"I explained during a recent speech in Poland that I get very upset when big companies support policies that disproportionately harm small businesses.

By the way, I have no objection to big companies simply because they are big. Or merely because they sometimes earn a lot of profit.

But, as captured by my Eleventh Theorem of Government, I don’t like big business when it gets in bed with big government.

That’s a recipe for all sorts of bad policies, and also a major source of political corruption.

For purposes of today’s column, though, let’s consider how it is a recipe for reducing competition.

We can now quantify the damage, thanks to some new research by Professor Shikhar Singla, published by Goethe University in Frankfurt.

…the total economy-wide cost of regulations since 1970 has increased by almost 1 trillion dollars, which is roughly 5% of US GDP in 2018. …there has been a massive increase in regulation since the late 1990s. …an average small firm faces an average of $9,093 per employee in our sample period compared to $5,246 for a large firm. …We find that a 100% increase in regulatory costs leads to a 1.2%, 1.4% and 1.9% increase in the number of establishments, employees and wages,

respectively, for large firms, whereas it leads to 1.4%, 1.5% and 1.6% decrease in the number of establishments, employees and wages, respectively for small firms… Results on employees and wages provide evidence that an increase in regulatory costs creates a competitive advantage for large firms. Large firms get larger and small firms get smaller. …The smaller the firm, the more competitively disadvantaged it gets… Fixed costs create a competitive disadvantage for small firms. …We find that large firms oppose regulations in general. But, they push for regulations which have an adverse impact on small firms. Hence, they are willing to incur a cost that creates a competitive advantage for them.

How much of a competitive advantage?

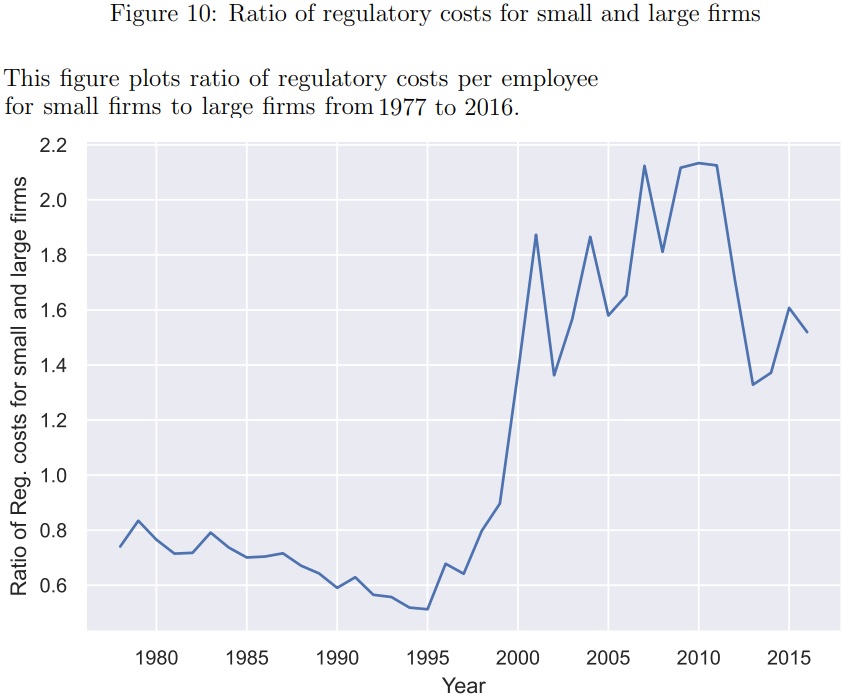

It’s become very significant this century, as shown by Figure 10 from the study.

Policy obviously veered in the wrong direction at the end of the Clinton Administration and then (unsurprisingly) stayed bad during the Bush, Obama, and Trump years.

And policy is staying bad during the Biden years.

The Wall Street Journal editorialized on this topic in 2021. Here are some excerpts.

…what’s really going on: Old-fashioned self-interest. …Take Amazon CEO Jeff Bezos’s endorsement of a higher corporate tax rate. …Mr. Bezos knows a higher rate would hurt Amazon much less than it would other companies. …Mr. Bezos can buy some political goodwill by providing cover to Democrats on taxes, while his company will benefit on the tax subsidy side of the ledger.

Big businesses also know they can afford the higher costs of new regulation that smaller competitors cannot. That helps explain Big Oil’s embrace of methane emission rules in the Obama years that hurt independent frackers, as well as putting a price on carbon now. …Or consider the rush by Big Finance to endorse environmental, social and governance investing, or ESG. …BlackRock CEO Larry Fink is an enthusiast, and guess who will benefit if Biden Administration regulators set new requirements for ESG disclosure or investing? ESG lets BlackRock charge higher investment fees than it can charge for index funds that buy the entire market. …corporations look out first and foremost for their own interests, and that often means collaborating with government for narrow purposes that aren’t always in the public interest.

This is disgusting. And it’s not the first time Bezos and Amazon have tried to hurt small businesses.

In my fantasy world, we would have separation of business and state.

In the real world, I’ll be happy if we can simply block the left’s ESG agenda so that big companies will be forced to earn money in the market rather than steal money via politics."

Thursday, May 18, 2023

Big Business vs. Free Enterprise

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.