “high speed, high efficiency, industrial connection” for 120,000 daily cars from the mostly white suburbs to a downtown that officials wanted to revitalize. Hundreds of Black families were forced to move when the city seized property through eminent domain, while others saw their home values plummet.

By the early 2000s, only 18,000 cars traveled on the freeway each day, and it became known as a “road to nowhere.” This year Akron won a grant of about $1 million from the Biden administration to create a community-based plan to redevelop the decommissioned roadway, by potentially adding a park and trails, public art and housing, and by reconnecting the street grid."

"City planners often routed highways through Black neighborhoods in part because they viewed them as blighted and expendable. Many of those areas—including some in Akron that made way for the Innerbelt—faced discriminatory housing policies known as redlining, in which banks declined to provide financing to Black owners seeking to improve their homes or businesses."

"Black families in Akron, many of whom had migrated from the South to work in the rubber industry, lost wealth tied to their homes. Some were forced to relocate, while others remained in an area that lost value when it was cut off by the freeway because planners didn’t include connections to their neighborhoods."

UAW Strike May Hasten Detroit’s Decline

Decades of regulations and subsidies have left the Big Three uncompetitive in the age of electric cars

By Clifford Winston. He is a senior fellow at the Brookings Institution. Excerpts:

"Some policies have weakened them by raising their costs; others have assisted them, with the unintended consequence that they failed to address the sources of their declining market share."

"The federal government has helped U.S. auto makers by protecting them against foreign rivals and by giving them financial assistance after economic shocks."

"in 1964, when Lyndon B. Johnson’s administration imposed a 25% tariff on light trucks."

"the tax on light trucks remains"

"The Reagan administration tried to give the Big Three time to become more competitive with the Japanese by negotiating voluntary export restrictions with Tokyo"

"by 2000, a dozen years after they ended, U.S. auto makers hadn’t closed the gap between the quality and value of their vehicles and that of their foreign competitors."

"by the eve of the Great Recession, U.S. auto makers still hadn’t addressed their production-cost problems and product deficiencies."

"During that recession, General Motors and Chrysler went into bankruptcy, but the government didn’t allow them to go through a court-supervised reorganization or to fail, which would have allowed their more-profitable light-truck operations to be acquired quickly by other companies. Instead, the Obama administration advanced roughly $80 billion to the companies and their financing arms and provided tax benefits not normally available to bankrupt companies."

"In response to the Covid pandemic, Congress made loans available to the auto companies and provided other benefits, such as a 50% employee retention tax credit. Most recently, the Biden administration has helped the auto companies record profits by providing billions in tax credits to spur purchases of new and used domestic electric vehicles.

Government policies that have reduced auto makers’ competitiveness include inefficient safety and environmental rules and mandates. Regulations mandated installation of various safety devices, such as shatterproof windshields and energy-absorbing steering columns, that raised auto makers’ costs but didn’t reduce overall highway deaths. Legislation required auto makers to install air bags on both sides of the front seat by 1998, increasing costs and risking the safety of smaller passengers. Corporate average fuel economy standards enacted in 1975 continue to increase, raising auto makers’ costs and consumer prices with uncertain benefits to the environment. And state and federal mandates to increase dramatically the share of electric vehicles on the road are pressuring auto makers to transform their production processes."

"Unfortunately, the legacy of government assistance and costly policies is that U.S. auto makers have significant catching up to do to compete effectively in an industry gearing up for large-scale production of electric vehicles and ultimately autonomous ones."

Henry Ford on the importance of entrepreneurs

See Schumer Wants a Cut of AI: Interest groups and politicians seek regulation for their own purposes by Andy Kessler of The WSJ. Excerpt:

"Henry Ford once said, “If I had asked people what they wanted, they would have said faster horses.” Politicians might have demanded to tax horses based on speed. Back then, no one appreciated the potential for those rickety automobiles to transform the economy. We’re at the same juncture with AI today.

When politicians get involved, their agenda for any business is to slow it, tax it, regulate it, harness it, redistribute it or just plain kill it. Mr. Schumer clearly forgets, if he ever even knew, what drives economic growth."

Saturday, September 23, 2023

A Solution To The Health Care Problem? Change In Behavior

We all know about rising health care costs. The health care industry is

now about 17% of GDP. How behavior changes can help are in this article Gentlemen, 5 Easy Steps to Living Long and Well.

Here is an excerpt:

"Living past 90, and living well, may be more than a matter of good genes and good luck. Five behaviors in elderly men are associated not only with living into extreme old age, a new study has found, but also with good health and independent functioning.

The behaviors are abstaining from smoking, weight management, blood pressure control, regular exercise and avoiding diabetes. The study reports that all are significantly correlated with healthy survival after 90."

Related posts:

Being in good physical shape could reduce the risk of nine types of cancer, study finds (2023)

What if the Most Powerful Way to Live Longer Is Just Exercise? (2023)

Exercise Helps Blunt the Effects of Covid-19, Study Suggests (2023)

How lifestyle changes can reduce the risk of dementia (2019)

Good health begins with individual decisions (2018)

Nearly half of U.S. cancer deaths blamed on unhealthy behavior (2017)

Regular Exercise: Antidote for Deadly Diseases? (2016)Redistribution Undermines Prosperity: Evidence from Italy

"I periodically explain that redistribution is bad for prosperity, mostly because it encourages sloth and dependency among recipients.

Though it is important to realize that the taxes needed to fund redistribution also are harmful (the magnitude of the problem can be viewed here and here).

I also periodically share new scholarly research on these issues.

And that’s our topic for today since the U.K.-based Centre for Economic Policy Research has published some new research about Italy.

The study, which looks at why Northern Italy is much more prosperous than Southern Italy, was authored by Jesús Fernández-Villaverde, Dario Laudati, Lee Ohanian, and Vincenzo Quadrini.

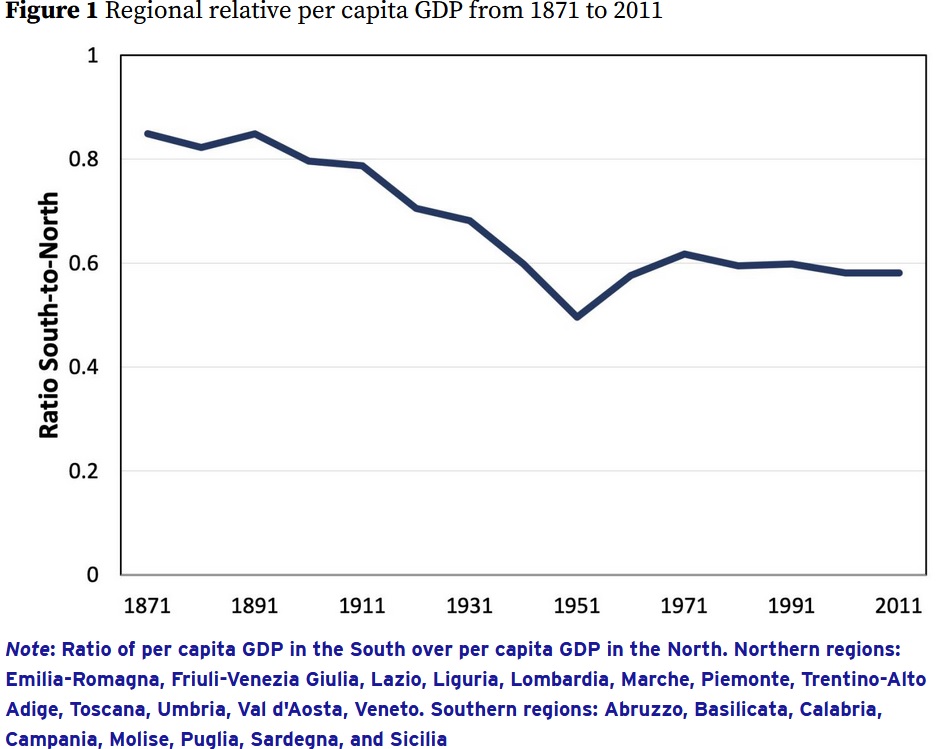

We’ll start by confirming there is a big difference in relative living standards. As you can see from this chart, this gap has existed ever since Italian unification in the 1800s and is bigger now than it was 100 years ago.

Here are some key findings, most notably the harmful impact of redistribution..

In a new paper (Fernández-Villaverde et al. 2023), we seek to identify the major drivers of the regional income differences in Italy using the macroeconomic approach based on the measurement of various wedges… The model consists of two integrated regions. The first is representative of the Northern and Central regions. The second is representative of the Southern and Island regions.

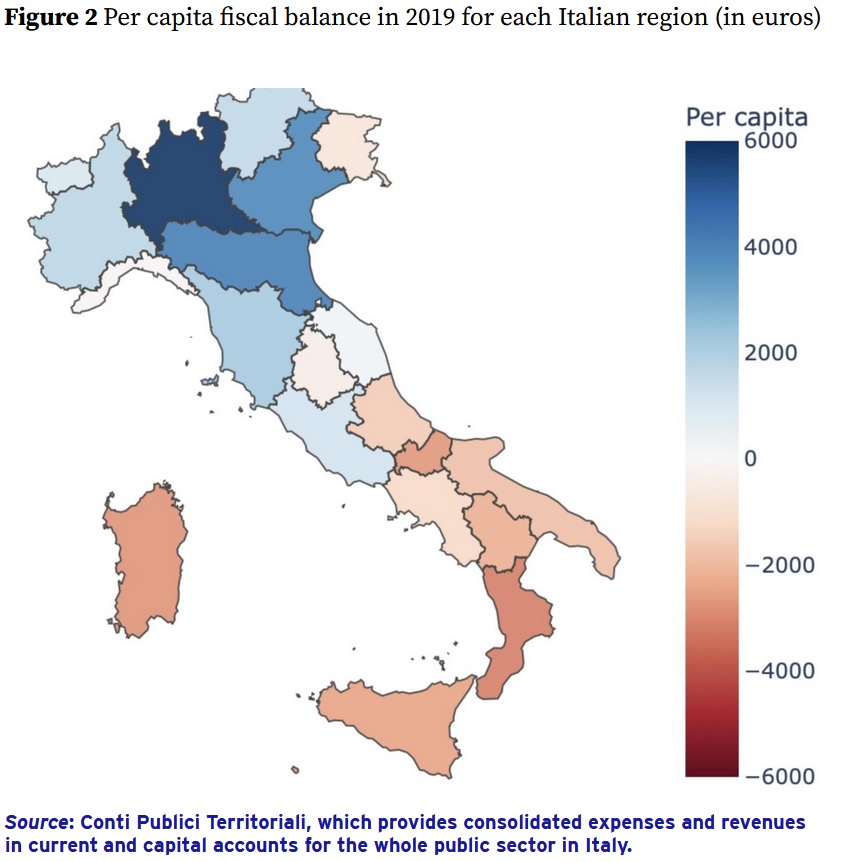

…our goal is to understand which of the measured wedges are especially important for generating lower income in the South. …We…find that inter-regional fiscal transfers contribute significantly to regional income differences (see Figure 2). The combined contribution of productivity differences and inter-regional fiscal transfers accounts for more than 70% of the income gap between Southern and Northern regions. The finding that inter-regional fiscal transfers contribute to regional income disparities is the most interesting finding, and the intuition is straightforward. First, inter-regional fiscal transfers are large. …In the counterfactual steady-state equilibrium without fiscal transfers, the output gap between the South and the North is reduced by one-fourth.

That’s remarkable. One-fourth of the gap between Northern Italy and Southern Italy could be eliminated simply by getting rid of redistribution.

Here’s the aforementioned Figure 2, which also is a good depiction of the dramatic difference between north and south.

There’s one other aspect of the study that is worth mentioning.

In their research on regional prosperity, the authors find that funds for “regional development” are not helpful.

And that is true regardless of whether the handouts come from Rome or Brussels.

Italy has invested large funds in regional development for decades. Were these monies well spent? …Nowadays, the European Structural and Investment Funds account for more than one-third of the whole budget of the EU, with a forecasted expenditure of €392 billion in 2021-2027. Will these funds make a difference? Our paper’s results cast doubt on the efficacy of these regional policies per se

I’m shocked, shocked.

P.S. The good news for Italy is that policy is not getting worse over time, but that also can be bad news since the country needs some shock therapy to avert a rather grim future (elaborated on here and here).

P.P.S. Not only does Italy provide some good evidence on the damage caused by redistribution, it also has led to research showing the harm of red tape."

Minneapolis destroyed itself for BLM — was it worth it?

"More than three years after George Floyd’s death at the hands of police, it is clear that Minneapolis allowed the Black Lives Matter movement to destroy it. Was it all really worth it?

Minneapolis’s police staffing shortage has now reached an all-time low, with just 585 officers on the job. For reference, the city had 888 officers in 2019 and 638 officers in early 2021. The city is now relying heavily on other police departments, and has an officer-to-resident ratio that is nearly half the national average. The decline isn’t slowing either, as the city has already lost 45 officers this year.

Unsurprisingly, crime still has not returned to pre-pandemic (before Floyd’s death) numbers. Violent crime is still up 11% compared to the five-year average before 2020, and the city’s 260 gunshot victims through the first eight months of the year is higher than any recorded number before 2020.

And all of this stems from the city being the launching point for Black Lives Matter’s resurgence. City leaders stood idly by as rioters burned down buildings and looted stores. They joined activists and some Democratic politicians in calling for the abolition of the city’s police department, going as far as to put it to a vote (which voters rejected). They made it clear that police officers in Minneapolis had no defenders among city leadership at the same time celebrities and Democratic politicians helped bail out rioters so they could continue to destroy the city.

All of this for a case of police misconduct that would have been prosecuted anyway. The officers who killed Floyd would have been fired, prosecuted, and convicted just the same as they have been. Minneapolis was sacrificed at the altar of the national Black Lives Matter movement, and as a result, crime has remained above normal levels and the police staffing shortage only grows worse.

Minneapolis residents and their leaders were used and discarded for a political movement just as Ferguson, Missouri, was before them. Activists and media crews rolled in, created havoc, left behind an unsustainable situation, and never thought twice about it. Minneapolis still hasn’t been able to recover three years later. So, again, was it all really worth it?"

What striking workers get wrong about automaker profits

By Rick Newman. He is a senior columnist for Yahoo Finance.

"General Motors spent $21 billion on stock buybacks during the last 12 years. It should give more money to assembly-line workers, instead.

That’s the logic of the United Auto Workers (UAW), which is staging an intensifying strike against GM, Ford, and Jeep parent Stellantis. So far, nearly 13,000 UAW members have walked off the job. The union has threatened other walkouts on a weekly basis and to ratchet up the pain on all three Detroit automakers.

The inevitable PR war is breaking out as each side digs in. In the Detroit Free Press on Sept. 20, GM president Mark Reuss said GM has already made a “record offer” to striking workers, while arguing that GM has reinvested the vast majority of its profits in new facilities during the last 10 years. The next day, UAW vice president Mike Booth rebutted those claims, saying GM has been “lavishing Wall Street with the results of our labor,” including stock buybacks. A key plank of the UAW’s demands is that the Detroit Three have been minting profits and need to share more of the lucre with the rank and file.

It's true the Detroit Three have enjoyed a nice run of profitability since emerging from the chaos of the Great Recession, when GM and Stellantis forerunner Chrysler declared bankruptcy and Ford nearly did. During the last five years, the Detroit Three combined have earned $99 billion in net income, according to data from S&P Capital IQ.

But any amount of profitability is meaningless unless compared with that of competitors. And next to other big automakers, plus upstarts such as Tesla, the Detroit Three don’t look nearly so rich.

The following chart shows Detroit Three profitability compared with the biggest automakers in Japan and Europe — Toyota and Volkswagen — along with Tesla, which only makes electric vehicles. GM and Ford trailed the other four in total profits last year, though Stellantis did better. On profit margin, Tesla beats them all, with a 15.4% margin in 2022, compared with 9.4% for Stellantis, 6.3% for GM and -1.3% for Ford, which had a small loss in in 2022.

Here’s the average profit margin for 11 big automakers during the last 10 years. Toyota’s average profit margin of 7.3% is about as good as it gets for a global automaker operating in every segment. The Detroit Three are considerably below that.

Tesla's average margin is negative because it only started earning a profit in 2020. But it now has double-digit margins other automakers can only dream about.

What about each company’s future prospects? Past profitability doesn’t tell you much about that, but the stock price is supposed to reflect the market’s best guess about future profitability. By that standard, GM and Ford have been dismal performers, with GM down 15% during the last 10 years and Ford down 29%. The broader market was up 141% during the same time frame.

Stellantis has done better, with the stock up 283% since 2013. But that may reflect catch-up from the dismal days when Fiat-Chrysler emerged from Chrysler’s 2009 bankruptcy as a weird US-European mashup, eventually morphing into a company that involves brands as diverse as Jeep, Ram, Fiat, Citroën, Peugeot, Vauxhall, and Maserati.

The Detroit Three have done well during the last few years because they’ve pared many small, barely profitable vehicles from their US lineups, relying heavily on large trucks and SUVs with hefty margins. Consumers have spent with abandon, aided by low interest rates for several years, then by trillions of dollars in COVID stimulus in 2020 and 2021 meant to keep the US economy going strong.

But investors aren’t sanguine about the three automakers’ futures, as the market shifts from the gas-powered models that have dominated for a century to electrics that require completely different technology and massive amounts of up-front investment. Ford says it will lose several billion dollars on EVs this year. General Motors has struggled with technology problems and delayed EV rollouts. Stellantis says EV sales, mostly in Europe, have contributed to profitability, but it still needs deep cost cuts to stay profitable.

Tesla is in a different category, given that it has no gas-powered vehicles to transition away from. Yet Tesla burned cash and lost billions before turning its first annual profit in 2020. Tesla’s stock has soared to stratospheric highs because investors think the pain of building robust EV infrastructure is largely in the past and Tesla will eventually displace many legacy automakers. Much of the pain for the Detroit Three, by contrast, is still in the future.

The Detroit Three are the only fully unionized automakers in the United States, and they already have higher labor costs than Tesla and all the foreign brands that operate US factories. The UAW is now demanding pay hikes that would raise that cost differential even more.

On paper, maybe the Detroit Three can afford to pay workers more and shareholders less. But nobody is asking their competitors to do that, and some of those competitors already enjoy advantages. The Detroit automakers aren’t the titans they used to be, and they’re not the titans the UAW seems to think they are, either."