"Everyone knows about the Tulip Bubble, first documented by Charles Mackay in 1841 in his book Extraordinary Popular Delusions and the Madness of Crowds:

In 1634, the rage among the Dutch to possess [tulips] was so great that the ordinary industry of the country was neglected, and the population, even to its lowest dregs, embarked in the tulip trade. As the mania increased, prices augmented, until, in the year 1635, many persons were known to invest a fortune of 100,000 florins in the purchase of forty roots. It then became necessary to sell them by their weight in perits, a small weight less than a grain. A tulip of the species called Admiral Liefken, weighing 400 perits, was worth 4400 florins; an Admiral Van der Eyck, weighing 446 perits, was worth 1260 florins; a Childer of 106 perits was worth 1615 florins; a Viceroy of 400 perits, 3000 florins, and, most precious of all, a Semper Augustus, weighing 200 perits, was thought to be very cheap at 5500 florins. The latter was much sought after, and even an inferior bulb might command a price of 2000 florins. It is related that, at one time, early in 1636, there were only two roots of this description to be had in all Holland, and those not of the best. One was in the possession of a dealer in Amsterdam, and the other in Harlaem [sic]. So anxious were the speculators to obtain them, that one person offered the fee-simple of twelve acres of building-ground for the Harlaem tulip. That of Amsterdam was bought for 4600 florins, a new carriage, two grey horses, and a complete suit of harness.Mackay goes on to recount other tall tales; I’m partial to the sailor who thought a Semper Augustus bulb was an onion, and stole it for his breakfast; “Little did he dream that he had been eating a breakfast whose cost might have regaled a whole ship’s crew for a twelvemonth.”

Anyhow, we all know how it ended:

At first, as in all these gambling mania, confidence was at its height, and everybody gained. The tulip-jobbers speculated in the rise and fall of the tulip stocks, and made large profits by buying when prices fell, and selling out when they rose. Many individuals grew suddenly rich. A golden bait hung temptingly out before the people, and one after the other, they rushed to the tulip-marts, like flies around a honey-pot. Every one imagined that the passion for tulips would last for ever…Thanks to Mackay’s vivid account, tulips are a well-known cautionary tale, applied to asset bubbles of all types; here’s the problem, though: there’s a decent chance Mackay’s account is completely wrong.

At last, however, the more prudent began to see that this folly could not last for ever. Rich people no longer bought the flowers to keep them in their gardens, but to sell them again at cent per cent profit. It was seen that somebody must lose fearfully in the end. As this conviction spread, prices fell, and never rose again. Confidence was destroyed, and a universal panic seized upon the dealers…The cry of distress resounded every where, and each man accused his neighbour. The few who had contrived to enrich themselves hid their wealth from the knowledge of their fellow-citizens, and invested it in the English or other funds. Many who, for a brief season, had emerged from the humbler walks of life, were cast back into their original obscurity. Substantial merchants were reduced almost to beggary, and many a representative of a noble line saw the fortunes of his house ruined beyond redemption.

The Truth About Tulips

In 2006, UCLA economist Earl Thompson wrote a paper entitled The Tulipmania: Fact or Artifact?

that includes this chart that looks like Mackay’s bubble:

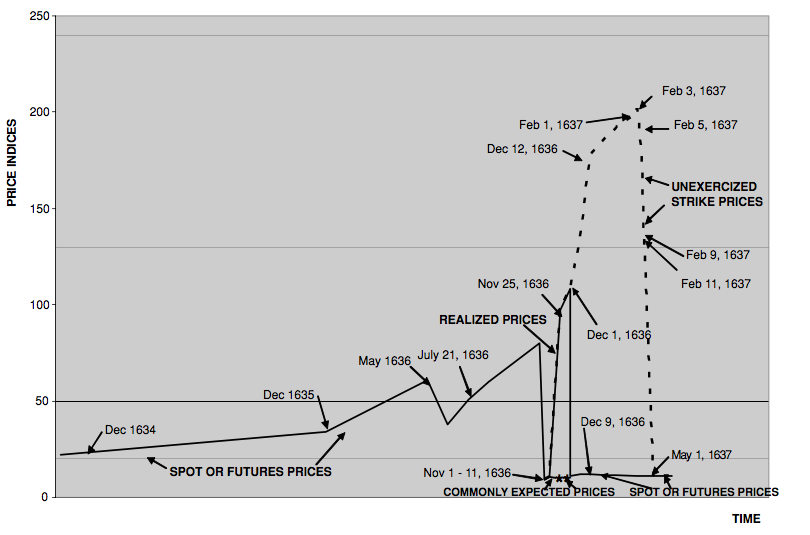

However, as Thompson wrote in the paper, “appearances are sometimes quite deceiving.” A much more accurate chart looks like this:

Mackay was right that there were insanely high prices: those prices, though, were for options; if the actual price of tulips were lower on the strike date for the options, then the owner of the option only needed to pay a small percentage of the contract price (ultimately 3.5%). Meanwhile, though, actual spot prices and futures (that locked in a price) stayed flat.

The broader context comes from this chart:

As Thompson explains, tulips in fact were becoming more popular, particularly in Germany, and, as the first phase of the 30 Years War wound down, it looked like Germany would be victorious, which would mean a better market for tulips. In early October, 1636, though, Germany suffered an unexpected defeat, and the tulip price crashed, not because it was irrationally high, but because of an external shock.

As Thompson recounts, that October crash was in fact a financial disaster for many, including some public officials who had bought tulip futures on a speculative basis; to get themselves out of trouble, said officials retroactively decreed that futures were in fact options. These deliberations were well-publicized throughout the winter of 1636 and early 1637, but not made official until February 24th; the dramatic rise in options, then, is explained as a longshot bet that the conversion would not actually take place: when it did, the price of the options naturally dropped to the spot price.

By Thompson’s reckoning, Mackay’s entire account was a myth."

Thursday, June 8, 2017

Maybe There Was No Tulip Bubble

See Tulips, Myths, and Cryptocurrencies from stratechery. Excerpt:

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.