See

False promises, real harm: Why Illinoisans should reject a progressive income tax.By By Orphe Divounguy, Bryce Hill and Joe Tabor of Illinois Policy. Excerpts:

"With

Illinoisans already shouldering a record $5 billion income tax hike

passed in 2017 – which still could not keep up with Springfield’s

spending demands – many state lawmakers are trying to justify further

tax hikes without drawing the ire of the voting public.

How? By calling for a progressive

income tax. Some members of the Illinois General Assembly, as well as

many Democratic gubernatorial candidates, have been pushing the idea of

scrapping Illinois’ constitutionally protected flat income tax in favor

of a progressive income tax that would make “the rich” pay their “fair

share.”

Proponents of scrapping this

constitutional protection make three key claims regarding a progressive

income tax: it would reduce taxes on the middle class, it would go a

long way toward reducing income inequality and it would benefit the

state’s economy.

An evaluation of current

progressive tax proposals in the Illinois General Assembly, economic

literature on progressive income taxes and outcomes in all 50 states

reveal these claims are misleading at best.

First, states with progressive income taxes have seen slower economic growth and faster growth in inequality.

Second, most economists agree that more progressive tax structures reduce economic growth.

And finally, Illinois’ spending

problems dictate that a progressive tax would entail large tax hikes on

the middle class, leading to severe economic damage. A leading

progressive tax proposal in the Illinois General Assembly – House Bill

3522 – would hike income taxes for a vast majority of Illinoisans.

Economic modeling estimates that if this proposal had been enacted in

2016, it would have cost Illinoisans 34,500 jobs and cost the state

economy $5.5 billion in the first year after enacted, erasing nearly 75

percent of the employment growth Illinois saw in 2017.

This potential economic harm is the

most important reason Illinoisans should not allow a progressive income

tax. It would likely lead to tax hikes on the middle class, fewer job

prospects and lower incomes.

In short, a progressive tax is not the solution Illinoisans need to turn their state around.

Instead, lawmakers must look to

rein in the growth in state spending, which outpaced personal income

growth by 25 percent from 2005-2015. This lack of discipline has forced

tax hikes, unsustainable debt and enormous uncertainty in the private

sector over the future of Illinois. Rather than introducing more

uncertainty with a progressive income tax system, lawmakers should adopt

a spending cap that ties state spending growth to growth in Illinois’

economy. Illinoisans can then rest assured they’re getting a state

government they can afford."

"Advocates of a progressive income tax at the state level make three key claims, all of which are misleading to varying degrees:

- A progressive income tax would reduce taxes on the middle class.

- A progressive income tax would go a long way toward reducing income inequality.

- A progressive income tax could actually benefit the state’s economy.

On the opposite side of the debate are those who believe the income

tax rate should remain flat, as it is currently in Illinois. Proponents

of the flat tax system pose three main arguments:

- A flat tax system is fairer because all taxpayers pay the same tax rate.

- Wealthier Illinoisans already pay the bulk of all income taxes collected in the state.

- A progressive income tax will do little to improve income equality while harming economic outcomes for all.

Since the publication of the seminal work of Hall and Rabushka (1995)1,

academics have been arguing in favor of a simplification of the tax

code, a broadening of the tax base and a reduction of marginal taxes.

Progressive taxation does the opposite: it makes the tax code more

complex and can have disastrous effects on economic growth."

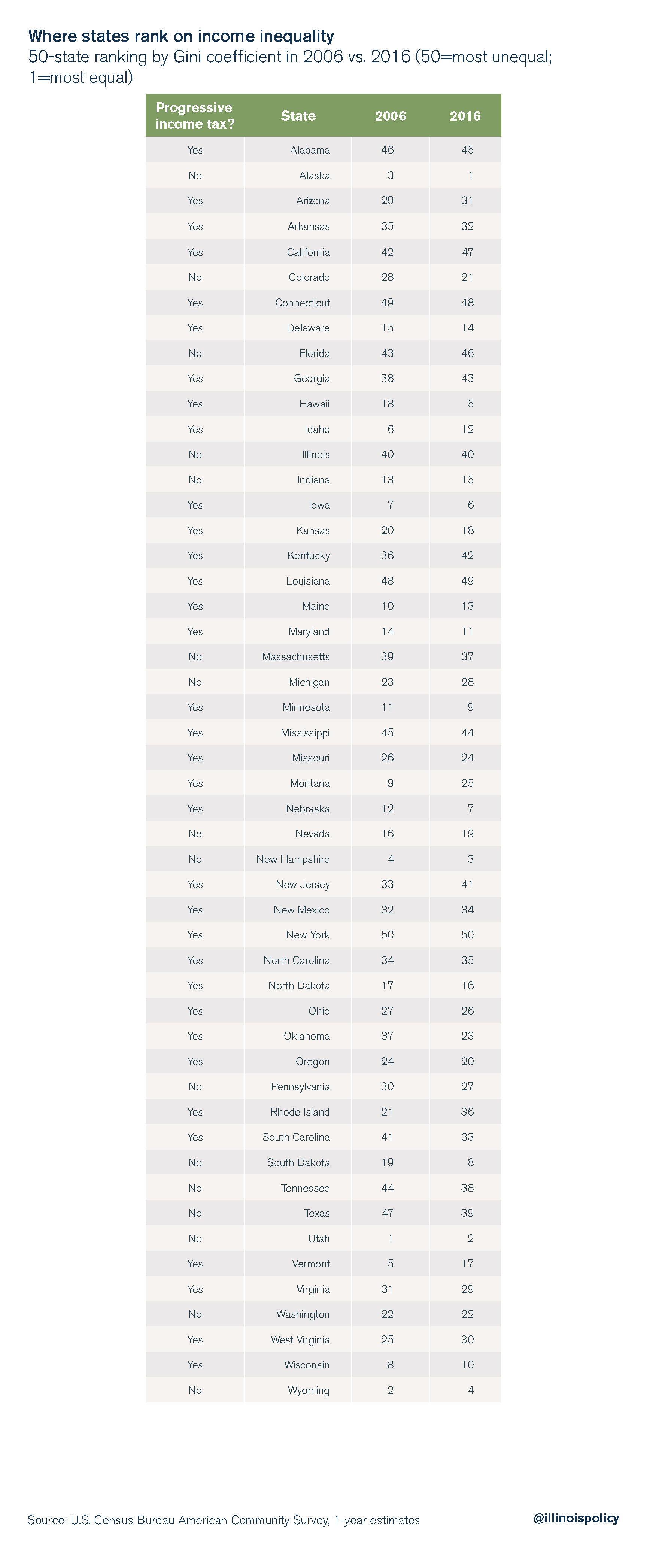

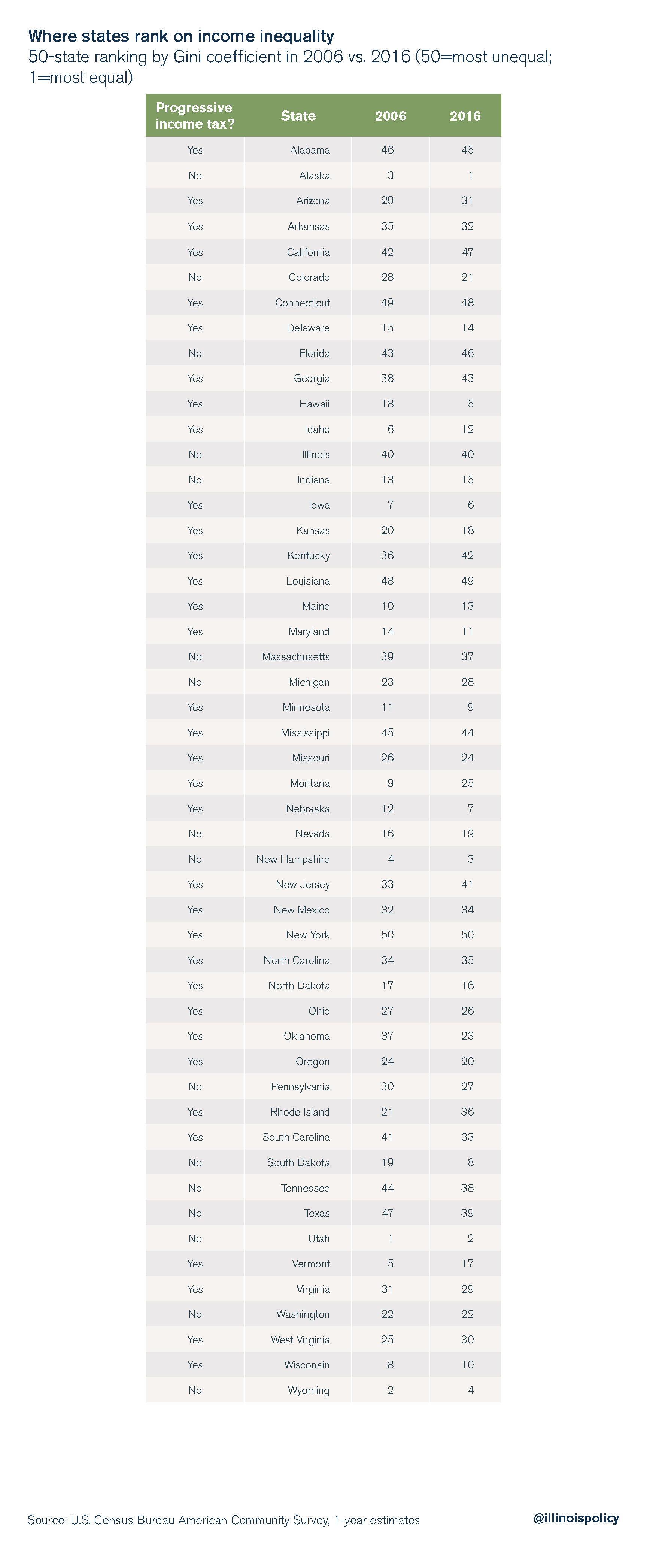

"According to the U.S. Census Bureau’s American Community Survey, the

five states in 2006 with the lowest Gini coefficients – meaning the

lowest levels of income inequality – were Utah, Wyoming, Alaska, New

Hampshire and Vermont. Only Vermont had a progressive income tax. In

2016, Alaska, Utah, New Hampshire, Wyoming and Hawaii had the lowest

Gini coefficients. Only Hawaii has a progressive income tax.

By 2016, Vermont was more unequal, falling to 17th place from 5th

place based on the Gini coefficient. Hawaii moved up the rankings to 5th

place from 18th place between 2006 and 2016. Hawaii’s rise in the

rankings was only due to rising inequality across the U.S.

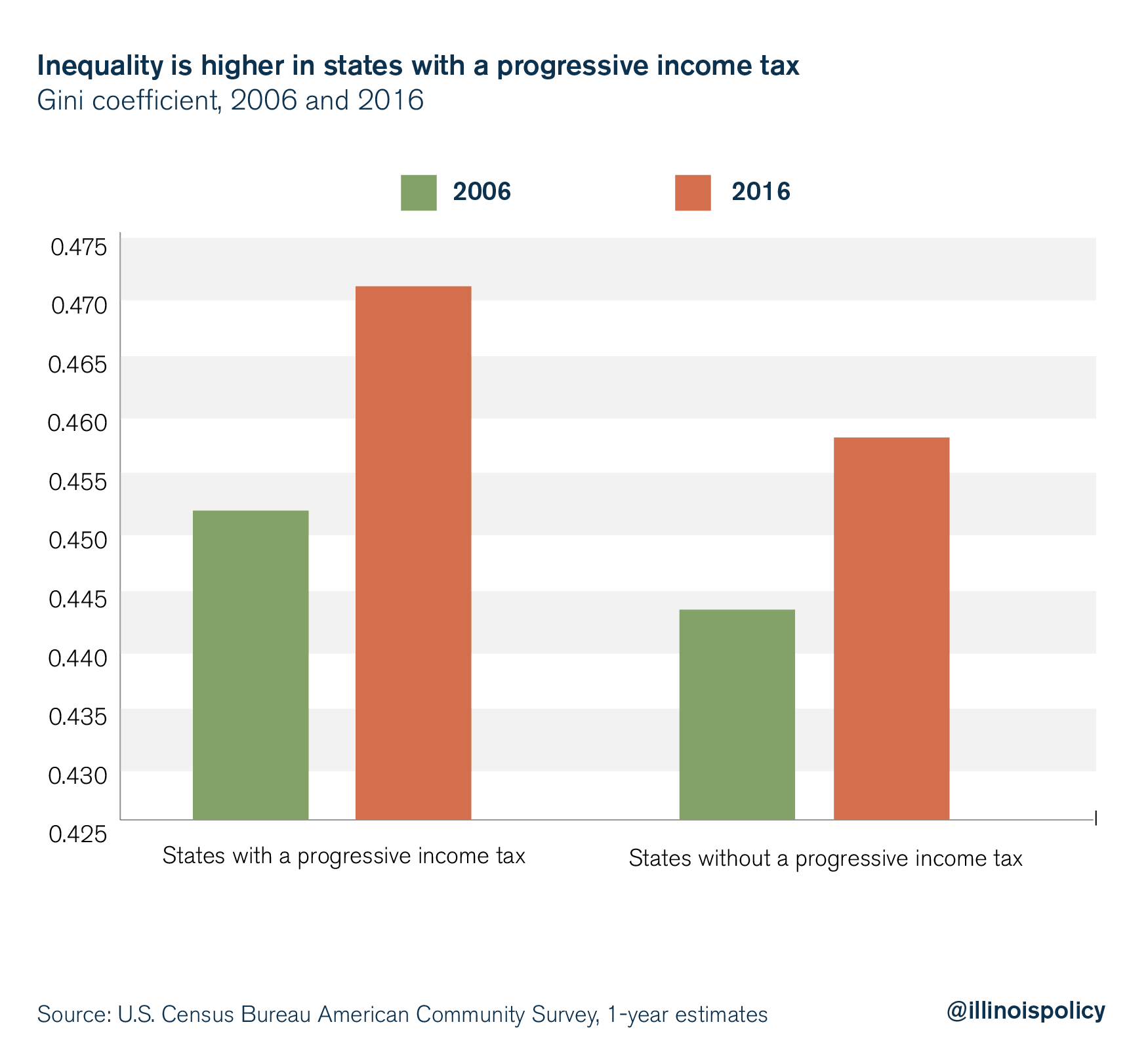

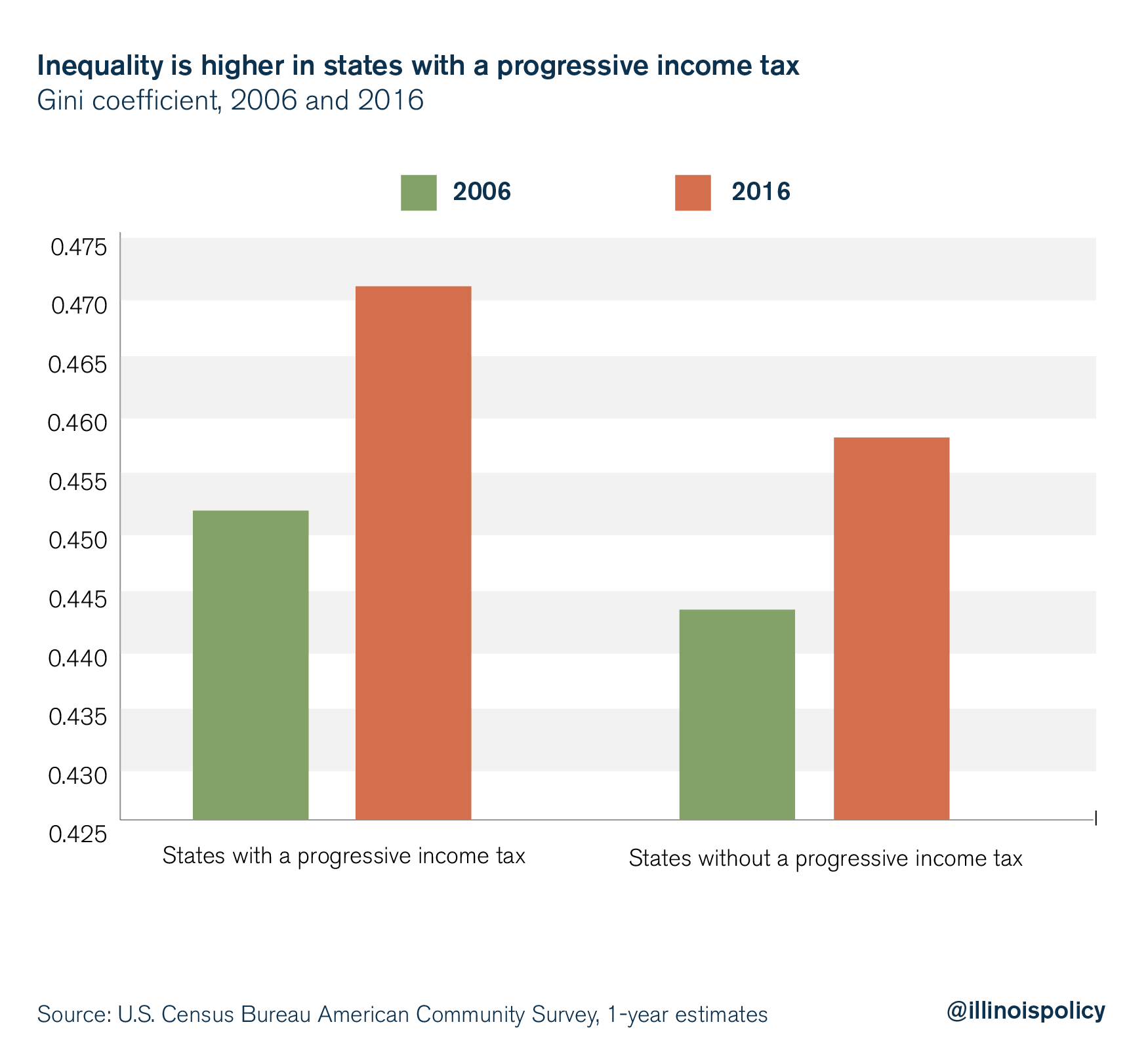

While changes in inequality reflect a host of factors, it is

certainly not the case that states with a progressive income tax are

more equal. In 2016, the average Gini coefficient in states with a

progressive tax was 2.8 percent higher than states without a progressive

income tax.

Not only is inequality higher in states with a progressive income

tax, but inequality has risen faster in those states as well. Inequality

in states with a progressive income tax grew 4.2 percent from 2006 to

2016, while inequality grew by 3.3 percent in states without a

progressive income tax.

Would a progressive income tax reduce inequality in Illinois?

Economists remain divided as to whether tax progressivity reduces

inequality or has any effect on inequality whatsoever (see Appendix A).

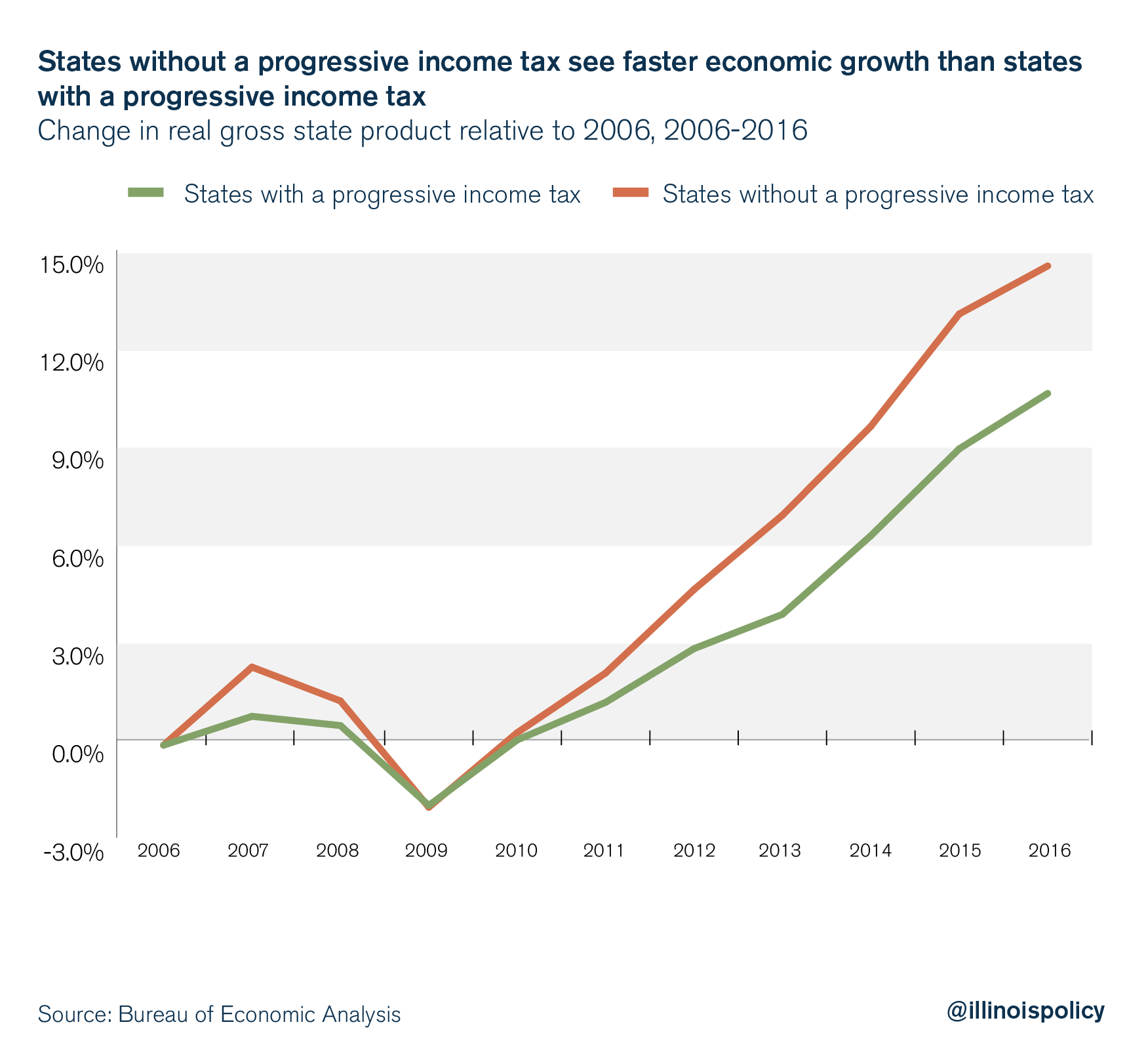

"most economists agree that more progressive tax structures

reduce economic growth. And the data point to the same conclusion:

States without a progressive income tax have performed better than

states with a progressive income tax.

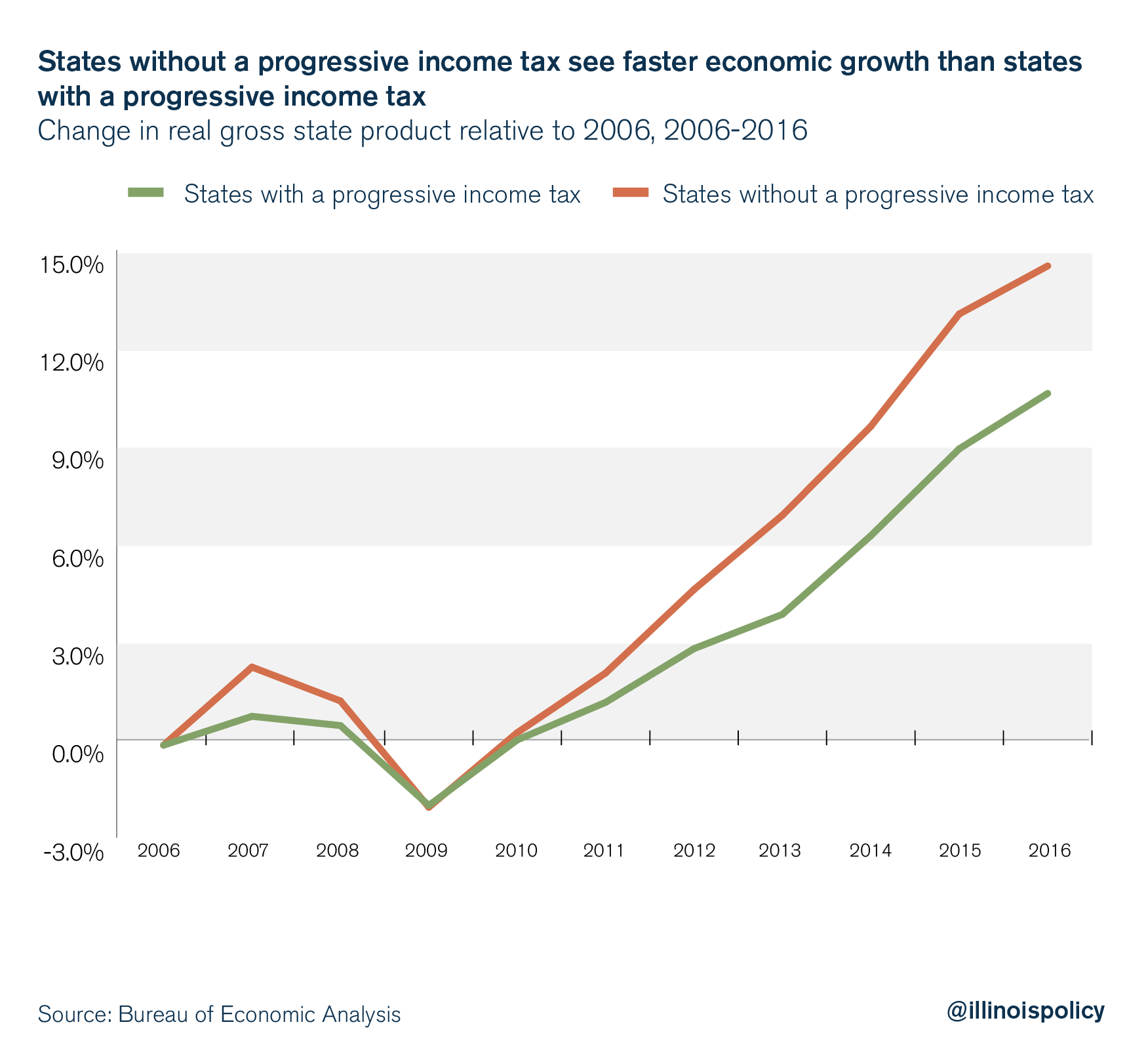

Examining the past decade of the most recently available

macroeconomic data reveals overall economic activity – measured as real

gross state product, or GSP – has grown faster in states without a

progressive income tax than in states with a progressive income tax.

Since 2006, states without a progressive income tax have seen GSP grow

by 14.7 percent, while states with a progressive income tax have seen

10.8 percent GSP growth.

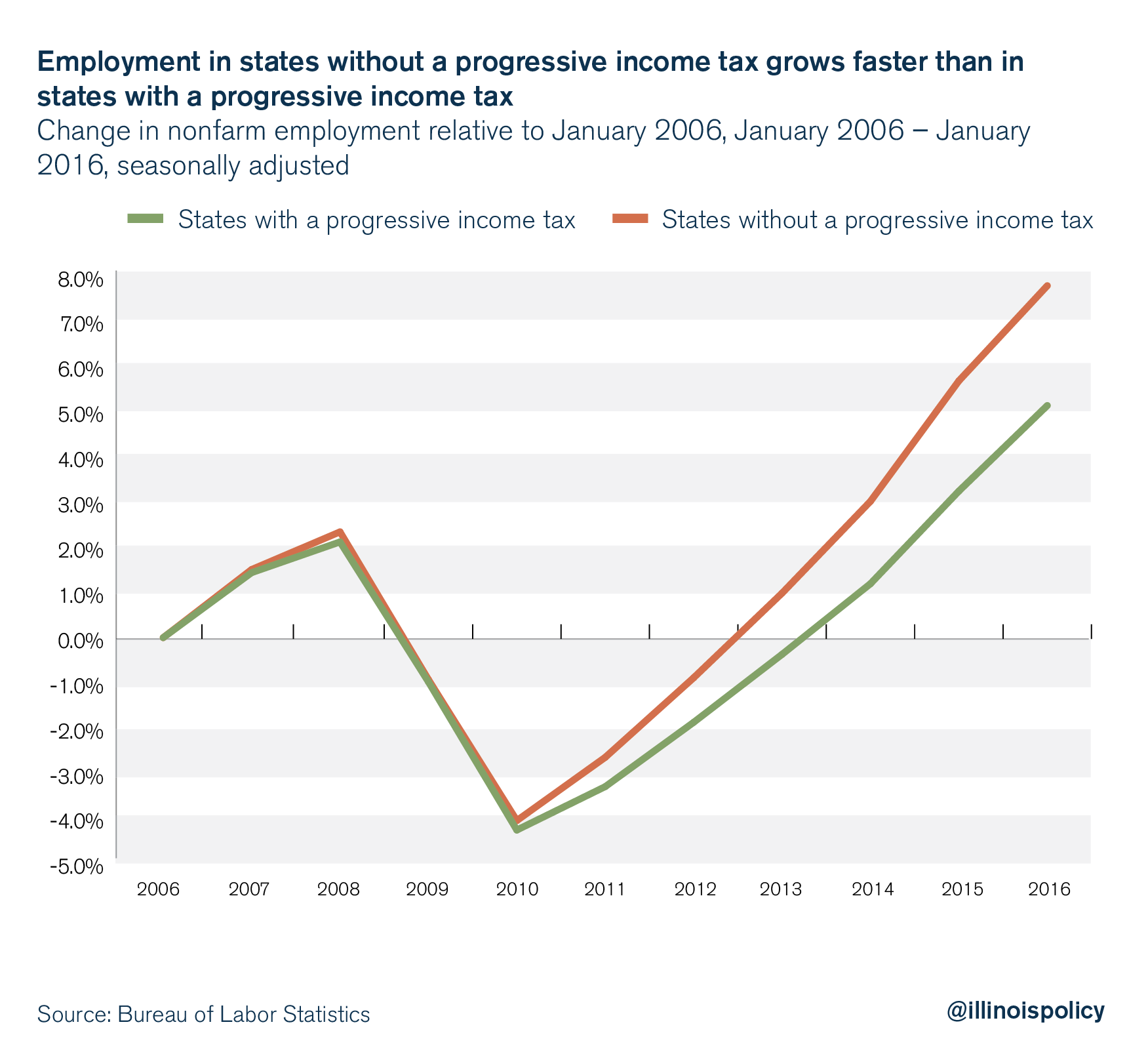

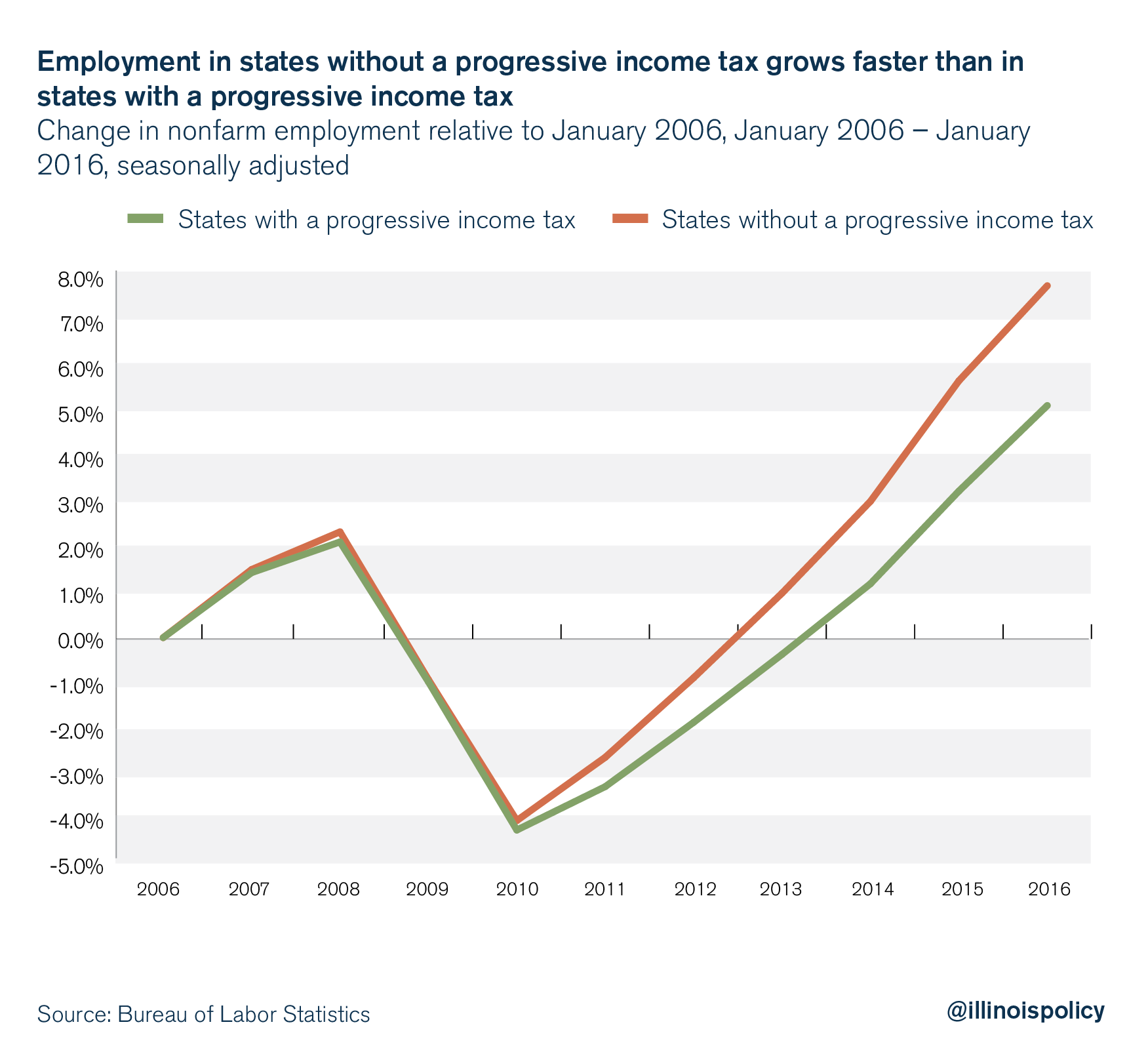

Additionally, employment has increased faster in states without

progressive income taxes. In states without a progressive income tax,

nonfarm payrolls have increased 7.8 percent, while payrolls have only

increased 5.1 percent in states with a progressive income tax, since

2006.

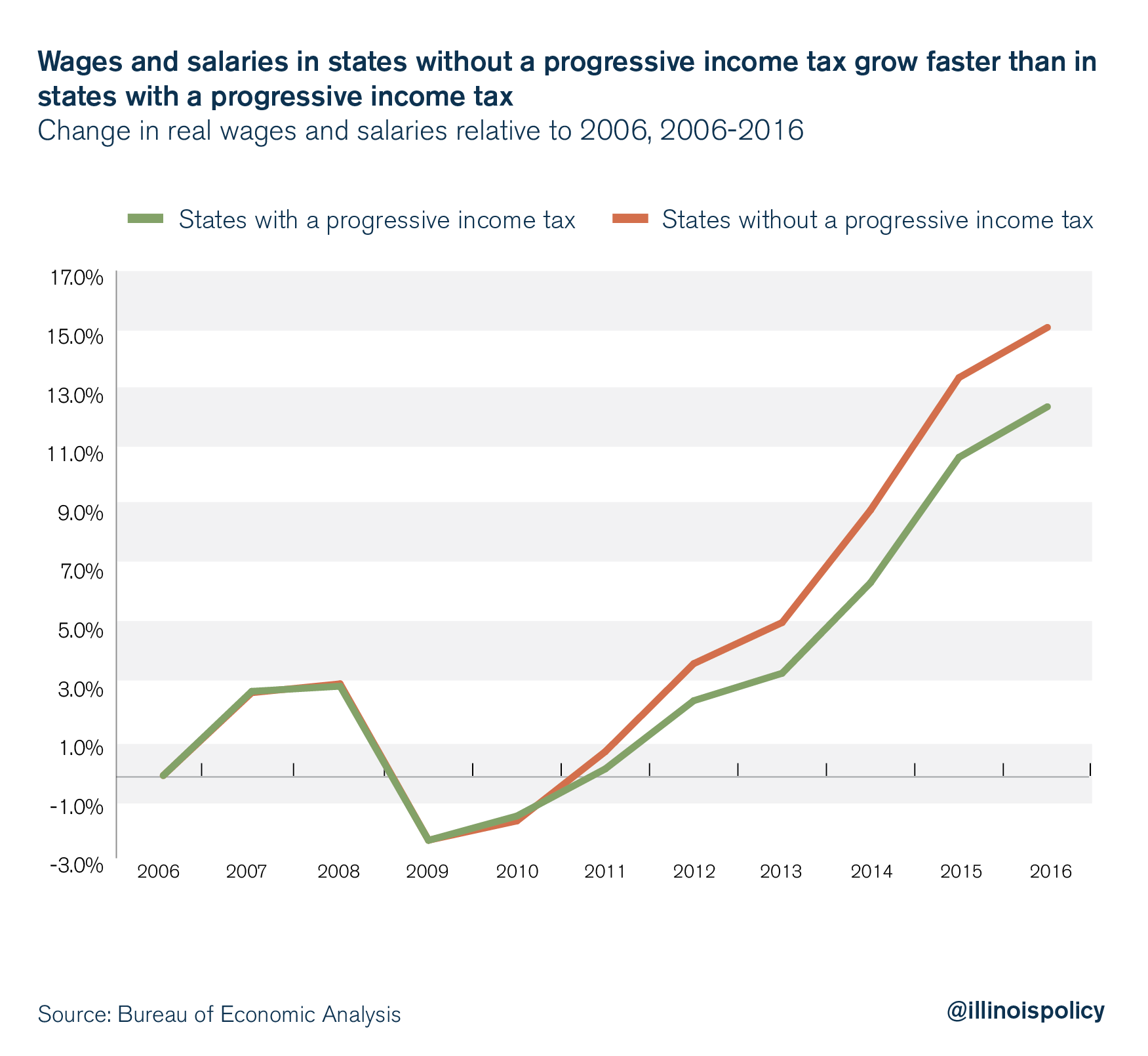

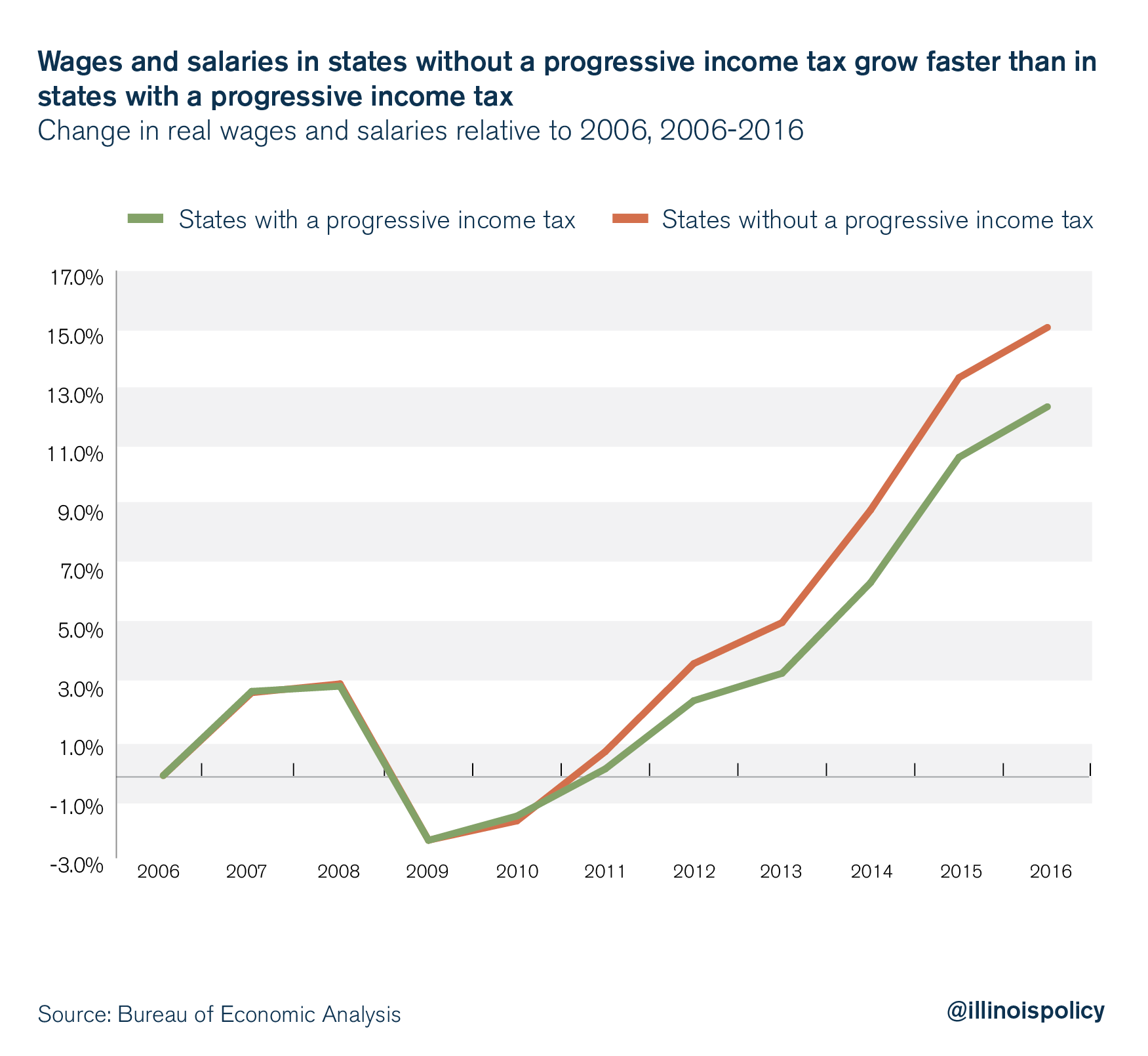

Wages and salaries have also been growing faster in states without a

progressive income tax. Since 2006, states without a progressive income

tax have seen wages and salaries increase 15.3 percent. Meanwhile, in

states with a progressive income tax, wages and salaries have only

increased 12.6 percent.

A majority of economists seem to agree that under plausible

assumptions, tax progressivity has had a negative impact on the U.S.

economy (see Appendix B)."

"Measuring the effects of tax changes on the economy is a challenging

task. Fortunately, there’s a large body of expert literature that

addresses difficult empirical challenges and that proposes economic

theories that are consistent with the data. Romer and Romer (2010) find that tax increases have a negative impact on real gross domestic product.2 This

is because tax increases have a large and sustained negative impact on

investment. These results are consistent with the findings of Blanchard

and Perotti (2002)3 and Mountford and Uhlig (2009).4"

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.