Even though you make payroll every Friday,

You don’t have a guaranteed paycheck.

You’re a small business owner, and you eat what you kill.

For those hunter-gatherers among us, the Regulatory Flexibility Act (RFA) directs federal agencies to assess their rules’ effects on small businesses and to “publish semiannual regulatory agendas

in the Federal Register describing regulatory actions they are

developing that may have a significant economic impact on a substantial

number of small entities.”

Upstarts and small firms can bear a heavier load of the regulatory

burden, since they can’t spread costs and hire experts to deal with

compliance the way large companies can. And large firms may make peace

with or even aggressively seek regulation intentionally in order to

shove smaller firms aside. Regulation can help them profit—at the

expense of rivals and consumers.

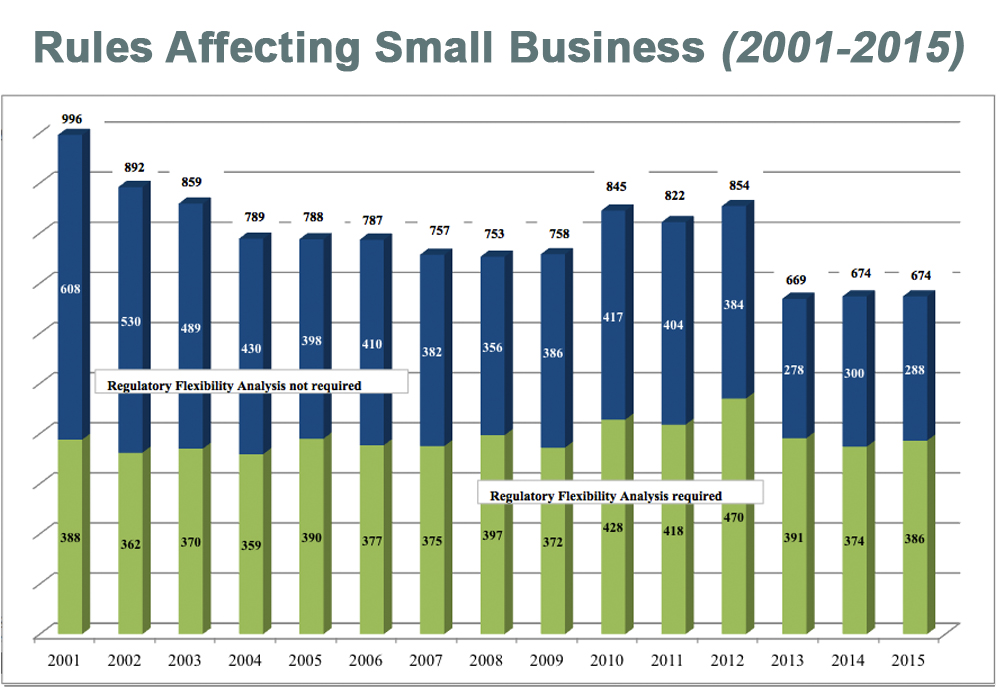

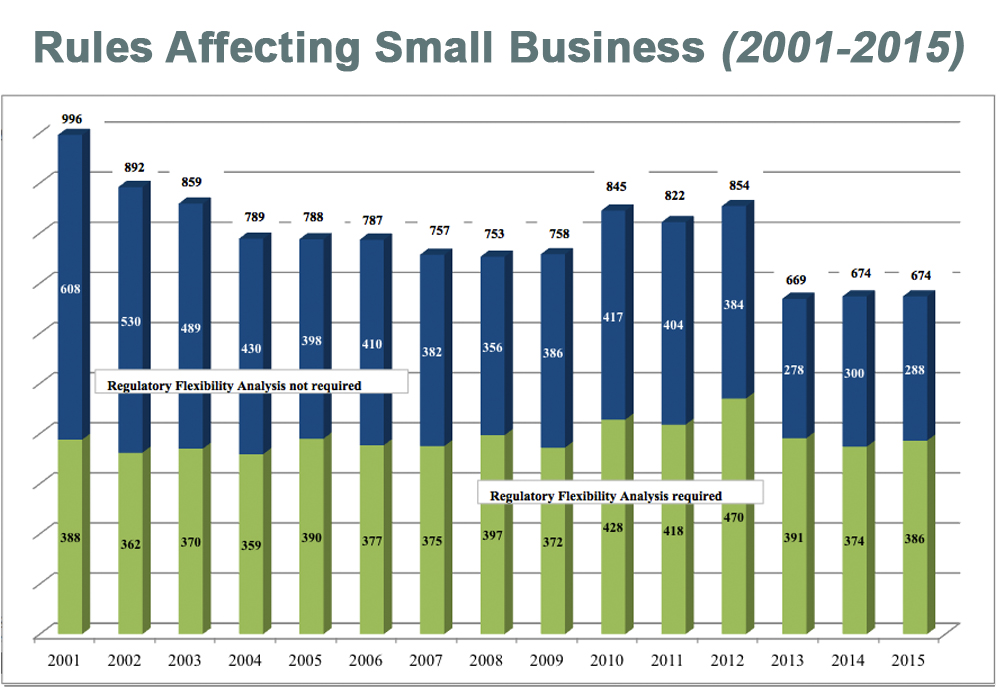

The chart nearby shows the number of rules annually requiring a

Regulatory Flexibility Analysis (RFA) since 2003, as well as other rules

that agencies anticipate will affect small business but do not require

an annual RFA analysis.

The number of rules acknowledged to significantly affect small

business dropped substantially since 2012, likely in part reflecting

reporting changes we have noted in some detail in Ten Thousand Commandments regarding Unified Agenda reporting, particularly the lessening of some disclosures and politically driven rule delays. Disclosure has suffered, but hopefully not irreparably.

At

the end of 2015, the overall number of rules affecting small business

stood at 674, the same as 2014 but down from the peak of 854 in 2012.

The reality is that before 2013—President Obama’s claim to have issued fewer rules than his predecessor notwithstanding—small

business rules initially rose under his administration. As the chart

shows, they popped up from 753 in Bush's last year to 854 in 2012.

Before the 2013 drop, the number of rules with small-business impacts

during the Obama administration regularly exceeded 800, which had not

occurred since 2003.

Of those 674 rules in play with small-business impacts, 386 required

an RFA, a drop from the peak of 470 requiring an RFA in 2012. The 470

rules in 2012, however, had been a 12.4 percent increase over 2011 and

far above anything seen in the past decade. Still, the annual number of

rules requirng a Regulatory Flexibility Analysis is still higher under

Obama than any Bush year apart from 2004.

Bottom line, Obama’s number of rules requiring small business Regulatory Flexibility Analysis is unsurpassed.

Another 288 rules in the Fall 2015 Unified Agenda were deemed by

agencies to affect small business, but not to rise to the level of

requiring an RFA. In the past three years, disclosure of this category

of rules appears to have diminished.

Notable here is that even though the overall reported number of rules

affecting small business is down, the average of Obama’s seven years so

far, 406, exceeds Bush’s eight year average of 377.

For additional detail, Table 8 in Ten Thousand Commandments

breaks out the 2015 Agenda’s 674 rules affecting small business by

department, agency, and commission. Five of them—the departments of

Commerce, the Federal Communications Commission, Health and Human

Services, Transportation and Agriculture—account for 402, or 60 percent,

of the rules affecting small business.

The overall proportion of total rules affecting small business,

stands at 20.4 percent, but the range is quite wide among agencies.

(For even further detail regarding the numbers of rules affecting

small business broken down by department and agency for Unified Agenda

editions since 1996, see Appendix: Historical Tables, Part H in Ten Thousand Commandments.)"

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.