"Who’s Being Subsidized for Buying EVs?

This is a thorny question for policymakers because of the current $7,500 federal tax credit for EV purchasers. There also are several state and local tax subsidies.

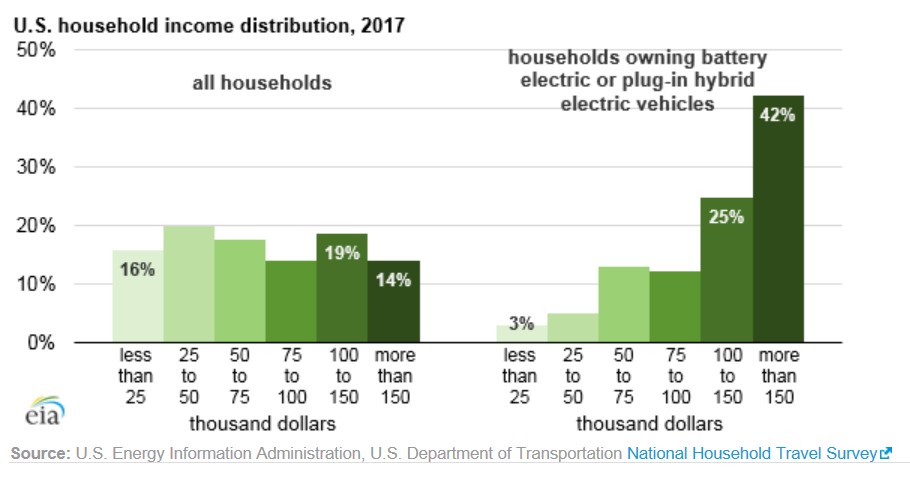

The U.S. Energy Information Administration reports that two-thirds of households that buy EVs have annual income in excess of $100,000, nearly twice the nationwide average:

The result is the tax credit becomes a subsidy for the rich. Households in this income bracket also are more likely to have multiple vehicles, so the EV serves a niche of their transportation needs and is a luxury. The obvious question, then, is whether U.S. taxpayers should be subsidizing the affluent."

"The EV tax credit is particularly bad policy. It is a giant transfer to wealthy Americans. According to JCT [Joint Committee on Taxation], 78% of the individual filers for the credit make more than $100,000 per year and receive 83% of the credits."

""From a current consumer’s standpoint, the main incentives to purchase an EV include getting a tax credit (which would include the federal credit mentioned above plus applicable state and local tax credits) and avoiding transportation fuel costs and taxes. However, the costs outweigh the benefits for most consumers.

For example, if electricity costs 13.2 cents per kilowatthour (kWh) – the 2017 U.S. residential average price per the EIA – and an EV consumes 34 kWh to travel 100 miles, the energy cost per mile is about 4.5 cents. By comparison, an average gasoline engine car that gets around 25 miles per gallon would have a fuel cost of 10 cents per gallon at a current price of $2.56 per gallon. So, an average EV owner could save 5.5 cents per mile, which equates to $550 of fuel savings for every 10,000 miles.

Yet, EVs typically cost more to manufacture and purchase, plus installing a 240v home charging station typically costs more than $1,000. In some states public utilities would increase consumer rates to install charging infrastructure. Furthermore, a large portion of the total cost of ownership includes vehicle depreciation, and electric vehicles lose more than $5,700 per year on average. Just as the market for a used iPhone is limited, it’s also limited for used EVs."

Thursday, December 6, 2018

Two-thirds of households that buy EVs have annual income in excess of $100,000

See Straight Talk on Electric Vehicles by Dean Foreman of API.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.