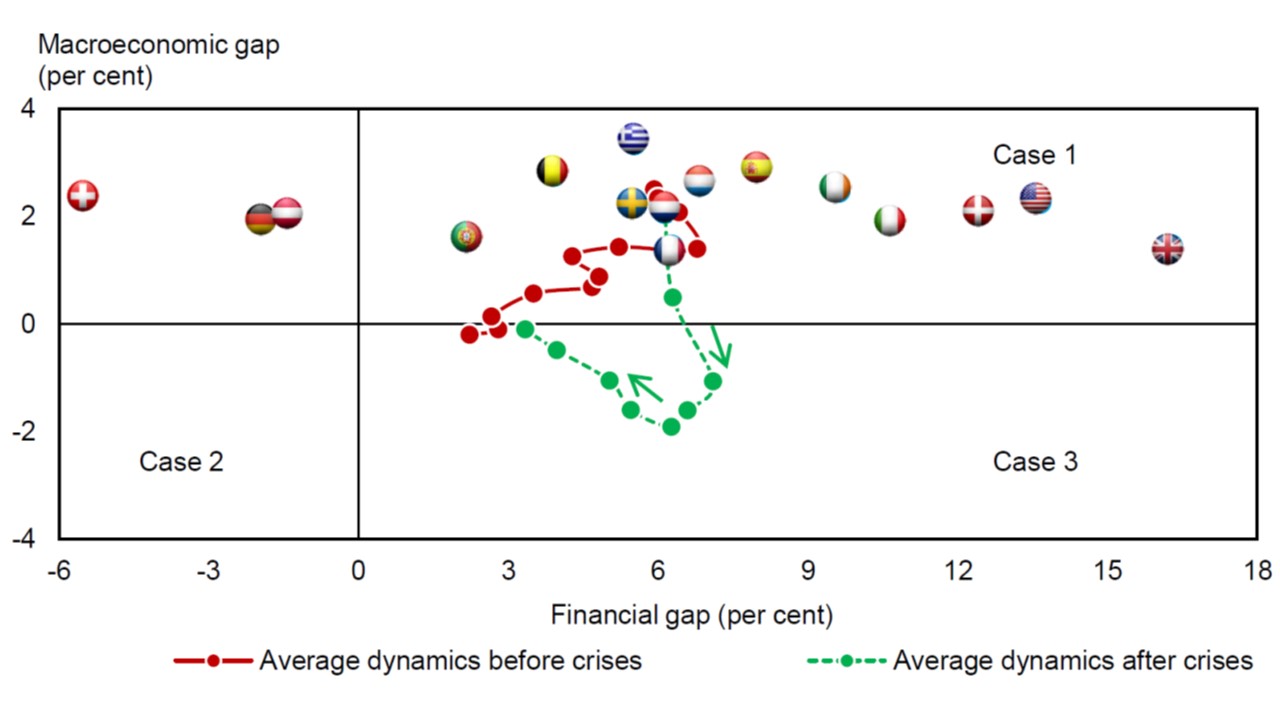

"Matthew Klein recently wrote a nice piece for the Financial Times on the role of the Fed in the asset price bubble in 2003-2005 and thereby in the subsequent bust leading to the financial crisis. He begins by reviewing a fascinating speech by Tim Lane, deputy governor of the Bank of Canada. Lane uses the following chart of macroeconomic gaps and financial gaps to show that during the period before the financial crisis (Case 1) monetary policy should have been tighter in many countries–including the United States–based on the macro gap (a combined output and inflation gap) and that this was associated with a large financial gap measured by housing price excesses and credit excesses.

I made a similar critique back in a 2007 Jackson Hole paper arguing that the Fed played a role in 2003-2005 in causing the search for yield, risk-taking, the housing boom and the eventual bust which were big factors in the financial crisis.

Klein also takes apart Ben Bernanke’s later denial of this critique in a 2010 speech at the American Economic Association meetings. Klein does a little investigative research, reporting that there were conflicting statements at the time made by Don Kohn when he was at the Fed. I had earlier responded to Bernanke’s speech on different grounds, but all this recent research is adding to the evidence that Fed played a role in bringing on the financial crisis.

And there’s a lot of other recent research accumulating. Recently a paper by Qiao Yu, Hanwen Fan and Xun Wu of Tsinghua University on the pre-crisis period finds that “appreciation of housing prices in the advanced countries is statistically significant and the impact of monetary policy on housing prices cannot be neglected” with the interest rate set by the Fed being unusually low and thus a factor in the housing bubble. They find that this policy deviation was much more significant than a global saving glut which Bernanke claims was the problem.

There is also a recent paper by Graeme O’Meara that looks at both deviations from policy rules and deviations from housing fundamentals. The paper is generally supportive of the original work for the U.S. regarding sign and significance of the impact of monetary policy during the housing boom, with regulatory policy sharing some of the blame.

This recent research should be considered in conjunction with earlier research with similar findings. In 2008 Jarocinski and Smets of the European Central Bank found evidence in the U.S. that “monetary policy has significant effects on housing investment and house prices and that easy monetary policy designed to stave off perceived risks of deflation in 2002-04 has contributed to the boom in the housing market in 2004 and 2005.”

In 2010, George Kahn of the Federal Reserve Bank of Kansas City found that “When the Taylor rule deviations are excluded from the forecasting equation, the bubble in housing prices looks more like a bump.”

Also in 2010 Rudiger Ahrend of the OECD found “‘below Taylor [rule] episodes have generally been associated with the build-up of financial imbalances in housing markets.”

And there’s historical evidence by Mike Bordo and Landon Lane who reviewed the existing literature and showed that over many countries and across many time periods asset price acceleration regularly follows such excessive monetary accommodation, And in his comprehensive history of the Fed, monetary historian Allan Meltzer said that it “was a mistake” to hold interest rates so low during the 2003-05 period (p 1248).

Of course Ben Bernanke is not the only central banker who disagrees with this research. In an article “Alan Greenspan: What Went Wrong” in the Wall Street Journal Alexandra Wolfe reported that Greenspan told her that he disagreed with my 2007 paper, though she also reported that I stood by the paper and said that “Other economists have corroborated the findings” and “the results are quite robust.”

Several years ago in comments on a paper I gave at the Bank for International Settlements, Ken Rogoff said (pp. 29-31) that “John Taylor’s critiques of post-2000 ultra-loose monetary policies are well known and have been widely discussed. His ideas are a subject of ongoing research, with no firm conclusion as yet.” When you add what has been done since Ken spoke to what was done before–amounting to about a decade of research, I’d say there’s a very firm conclusion now."

Sunday, March 13, 2016

During the period before the financial crisis monetary policy should have been tighter in many countries–including the United States

A Firm Conclusion About the Role of Fed Leading Up to the Crisis by John Taylor.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.