"When corporations pay taxes, you pay taxes. That is, while it’s popular to tax rich corporations, and even if they write the check to the U.S. Treasury, part of the cost gets passed down to consumers.

Like the taxes they are required to pay, businesses pass regulatory costs on to consumers, too.

The costs of regulations borne by businesses and lower-level governments end up seeping downward to households through direct hand-offs and in broader indirect economic effects.

As the authors of a major National Association of Manufacturers study on regulatory costs observed:

It is worth emphasizing that all regulatory costs are—and can only be—borne by individuals, as consumers, as workers, as stockholders, as owners or as taxpayers. In other words, the distinction between “business” and “individuals” focuses on the compliance responsibility, fully recognizing that ultimately all costs must fall on individuals. (W Mark Crain and Nicole V. Crain, “The Cost of Federal Regulation,” 2014, p. 46.)

So regulatory costs propagate through an economy, for which the basic unit remains the individual and the household. The implication is that when regulation costs too much it is sure to have large effects on societal wealth.

For perspective on the magnitude of regulatory costs, if we assume the full pass-through of all regulatory costs to consumers, we can look at the share of each household’s regulatory costs and compare it with total annual household expenditures (as compiled by the Labor Department’s Bureau of Labor Statistics (“Consumer Expenditures—2014,” September 3, 2015).

The BLS defines America’s 127 million “consumer units” as “families, single persons living alone or sharing a household with others but who are financially independent, or two or more persons living together who share expenses.”

I just call them households. Anyway, for each “unit,” the average 2014 pretax income was $66,877, and average annual expenditures were $53,495, according to the BLS.

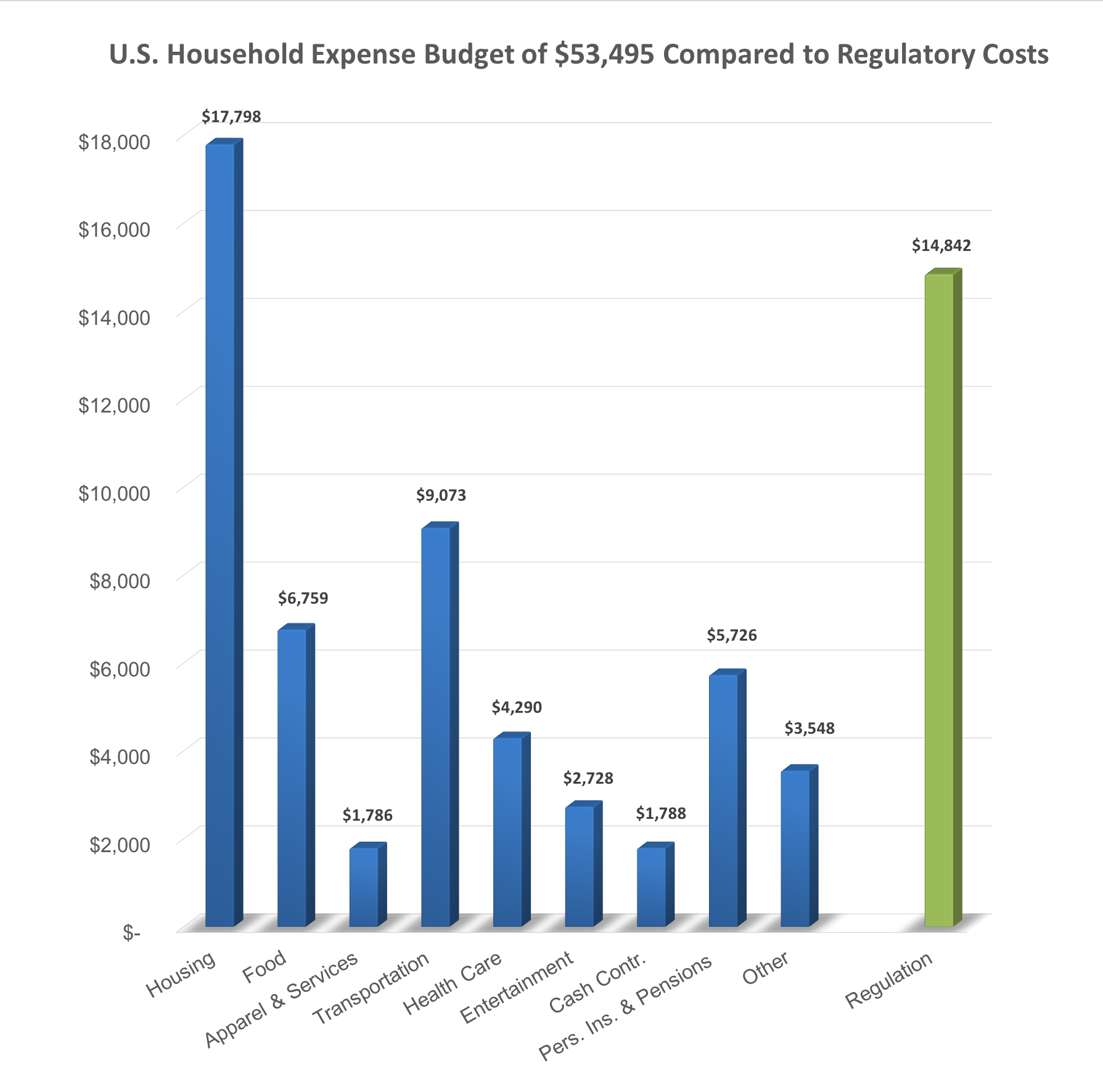

The chart nearby breaks down household expenditures of $53,495 by category. The highest is housing at $17,798 annually. The second-highest category is transportation at $9,073.

Regulatory costs obviously are not “paid” directly out of pocket by households. You don’t write a check for them, they are embedded in costs of goods and services, and in lost economic growth and opportunity.

Still, if one envisions these costs being allocated directly to individuals as the chart depicts, U.S. households “pay” $14,842 annually in a hidden regulatory tax ($1.885 trillion in annual regulatory costs divided by 127 million “consumer units”), or 22 percent of average income before taxes.

That figure is higher than every annual household budgetary expenditure item except housing costs. More is “spent” on embedded or hidden regulation in society than on health care, food, transportation, entertainment, apparel and services, and savings. Societal regulatory costs amount to up to 28 percent of the typical household’s expenditure budget.

On the bright side, regulatory costs are still a “light” load compared to the federal debt per household, which Ohio Senator and former Director of the OMB Rob Portman has said reaches $140,000 per household.

But as regulations substitute for spending, things will increasingly change. Congress needs to pay as much attention to the regulatory burden as it will need to direct at federal spending as interest rates start to rise and overwhelm the federal budget."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.