By Scott Lincicome of Cato. Excerpt:

"Over at National Review today, I correct recent claims from American Compass’ Wells King and Dan Vaughn that 1980s U.S. automotive protectionism—in the form of Japanese “voluntary export restraints”—was a tremendous success, boosting both Japanese investment in the United States and domestic “Big 3” car manufacturers at minimal cost to American consumers or the economy more broadly. As I explain, “a fuller accounting… reveals the VERs not to be some inspiring success but instead a cautionary tale of American industrial policy’s high costs and failed objectives.” Owing to word limits and format (as a letter in the “dead‐tree” magazine), however, several aspects of my original critique—hyperlinks, charts, snarky asides, etc.—were left on the cutting room floor. This blog post will therefore serve as a supplement to the letter, which you can read in full over at NR.

Let’s start with the litany of rigorous economic studies showing that the consumer costs of the VERs were far greater than the $5 billion total King and Vaughn provided, due in large part to the fact that (contra their figures) the quotas increased the prices of not just Japanese cars, but also American and European ones too, and they lasted for another decade after President Reagan wisely disavowed them in early 1985:

As I note in my letter, this means that the automotive quotas cost, per Dinopoulos and Kreinin (1988), as much as $6 billion (around $16.5 billion in 2022 dollars) in 1984 alone—a burden that persisted for several more years and was, per the New York Fed study, disproportionately borne by Americans with lower incomes.

That burden, moreover, was just the VER’s seen economic costs. As Cato adjunct Don Boudreaux explains, there were significant unseen economic harms that remain unexplored and unknowable:

King and Vaughn never ask “As compared to what?” Because the VERs caused Americans to pay higher prices for automobiles – on average about $1,000 more per vehicle* – which goods and services were, as a result, denied to American consumers? And which industries in America shrank, and which jobs in America were destroyed or not created, by whatever artificial diversion was effected by the VERs of resources into increased auto manufacturing in America?

Next, the claim that the VERs helped the Big 3 (or, per King, “saved Detroit”) and their unionized workforce is also, at best, a stretch. The biggest problem here was the VERs design:

- First, as quotas, the measures funneled most of the additional dollars that U.S. consumers were forced to spend on cars not to the Big 3 or to the U.S. Treasury (as tariffs do), but to foreign automakers via what economists call “quota rents.” As Dartmouth’s Doug Irwin recalls in his epic book, Clashing over Commerce, “The second most costly trade restriction in the 1980s was Japan’s auto VER. If the VER had been removed in 1984, De Melo and Tarr (1992) calculate that the welfare gain would have been $10 billion, of which $8 billion was the quota rent transferred to Japanese producers.” (For reference, $8 billion in 1992 is around $16 billion today.) Upstart Korean and established European automakers also benefited from the VERs, not only because of higher prices and quota rents but also because their Japanese competition was limited. Overall, it was a great time to be a foreign automaker selling cars America; for American car‐buyers, on the other hand, not so much.

- Second, the quotas were set based on the number, not the value, of Japanese cars shipped. This gave Japanese automakers an incentive to spend all that quota rent cash on quality enhancements, marketing, and larger, more expensive models that further boosted their profits and competed more directly with the Big 3. (Japanese brands Acura, Lexus, and Infinity all got their start during the VER period.)

- Third, the quotas encouraged and allowed Japanese automakers, aided by Tokyo, to operate in the United States as “legal” cartel. “The big problem for the U.S.,” one observer noted in 1993, “was that it couldn’t complain of the anti‐competitive nature of [Japan’s] setting of a quota and allocating market shares because the U.S. was the one who suggested the quota in the first place.” Oops.

For these and other reasons, economists generally agree that, to the extent a government must restrict trade, quotas are one of the worst possible ways to do it.

There’s also little evidence that the VERs put the U.S. auto industry onto a path of long‐term global competitiveness and financial sustainability. For starters, the Big 3 spent its windfall profits like protected industries so often do—unwisely: “rather than investing more of their short run profits to quickly catch up with the Japanese… auto executives purchased financial, aircraft, and computer companies, wrote books, headed monument restoration commissions, and gave themselves hefty bonuses for earning profits from a restrictive trade agreement.” The Washington Post noted much the same in 1985, providing this helpful example: “General Motors Corp.‘s well‐advertised Saturn project (a mere 200,000-car potential) will cost only $450 million, whereas GM spent five times that sum— $2.5 billion— to acquire Electronic Data Systems Corp., among other nonauto investments.” (Saturn is, of course, out of business today.)

To the extent that Detroit automakers did improve quality during the 1980s, they still badly lagged the Japanese throughout the 1980s and early 1990s. In 1985, for example, Big 3 cars continued to necessitate repairs at double the frequency of those made in Japan:

Indeed, because the Japanese were also innovating in the 1980s, the quality gap between them and U.S. automakers actually widened by 1990:

“Without a doubt, the Japanese won the 1980s,” said Chris Cedergren, an automotive analyst with J. D. Power & Associates, a research firm in Agoura Hills, Calif., that publishes studies that are considered, both here and in Detroit, to be the last word on automotive quality. “The Japanese are winning the war.”

Even Detroit executives–who usually like to publicize only their own quality gains–quietly admit that they have failed to catch Japan during their decade‐long race.

…

J. D. Power’s surveys–perhaps the only quality measurements used internally by every major auto company in Japan and the United States–have found that while the domestics reduced their defects by 8% in 1989, the Japanese cut theirs by 17% to an all‐time low, effectively opening up a wider quality gap over Detroit. In 1988, measured by defects per 100 cars, the Japanese had an 18% quality advantage over the domestic industry; in 1989 the gap was 27%, according to J. D. Power.

“The quality gap is still there, and if anything, it’s getting bigger,” Cedergren warned. “The domestics are certainly improving, but the Japanese are too. The domestics are now only about where the Japanese were in 1983 or 1984.”

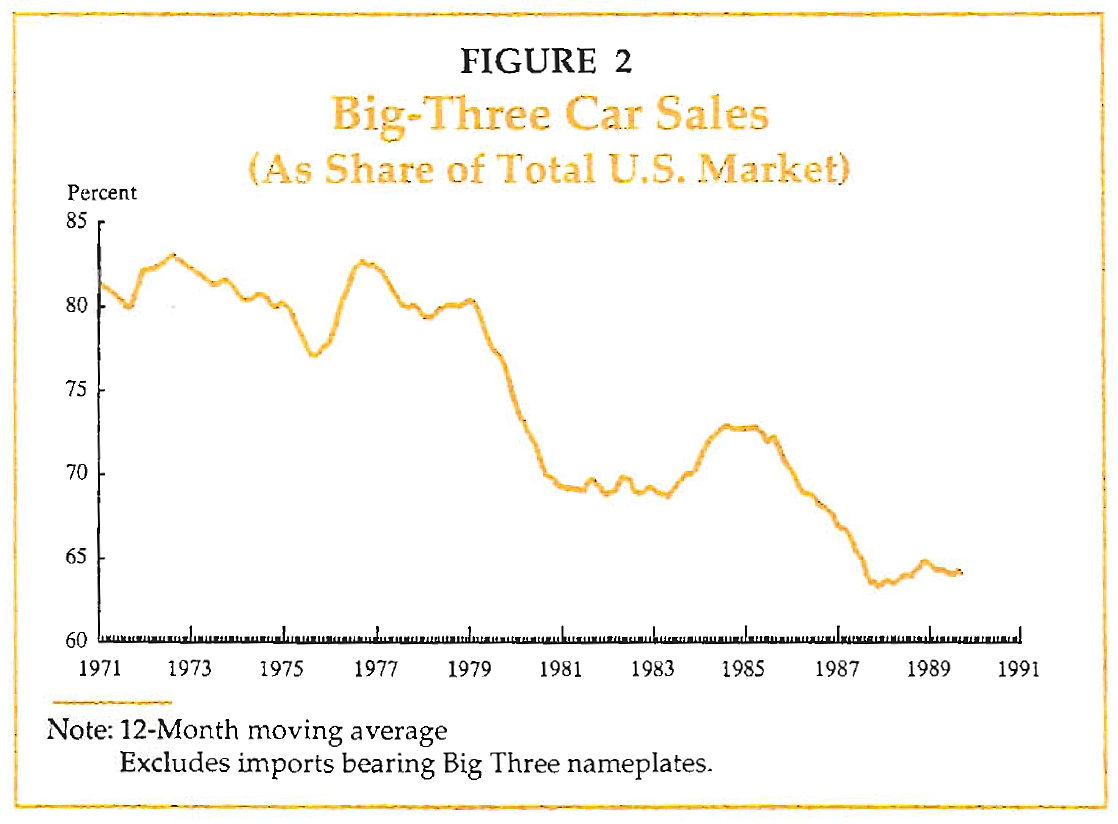

Falling sales and market share—which resumed its decline after a brief uptick in 1985 (see figure below)—caused GM, Ford and Chrysler to lay off tens of thousands of workers, temporarily shutter almost two‐thirds of their 62 assembly plants, delay new investments, and sell off old ones.

According to the New York Times a month earlier, “the Japanese still hold a competitive advantage, and some analysts say Detroit used too little of its profits from the quota‐protected years to develop new products. Now the Japanese, loaded with cash, are able to speed the pace of new‐model introductions and increase the pressure on Detroit.” Given these and other pressures, recent decades have seen six different American car brands (AMC (1988), Plymouth (2001), Oldsmobile (2004), Saturn (2010), Pontiac (2010), and Mercury (2011)) shut down. So much for saving Detroit."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.